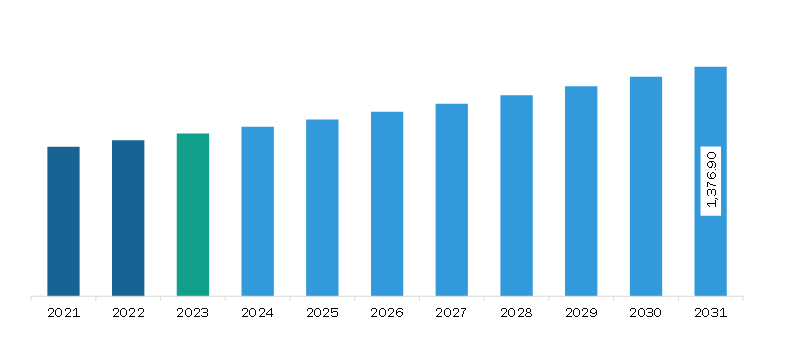

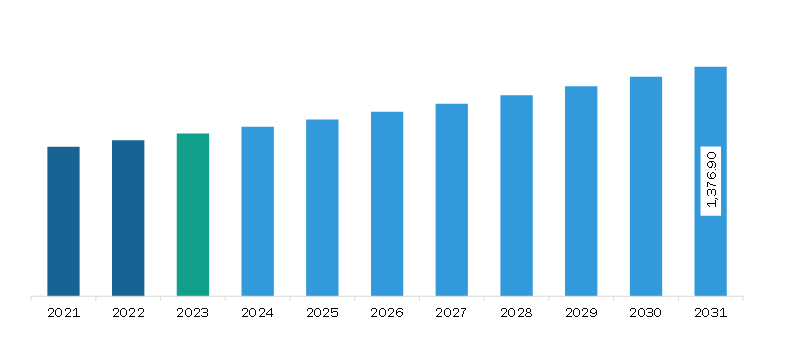

The Middle East & Africa frozen vegetables market was valued at US$ 974.57 million in 2023 and is expected to reach US$ 1,376.90 million by 2031; it is estimated to register a CAGR of 4.4% from 2023 to 2031.

Sustainability in the Frozen Vegetable Industry Bolsters Middle East & Africa Frozen Vegetables Market

Sustainability is becoming a core focus in the frozen vegetable market, driven by both consumer demand and environmental responsibility. One major advantage of frozen vegetables is reduced food waste—thanks to their long shelf life, they help limit spoilage at both retail and household levels. Additionally, many producers are transitioning to eco-friendly packaging, such as recyclable or compostable materials, to minimize plastic waste.

Sustainable farming practices are also gaining traction, including reduced pesticide use, crop rotation, and organic certification. Locally sourced produce is being prioritized to lower carbon emissions from transportation. Energy-efficient freezing and storage technologies are being adopted to further reduce environmental impact.

Moreover, companies are increasingly transparent about their sustainability efforts, using labeling and certifications to inform eco-conscious consumers. As sustainability becomes a key differentiator, brands that invest in green innovations are better positioned to lead the market in the coming years.

Middle East & Africa Frozen Vegetables Market Overview

In the Middle East and Africa, the middle-class population is increasing, along with rising disposable income. With improved purchasing power, consumers are more inclined to explore a variety of frozen vegetables, including premium and exotic options. The presence of supermarket chains and the development of cold chain infrastructure in countries across the Middle East further facilitate the availability and accessibility of frozen vegetables. The market also witnesses growing production and consumption of organic produce in a few countries, such as Saudi Arabia, Kuwait, and the UAE. According to Business Start Up Saudi Arabia, the number of organic farms increased by 28% in 2021 owing to Saudi Arabia's US$ 200 million strategy for innovation plan. The plan aims to increase the capacity of organic farming by 300% in the coming years. The rising urbanization, increasing disposable income, and advancement in supply chain infrastructure are a few factors that drive the market for frozen vegetables.

Middle East & Africa Frozen Vegetables Market Revenue and Forecast to 2031 (US$ Million)

Middle East & Africa Frozen Vegetables Market Segmentation

The Middle East & Africa frozen vegetables market is categorized into type, category, end user, and country.

By type, the Middle East & Africa frozen vegetables market is segmented into corn cob, corn kernels/sweet corn, green peas, baby corn, carrot, cauliflower, green beans, spinach, broccoli, onions, brussel sprouts, mixed vegetables, and others. The others segment held the largest share of the Middle East & Africa frozen vegetables market share in 2023.

In terms of category, the Middle East & Africa frozen vegetables market is bifurcated into organic and conventional. The conventional segment held a larger share of the Middle East & Africa frozen vegetables market share in 2023.

Based on end user, the Middle East & Africa frozen vegetables market is segmented into food processing, food retail, and foodservice. The food retail segment held the largest share of the Middle East & Africa frozen vegetables market share in 2023.

Based on country, the Middle East & Africa frozen vegetables market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East and Africa. The Rest of Middle East and Africa segment held the largest share of Middle East & Africa frozen vegetables market in 2023.

Alasko Food Inc.; Ardo Foods NV; B&G Foods; Bonduelle SA; Dawtona Frozen; General Mills Inc; Goya Foods Inc; Grupo Virto; Hanover Foods; La Fe Foods; McCain Foods Ltd; Mondial Foods BV; Mother Dairy Fruit & Vegetable Pvt. Ltd; Seneca Foods Corp; and Simplot Global Food are some of the leading companies operating in the Middle East & Africa frozen vegetables market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 974.57 Million |

| Market Size by 2031 | US$ 1,376.90 Million |

| CAGR (2023 - 2031) | 4.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Middle East & Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Frozen Vegetables Market is valued at US$ 974.57 Million in 2023, it is projected to reach US$ 1,376.90 Million by 2031.

As per our report Middle East & Africa Frozen Vegetables Market, the market size is valued at US$ 974.57 Million in 2023, projecting it to reach US$ 1,376.90 Million by 2031. This translates to a CAGR of approximately 4.4% during the forecast period.

The Middle East & Africa Frozen Vegetables Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Frozen Vegetables Market report:

The Middle East & Africa Frozen Vegetables Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Frozen Vegetables Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Frozen Vegetables Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)