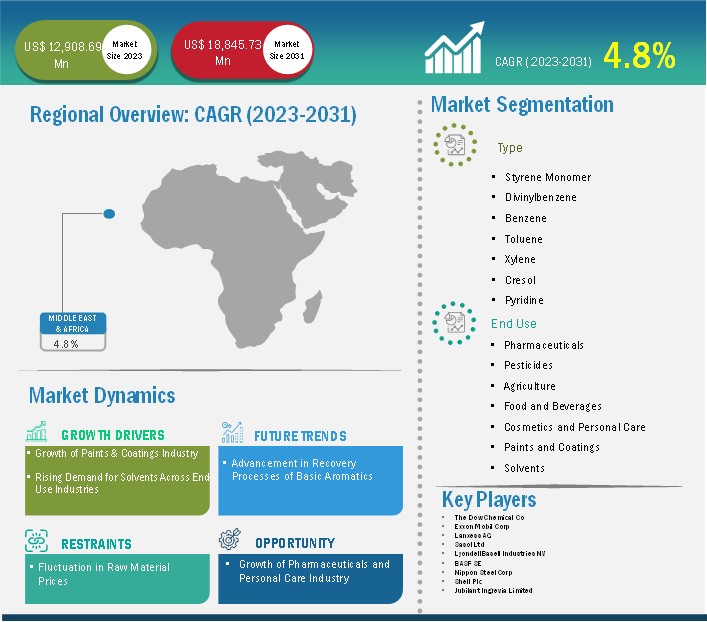

The Middle East & Africa basic aromatics market size is expected to reach US$ 18,845.73 million by 2031 from US$ 12,908.69 million in 2023. The market is estimated to record a CAGR of 4.8% from 2023 to 2031.

According to the US Energy Information Administration, the Middle East consists of five of the leading oil-producing countries: Saudi Arabia, Iraq, the UAE, Iran, and Kuwait. The Middle East accounts for ~27% of the global production of oil. According to the International Energy Agency, the Middle East ranks as the third-largest petrochemical producer worldwide. In the past few years, the major oil companies in the Middle East have been involved in expansion strategies. For instance, Abu Dhabi National Oil Corporation (ADNOC) announced the launch of a US$ 45 billion expansion program for the development of the world’s largest integrated refining and petrochemicals complex by 2025. The petrochemical derivatives complex will be integrated into the Ruwais complex, thereby boosting the ADNOC’s production capacity for construction chemicals, detergents, and other substances.

The majority of the primary chemical production capacity in the Middle East is located on the coastline of the Persian Gulf to facilitate trade. In the Middle East & Africa, the oil demand for chemical feedstock increases as the countries are transitioning toward the oil refining and petrochemical businesses. This factor is expected to enhance the value of their indigenous oil production and aid in the diversification of the economies. Thus, development in petrochemicals and oil production is projected to create lucrative opportunities for the basic aromatics manufacturers during the forecast period.

Middle East & Africa Basic Aromatics Market Segmentation Analysis:

Key segments that contributed to the derivation of the basic aromatics market analysis are type and end user.

Advancement in recovery processes of basic aromatics is driven by the need for increased cost-effectiveness, efficiency, and environmental sustainability. Techniques such as continuous catalytic reforming have improved yield and stability allowing better recovery rates. The development of new solvents and solvent systems such as ionic liquids have improved the selectivity and efficiency of extractive distillation processes. In February, 2024, Sulzer Chemtech was awarded a technology license contract to revamp its existing glycol-based aromatics extraction unit. In 2022, Sulzer Chemtech finalized an agreement with Encina Development Group LLC to provide technology to recover high purity circular aromatics from cracked oil products derived from the mixed-plastics-to-aromatics catalytic conversion platform. Encina has developed a catalytic platform wherein the cracked products selectively contain high levels of circular aromatics. Sulzer Chemtech offers its hydrotreating and aromatics extraction technology to recover high purity circular benzene and toluene. In 2022, GTC Vorro Technology launched BTX Gold Solvent for petrochemical separations. BTX Gold solvents are utilized for benzene, toluene, and xylene recovery from feed, including catalytic reformate, pyrolysis gasoline, coker naphtha, coke oven light oil, FCC gasoline, and straight run naphtha. The integration of advanced sensors, real-time monitoring and automation is expected to provide better control and optimization of aromatic recovery processes, resulting in high efficiency and low operational costs. Thus, the advancement in recovery processes of basic aromatics is expected to be a key trend contributing to the market growth.

Based on geography, the Middle East & Africa basic aromatics market comprises South Africa, Saudi Arabia, the UAE, and the Rest of MEA. The Rest of Middle East & Africa held the largest share in 2023.

Egypt, Ghana, Algeria, Morocco, Zimbabwe, Oman, Qatar, Nigeria, and Tanzania are among the major countries in the Rest of Middle East & Africa basic aromatics market. The food industry in Egypt has experienced steady growth in the past few years. According to the Food Export Council, Egypt's food exports accounted for US$ 4.12 billion in 2022. Egypt marks the presence of 1,678 food companies, including 302 companies with export value of more than US$ 1 million. According to the Organic Trade Association report, organic beverage consumption in Qatar increased from US$ 14.1 million in 2021 to US$ 16.6 million in 2022. In contrast, organic packaged food and beverage consumption increased to US$ 20.0 million in 2022 from US$ 17.2 million in 2021. As per the Investment Promotion Agency Qatar, the country offers competitive business opportunities for the medical and pharmaceutical industries through extensive investments in infrastructure and research and development projects.

Morocco has an attractive investment environment, vast gas reserves, and a huge exploration potential within the oil & gas industry. Ghana is also an emerging player in the oil & gas industry with operations in the upstream (exploration and production), midstream, and downstream sectors. Thus, with the growing applications in the oil & gas industry in the region, the Middle East & Africa basic aromatics market is expected to grow during the forecast period.

Middle East & Africa Basic Aromatics Market Company Profiles

Some of the key players operating in the market include BASF SE, Exxon Mobil Corp, Jubilant Ingrevia Limited, Lanxess AG, LyondellBasell Industries NV, Nippon Steel Corp, Sasol Ltd, Shell Plc, and The Dow Chemical Co among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 12,908.69 Million |

| Market Size by 2031 | US$ 18,845.73 Million |

| CAGR (2023 - 2031) | 4.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Basic Aromatics Market is valued at US$ 12,908.69 Million in 2023, it is projected to reach US$ 18,845.73 Million by 2031.

As per our report Middle East & Africa Basic Aromatics Market, the market size is valued at US$ 12,908.69 Million in 2023, projecting it to reach US$ 18,845.73 Million by 2031. This translates to a CAGR of approximately 4.8% during the forecast period.

The Middle East & Africa Basic Aromatics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Basic Aromatics Market report:

The Middle East & Africa Basic Aromatics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Basic Aromatics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Basic Aromatics Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)