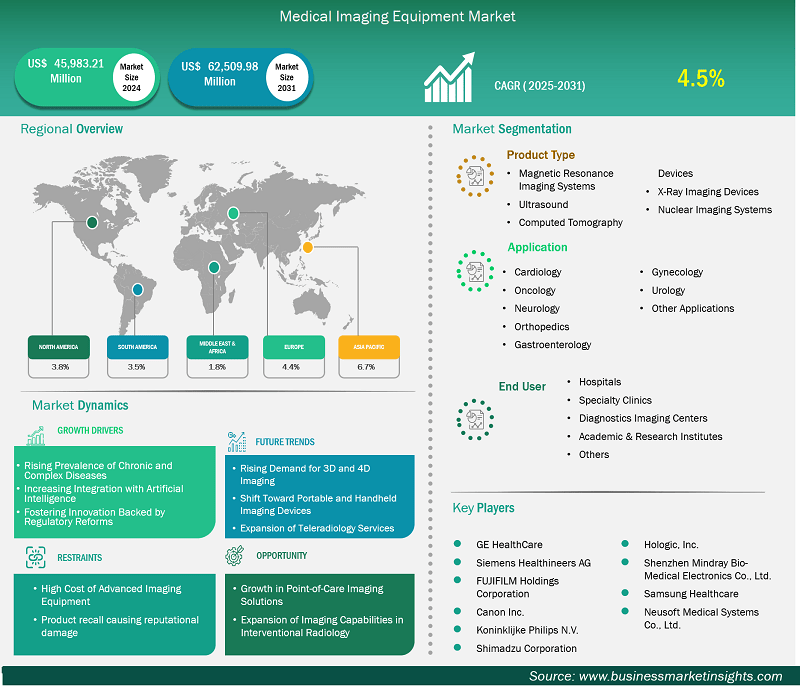

The medical imaging equipment market size is expected to reach US$ 62,509.98 million by 2031 from US$ 45,983.21 million in 2024. The market is estimated to record a CAGR of 4.5% from 2025 to 2031.

Executive Summary and Global Market Analysis:

The global medical imaging equipment market is growing with technological advancements designed to meet the complex and escalating healthcare demands of the aging population. As chronic conditions become more prevalent and early diagnosis gains strategic importance, next-generation imaging solutions are playing a pivotal role in enhancing diagnostic precision, streamlining clinical workflows, and improving patient outcomes. This shift not only underscores the critical role of innovation in modern healthcare but also positions the sector for sustained growth amid rising global health challenges. The market performance is evaluated by considering the adoption of devices such as X-rays, MRI, CT scanners, ultrasound, and nuclear imaging globally.

In line with the adoption rate, the global medical imaging equipment market stood at US$ 45,983.21 million in 2024 and is expected to reach US$ 62,509.98 million by 2031. This steady growth is expected due to rising healthcare investments, innovation in Al and machine learning integration, and expanding access to healthcare in emerging economies. Future trends indicate greater demand for affordable, portable imaging products and the use of Al to enhance diagnostic quality and workflow. Also, the trend toward personalized medicine and the detection of disease in its early stages will continue to drive the growth of the market. Nevertheless, the expansion of the market is being hampered by the expensive prices of sophisticated imaging products and product recalls, which result in reputational risks.

Key segments that contributed to the derivation of the medical imaging equipment market analysis are product type, application, and end user.

Medical Imaging Equipment Market Drivers and Opportunities:

Rising Prevalence of Chronic and Complex Diseases

The world's increase in chronic and complicated diseases, including cancer, cardiovascular disease, diabetes, and neurologic conditions, is having a profound impact on the healthcare industry. Demographic changes, urbanization, lifestyle changes, and environmental factors have driven a high increase in disease incidence. For instance, according to the data published by the Global Cancer Observatory (GCO), new cancer cases were reported in 2022 across the globe. In addition, cancer resulted in 9,743,832 deaths globally in 2022.

Medical imaging is vital in early diagnosis of medical disorders, giving detailed and clear pictures of inner body structures without having to perform invasive surgical intervention. MRI, CT, and ultrasound are the most common medical imaging equipment used in hospitals. To understand a patient's condition and determine the most effective treatment, various diagnostic tools have become integral to the management of serious health issues. As diseases become increasingly prevalent and challenging to treat, medical teams require more precise and expedited methods for decision-making. In this context, imaging technology plays a crucial role.

Increasing Integration with Artificial Intelligence

Healthcare providers have begun to look for ways to improve accuracy in their diagnoses, lower operational costs, and deal with the abundant number of patients. The use of artificial intelligence in diagnostic imaging devices has several advantages, including improved quality of diagnosis, speedier image multi-processing, improved decisions being determined by advanced algorithms that can recognize patterns, identify abnormalities, and make improved and more definitive decisions while reducing the potential of human error. Artificial intelligence's possibilities are generating serious interest in hospitals since they may have even more choices to consider upgrading to hardware that includes AI software without worrying about bias and consistency.

The possibilities have empowered manufacturers to create better systems with AI-based functions. For instance, on December 5, 2024, GE Healthcare, a multi-national corporation and medical device manufacturer from the USA announced advances in their deep learning image processing and image reconstruction solutions for their Recon DL MRI system. The newer-compatible MRI systems with AI algorithms will provide enhanced image quality as well as improved workflow. The health system will receive improved workflow and satisfaction with cost savings especially if they can further justify the higher cost of more sophisticated machines.

Medical Imaging Equipment Market Size and Share Analysis

By product type, the medical imaging equipment market is segmented into Magnetic Resonance Imaging Systems, Ultrasound, Computed Tomography Devices, X-Ray Imaging Devices and Nuclear Imaging Systems. The Computed Tomography segment dominated the market in 2024. Due to their fast scanning capabilities and high-resolution imaging, CT devices are beneficial in emergency medical settings and routine diagnostics.

In terms of applications, the market is segmented into Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology, Urology, and Other Applications. The oncology segment held the largest share of the market in 2024. According to the data published by the Global Cancer Observatory (GCO), ~19,976,499 new cancer cases were reported across the globe in 2022, and cancer resulted in 9,743,832 deaths globally in 2022. As the cancer burden rises globally, the demand for advanced imaging technologies to provide precise, non-invasive diagnostic solutions continues to grow.

By end user, the market is segmented into Hospitals, Specialty Clinics, Diagnostics Imaging Centers, Academic & Research Institutes and Others. The hospitals segment held the largest share of the market in 2024. Hospitals rely heavily on a range of imaging modalities—including MRI, CT, X-ray, ultrasound, and nuclear imaging—for diagnosis, treatment planning, and monitoring across nearly all medical specialties. The need for rapid, accurate diagnostics in inpatient and emergency settings drives the demand for advanced imaging systems in hospitals. Additionally, investments in high-end technologies, integration with electronic health records (EHRs), and the availability of skilled radiology professionals further contribute to the demand.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 45983.21 Million |

| Market Size by 2031 | US$ 62509.98 Million |

| Global CAGR (2024 - 2031) | 4.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Medical Imaging Equipment Market Report Coverage and Deliverables

The "Medical Imaging Equipment Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

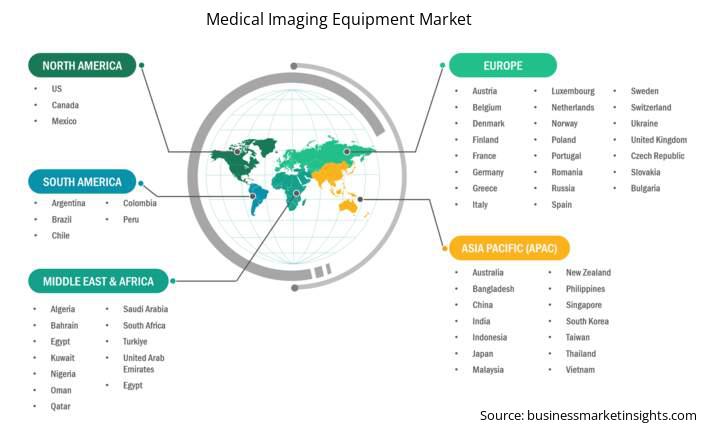

The geographical scope of the medical imaging equipment market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The medical imaging equipment market in Asia Pacific is expected to grow significantly during the forecast period.

The Asia Pacific medical imaging equipment market is segmented into China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Taiwan, Bangladesh and Rest of Asia. The region's demand for medical imaging is fuelled by a large and diverse population, rising incidences of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders, as well as an expanding elderly population. Various factors such as advancement in the in imaging technology, along with increased adoption of portable and digital imaging solutions, are making diagnostic tools more accessible in urban and rural areas of APAC countries. Government bodies are implementing initiatives to modernize healthcare systems and increase public access to advanced diagnostic services.

Medical Imaging Equipment Market Research Report Guidance

Medical Imaging Equipment Market News and Key Development:

The medical imaging equipment market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the medical imaging equipment market are:

Key Sources Referred:

The Medical Imaging Equipment Market is valued at US$ 45983.21 Million in 2024, it is projected to reach US$ 62509.98 Million by 2031.

As per our report Medical Imaging Equipment Market, the market size is valued at US$ 45983.21 Million in 2024, projecting it to reach US$ 62509.98 Million by 2031. This translates to a CAGR of approximately 4.5% during the forecast period.

The Medical Imaging Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Medical Imaging Equipment Market report:

The Medical Imaging Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Medical Imaging Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Medical Imaging Equipment Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)