The centrifugal pumps market in the MEA is further segmented into South Africa, Saudi Arabia, the UAE, and Rest of the MEA. Economic diversification through the establishment of new business and industrial hubs as well as increase in number of infrastructure development projects such as the Shah Sour gas field’s pipeline and Zayed City Infrastructure have fueled the growth of the centrifugal pumps market across the Middle Eastern countries. Further, government-imposed environmental regulations have resulted in the mandatory installation of centrifugal pumps in the industrial sector for wastewater treatment. Future international events such as the FIFA World Cup, to be hosted by Qatar in 2022, and the World Expo, to be organized in Dubai in 2020, are likely to attract greater expenditure in infrastructure developments in the MEA countries, which would trigger the adoption of centrifugal pumps in the construction sector. The growing demand for freshwater in African countries such as South Africa and Nigeria would boost the performance of the centrifugal pump industry in the coming years. Countries such as Saudi Arabia and the UAE are rapidly growing in terms of infrastructure and economy. These countries are also characterized by huge oil resources and water management system which rises the demand for centrifugal pumps and thus more companies are investing in improving these technologies to make them cheaper and more reliable in these regions.

In case of COVID-19, MEA is highly affected especially South Africa. Other major countries in the MEA facing the economic impact of COVID-19 pandemic include Saudi Arabia, the UAE, Egypt, Morocco, and Kuwait. The region is projected to register a swift decline in exports due to lowered demands for raw materials and products from manufacturers across North America, Europe, and APAC; this can be attributed to lowered production activities and disruption of manufacturing in many countries in these regions. Irrespective of the previous projections regarding steady growth of the centrifugal pump market in the MEA due to escalating adoption of the IIoT for centrifugal pumps, and large number of oil refineries located in this region. To enhance resource utilization, improve efficiencies, and enhance worker safety, in Saudi Arabia and the UAE, the imposition of travel restrictions and disruption of supply chains are limiting the centrifugal pump market growth to a certain extent.

Strategic insights for the Middle East and Africa Centrifugal Pump provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

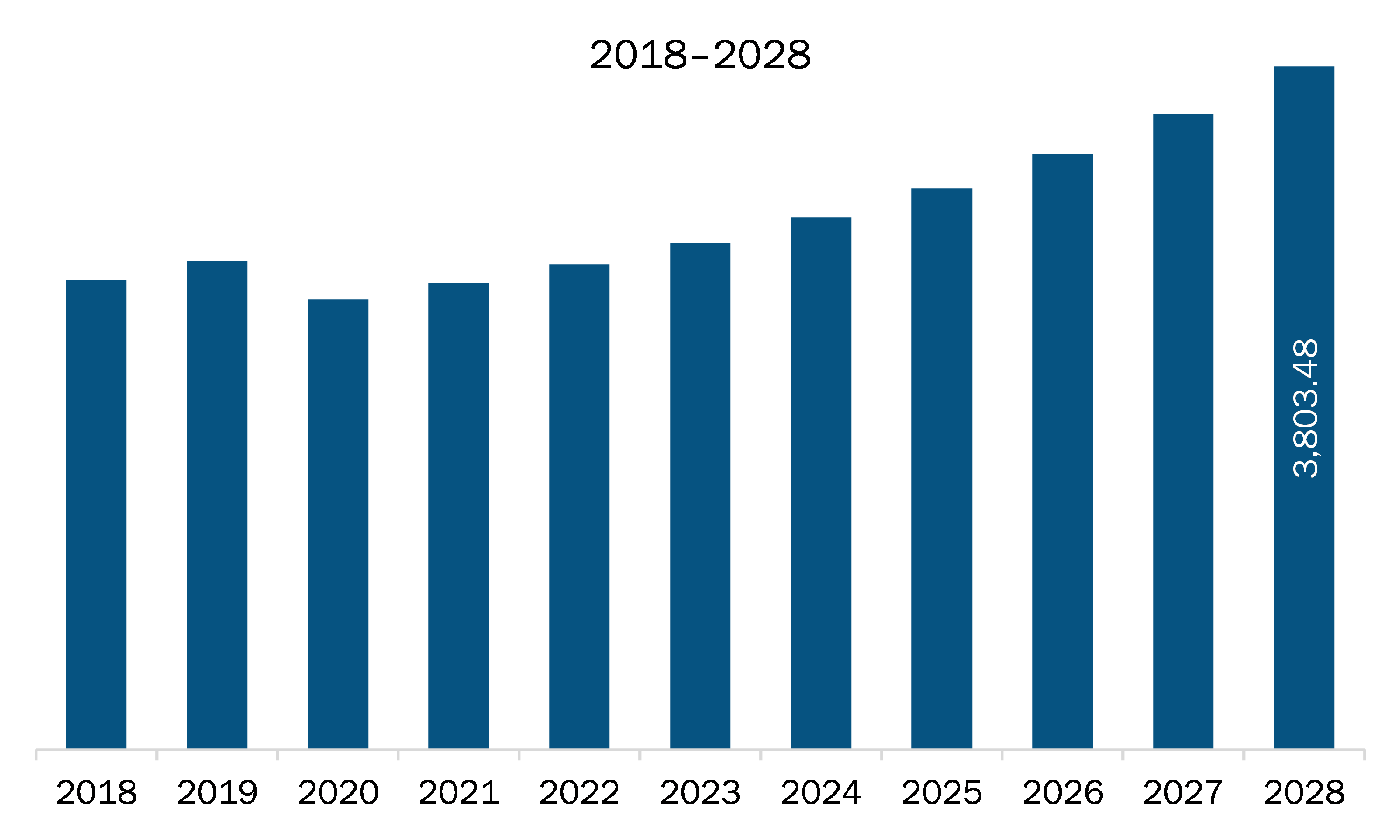

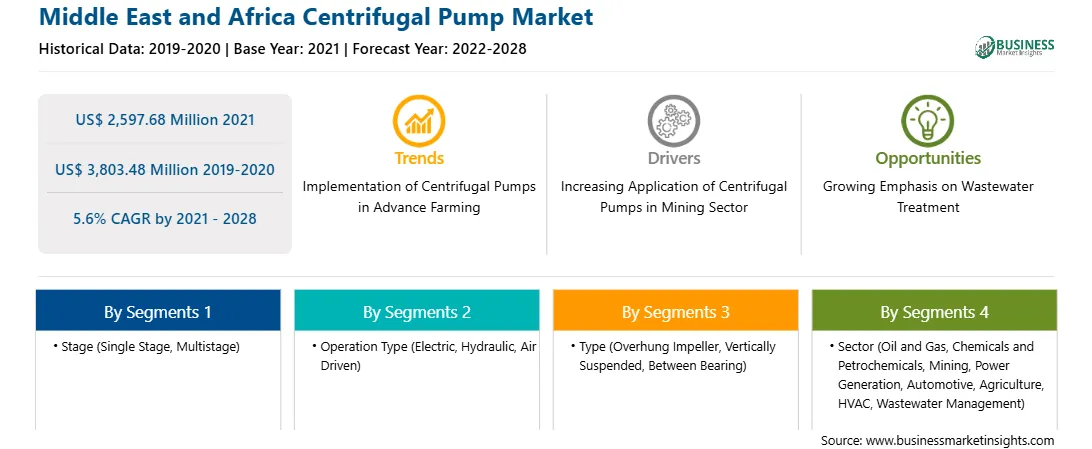

| Market size in 2021 | US$ 2,597.68 Million |

| Market Size by 2028 | US$ 3,803.48 Million |

| CAGR (2021 - 2028) | 5.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Stage

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

|

The geographic scope of the Middle East and Africa Centrifugal Pump refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The MEA centrifugal pump market is expected to grow from US$ 2,597.68 million in 2021 to US$ 3,803.48 million by 2028; it is estimated to grow at a CAGR of 5.6% from 2021 to 2028. Minerals extracted from mining are the backbone of human civilization. These minerals are widely used across industries such as manufacturing, power generation, chemicals and petrochemicals, healthcare and pharmaceuticals, and construction. Currently, copper, coal, iron ore, gold, and aluminum are among the most mined minerals. Moreover, the aggregate revenue of top 40 mining companies has grown steadily from 2016 to 2019. In 2020, they witnessed a fall in revenue due to the COVID-19 outbreak. Mining activities such as transportation of ore and waste in slurries and suspension, separation of minerals using chemical processes, controlling temperature via cooling systems around power generators, suppression of dust during mineral processing, dewatering of mines require enormous volume of water. Centrifugal pumps play a vital role in these applications. Moreover, with the growing rate of industrialization and urbanization, and increasing need of energy, the demand for minerals is projected to rise significantly during the forecast period, which would fuel adoption of centrifugal pumps, thus driving the MEA market growth.

In terms of stage, the single stage segment accounted for the largest share of the MEA centrifugal pump market in 2020. In terms of operation type, the electric segment held a larger market share of the MEA centrifugal pump market in 2020. In terms of type, the overhung impeller segment held a larger market share of the MEA centrifugal pump market in 2020. Further, the wastewater management segment held a larger share of the MEA centrifugal pump market based on sector in 2020.

A few major primary and secondary sources referred to for preparing this report on the MEA centrifugal pump market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are EBARA CORPORATION; Grundfos Holding A/S; KIRLOSKAR BROTHERS LIMITED; KSB SE & Co. KGaA; PLEUGER INDUSTRIES; Sulzer Ltd; The Weir Group PLC; Tsurumi Manufacturing Co., Ltd.; WILO SE; and Xylem Inc.

The Middle East and Africa Centrifugal Pump Market is valued at US$ 2,597.68 Million in 2021, it is projected to reach US$ 3,803.48 Million by 2028.

As per our report Middle East and Africa Centrifugal Pump Market, the market size is valued at US$ 2,597.68 Million in 2021, projecting it to reach US$ 3,803.48 Million by 2028. This translates to a CAGR of approximately 5.6% during the forecast period.

The Middle East and Africa Centrifugal Pump Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Centrifugal Pump Market report:

The Middle East and Africa Centrifugal Pump Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Centrifugal Pump Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Centrifugal Pump Market value chain can benefit from the information contained in a comprehensive market report.