Using the fueled military vehicle can be expensive for the armed forces. For example, in January 2022, Oshkosh Corp introduced its first-ever hybrid-electric Joint Light Tactical Vehicle (eJLTV) with a silent drive. This new vehicle enables a silent drive, extended silent watch, enhanced fuel economy, and increased exportable power, making it an ideal option in combat and reconnaissance scenarios. The eJLTV also helps improve fuel economy by more than 20% and provides a battery capacity of 30kWh. Thus, growing investments in the manufacturing of hybrid and electric military vehicles (other than trucks) would encourage manufacturers to undertake partial or full electrification of military trucks, which is likely to emerge as a significant trend in the market during the forecast period.

The military truck market in the Middle East & Africa (MEA) is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of the MEA. According to SIPRI, in 2021, the military expenditure of Saudi Arabia was US$ 55.6 billion, which was 17% less compared to 2020. Saudi Arabia fell from being the fourth-largest spender in 2020 to the eighth-largest in 2021. In 2021, Iran increased its military spending by 11%, making it the 14th largest military spender in 2021. Furthermore, the country increased its military budget for the first time since 2017 to US$ 24.6 billion. In addition, in 2021, Qatar's military spending was US$ 11.6 billion, making it the fifth-largest military spender in the Middle East. It was also seen that Qatar's military spending in 2021 was 434% higher than in 2010. In addition, due to the growing demand for military trucks, governments of a few countries in the MEA are working on starting manufacturing facilities for military vehicles in the region. For instance, in September 2022, the Egyptian Ministry of State for Military Production had discussions with Renault, a French company, for the co-production of military vehicles, particularly military trucks in Egypt.

Strategic insights for the Middle East & Africa Military Truck provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

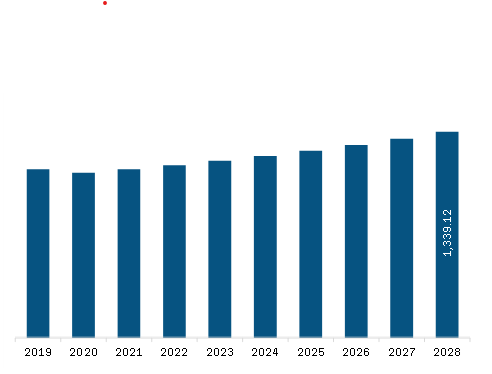

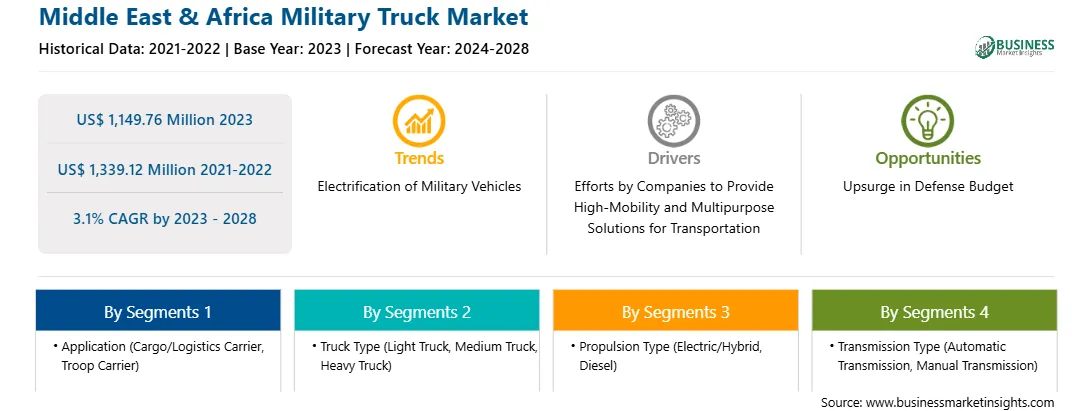

| Market size in 2023 | US$ 1,149.76 Million |

| Market Size by 2028 | US$ 1,339.12 Million |

| CAGR (2023 - 2028) | 3.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

|

The geographic scope of the Middle East & Africa Military Truck refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa military truck market is segmented into application, truck type, propulsion type, transmission type, and country.

Based on application, the Middle East & Africa military truck market is segmented into cargo/logistics carrier and troop carrier. The troop carrier segment held a larger share of the Middle East & Africa military truck market in 2023.

Based on truck type, the Middle East & Africa military truck market is segmented into light truck, medium truck, and heavy truck. The heavy truck segment held the largest share of the Middle East & Africa military truck market in 2023.

Based on propulsion type, the Middle East & Africa military truck market is segmented into electric/hybrid and diesel. The diesel segment held a larger share of the Middle East & Africa military truck market in 2023.

Based on transmission type, the Middle East & Africa military truck market is segmented into automatic transmission and manual transmission. The automatic transmission segment held a larger share of the Middle East & Africa military truck market in 2023.

Based on country, the Middle East & Africa military truck market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the share of the Middle East & Africa military truck market in 2023.

AB Volvo; Hyundai Rotem Co; Iveco Group NV; Navistar Defense LLC; Oshkosh Corp; Rheinmetall AG; and Tata Motors Ltd are the leading companies operating in the Middle East & Africa military truck market.

The Middle East & Africa Military Truck Market is valued at US$ 1,149.76 Million in 2023, it is projected to reach US$ 1,339.12 Million by 2028.

As per our report Middle East & Africa Military Truck Market, the market size is valued at US$ 1,149.76 Million in 2023, projecting it to reach US$ 1,339.12 Million by 2028. This translates to a CAGR of approximately 3.1% during the forecast period.

The Middle East & Africa Military Truck Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Military Truck Market report:

The Middle East & Africa Military Truck Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Military Truck Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Military Truck Market value chain can benefit from the information contained in a comprehensive market report.