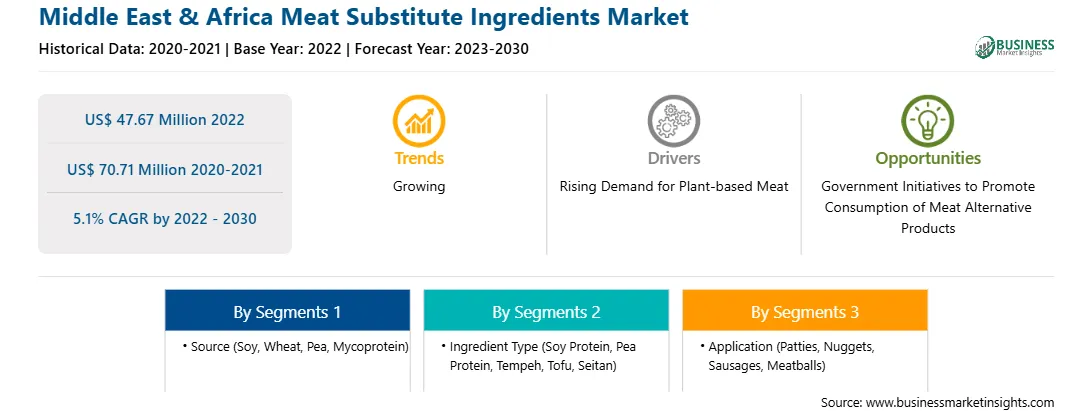

The Middle East & Africa meat substitute ingredients market was valued at US$ 47.67 million in 2022 and is expected to reach US$ 70.71 million by 2030; it is estimated to record a CAGR of 5.1% from 2022 to 2030.

Several dieticians and health practitioners recommend reducing meat consumption and switching to a vegetarian diet to reduce the risks of chronic health issues, such as obesity, heart disease, hypertension, and digestive disorders.

According to Google Trends, veganism was one of the top five searched terms on Google in 2019 worldwide.

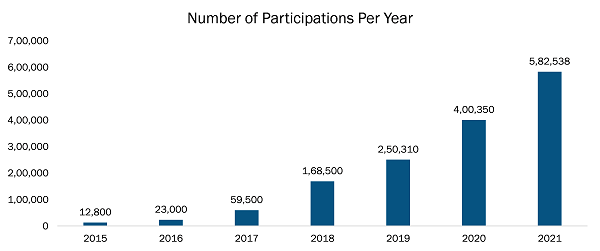

A report published by Veganuary (a nonprofit organization that encourages individuals worldwide to turn vegan for the whole month of January) states that ~5.8 million people signed up for the Veganuary Campaign in 2021. The figure below shows the global number of participants enrolled in the Veganuary Campaign during 2015–2021.

Strategic insights for the Middle East & Africa Meat Substitute Ingredients provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 47.67 Million |

| Market Size by 2030 | US$ 70.71 Million |

| CAGR (2022 - 2030) | 5.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Source

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

|

The geographic scope of the Middle East & Africa Meat Substitute Ingredients refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Source: Veganuary 2020 Campaign Review

As depicted in the figure, registrations for the Veganuary Campaign have increased dramatically in the past few years. The large shift toward vegetarianism and veganism is owing to increasing care for animals among the population, as people don’t want to see them suffer. Several people have become more aware of the impact of animal-based meat on the environment. This factor makes them more willing to adopt vegan food to reduce carbon emissions and combat climate change. However, many people are adopting a vegan diet due to the rising health consciousness. In addition, the number of flexitarians who consume less meat and are occasionally vegetarian is also on the rise.

Recently, the rising health concerns among people due to the increasing prevalence of obesity, diabetes, and other diseases are compelling people to change their dietary habits. Plant-based meat is generally perceived to be healthier than animal-based meat. The increasing adoption of veganism is also attributed to the empathy toward animals and awareness of the ill-treatment of animals in slaughterhouses and similar facilities, which has raised concerns about animal protection among consumers. These factors are boosting the demand for meat substitute ingredients such as soy protein, pea protein, tofu, and tempeh. Thus, surging veganism across the globe is expected to create new trends in the meat substitute ingredients market.

The growing consumer preference for a plant-based diet due to the rising adoption of a vegan lifestyle and exposure to Westernized dietary trends aids to increasing demand for meat substitute products in the region. Additionally, the benefits of cholesterol-free protein, with a meat-like texture, are key factors promoting the demand for plant-based meat. Furthermore, one of the important elements encouraging the growth of the plant-based meat products industry is the benefits of cholesterol-free protein with a meat-like texture. Consumers believe that these alternative products pose no challenges to the environment and contribute to animal welfare. Furthermore, the functional efficacy and high sustainability claims associated with plant-derived products propel the meat substitute ingredients market in the Middle East & Africa.

The key manufacturers in the market are expanding their businesses in the Middle East & Africa. For instance, in January 2022, Kerry Group, a major taste and nutrition company, opened a new 21,500-square-foot state-of-the-art facility in Jeddah, Saudi Arabia. The company has invested more than US$ 89 million in the region, and this new facility produces great-tasting, nutritious, and sustainable meat substitute ingredients, including plant-based proteins, and distributes ingredients throughout the Middle East. Such expansion strategies by manufacturers in the region boost the demand for meat-substitute ingredients, thereby positively influencing market growth.

Strategic insights for the Middle East & Africa Meat Substitute Ingredients provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Meat Substitute Ingredients refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Meat Substitute Ingredients Strategic Insights

Middle East & Africa Meat Substitute Ingredients Report Scope

Report Attribute

Details

Market size in 2022

US$ 47.67 Million

Market Size by 2030

US$ 70.71 Million

CAGR (2022 - 2030) 5.1%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Source

By Ingredient Type

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Meat Substitute Ingredients Regional Insights

The Middle East & Africa meat substitute ingredients market is categorized into source, ingredients type, application, and country.

Based on source, the Middle East & Africa meat substitute ingredients market is categorized into Soy, wheat, pea, mycoprotein, and others. The soy segment held the largest market share in 2022.

Based on ingredients, the Middle East & Africa meat substitute ingredients market is segmented into soy protein, pea protein, tempeh, tofu, seitan, and others. The soy protein segment held the largest market share in 2022.

In terms of application, the Middle East & Africa meat substitute ingredients market is categorized into patties, nuggets, sausages, meatballs, and others. The others segment held the largest market share in 2022.

By country, the Middle East & Africa meat substitute ingredients market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa meat substitute ingredients market share in 2022.

DuPont de Neumours Inc, Ingredion Inc, Wilmar International Ltd, Archer Daniels Midland Co, and Kerry Group Plc are some of the leading companies operating in the Middle East & Africa meat substitute ingredients market.

The Middle East & Africa Meat Substitute Ingredients Market is valued at US$ 47.67 Million in 2022, it is projected to reach US$ 70.71 Million by 2030.

As per our report Middle East & Africa Meat Substitute Ingredients Market, the market size is valued at US$ 47.67 Million in 2022, projecting it to reach US$ 70.71 Million by 2030. This translates to a CAGR of approximately 5.1% during the forecast period.

The Middle East & Africa Meat Substitute Ingredients Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Meat Substitute Ingredients Market report:

The Middle East & Africa Meat Substitute Ingredients Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Meat Substitute Ingredients Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Meat Substitute Ingredients Market value chain can benefit from the information contained in a comprehensive market report.