Last Mile Delivery Drones Market Outlook (2021-2031)

No. of Pages: 200 | Report Code: BMIPUB00031694 | Category: Automotive and Transportation

No. of Pages: 200 | Report Code: BMIPUB00031694 | Category: Automotive and Transportation

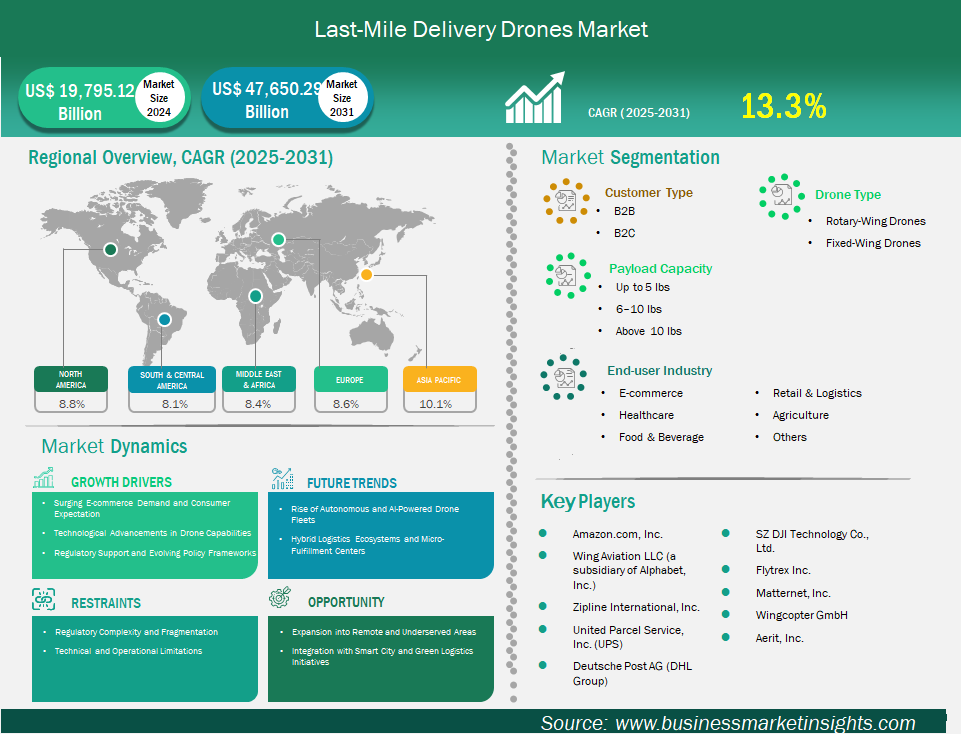

The last-mile delivery drones market size is expected to reach US$ 47,650.29 million by 2031 from US$ 19,795.12 million in 2024. The market is estimated to record a CAGR of 13.3% from 2025 to 2031.

The global last-mile drone delivery market is experiencing rapid transformation, driven by the growing demand for faster, more efficient, and environmentally friendly delivery solutions. E-commerce expansion, urbanization trends, and the need to overcome traditional delivery bottlenecks are fueling widespread interest and investment in drone technology. Leading logistics providers, major retailers, and technology innovators are actively developing and deploying drone delivery systems, signaling a shift toward more automated and scalable logistics networks.

Regulatory frameworks are evolving to accommodate this emerging sector, with governments and aviation authorities increasingly supporting pilot programs and the integration of drones into national airspace. As a result, the market is transitioning from experimental trials to broader commercial adoption, with the potential to redefine urban and rural supply chains.

Last Mile Delivery Drones Market Strategic Insights

Last Mile Delivery Drones Market Segmentation Analysis

Key segments that contributed to the derivation of the Last-mile delivery drones market analysis are drive type, propulsion, sales channel, and geography.

Continuous innovation in drone technology is a major driver of market growth. Improvements in autonomous navigation, artificial intelligence, and real-time data analytics have made drones safer, more reliable, and capable of handling complex urban environments. Enhanced battery life and payload capacities enable longer and more frequent flights, while advanced obstacle detection systems reduce the risk of accidents. These technological advancements are lowering operational costs and increasing the feasibility of large-scale drone delivery operations. As drones become more intelligent and efficient, they are increasingly integrated into logistics networks, supporting the transition from pilot projects to mainstream commercial deployment.

One of the most promising opportunities for last-mile drone delivery lies in serving remote, rural, or otherwise underserved regions. Traditional logistics infrastructure is often inadequate in these areas, making it difficult and costly to deliver essential goods such as medicines, food, and emergency supplies. Drones can overcome geographical barriers, delivering critical items quickly and efficiently. This capability is especially valuable in developing countries, island communities, and regions affected by natural disasters. By addressing these gaps, drone delivery providers can unlock new markets and create significant social impact while building brand loyalty and goodwill.

By customer type, the B2B segment led the market in 2024 – This dominance is primarily driven by the rapid expansion of e-commerce, which has led to increased consumer expectations for fast, convenient, and reliable deliveries. The rise of online shopping and the growing purchasing power of the global middle class have further amplified demand for direct-to-consumer services, making B2C the leading segment. Additionally, B2C drone deliveries benefit from their ability to serve large urban populations efficiently, reducing delivery lead times and enhancing customer satisfaction. While B2B drone deliveries are important, especially for logistics between warehouses and retail outlets or for specialized sectors like healthcare, their scale and revenue impact have not yet matched that of B2C in the last-mile context.

By payload capacity, The segment with payload capacities of up to 5 lbs dominates the last-mile drone delivery market by payload capacity. his dominance is primarily due to the high demand for rapid and efficient delivery of small packages, which are typical in e-commerce and medical supply deliveries. Drones capable of carrying up to 5 lbs are cost-effective, require less power and maintenance, and are well-suited for frequent, short-range deliveries in urban and suburban environments. Additionally, regulatory frameworks in many regions favour lighter drones, which face fewer restrictions and can be deployed more widely, further supporting their market leadership.

By end-user industry, the retail & logistics was the dominant end-user in the last mile delivery drones market due to its explosive growth, high delivery volume, and alignment with consumer expectations for fast, efficient service. Drones are especially well-suited for delivering lightweight goods commonly purchased online, such as electronics, clothing, and consumer goods, which are typically under 5 lbs. The integration of drone technology allows retailers to bypass urban traffic congestion and logistical bottlenecks, enabling faster and more efficient delivery—crucial factors for maintaining a competitive edge in e-commerce. The retail sector’s dominance is further reinforced by ongoing technological advancements in drone capabilities and the growing acceptance of drone delivery among consumers.

By drone type, the market was segmented into rotary-wing and fixed-wing drones. Rotary-wing drones dominated the market in 2024, as they are generally easier to operate, require less infrastructure for deployment, and can be manufactured more affordably, which supports rapid scaling and widespread adoption among delivery companies. Their adaptability to various payload capacities—especially for lightweight, high-frequency urban deliveries—further solidifies their market leadership in the last-mile segment.

By geography, North America, and specifically the United States, dominated the last-mile drone delivery market as of 2024. This leadership is primarily due to the region’s advanced technological infrastructure, strong presence of major drone manufacturers and technology companies, and a robust regulatory framework that is increasingly supportive of commercial drone operations. The Federal Aviation Administration (FAA) has played a pivotal role by granting beyond visual line of sight (BVLOS) permissions, which has enabled more extensive and innovative drone delivery programs.

Last Mile Delivery Drones Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 19,795.12 Million

Market Size by 2031

US$ 47,650.29 Million

Global CAGR (2025 - 2031) 13.3%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Customer Type

By Payload Capacity

By End-User Industry

By Drone Type

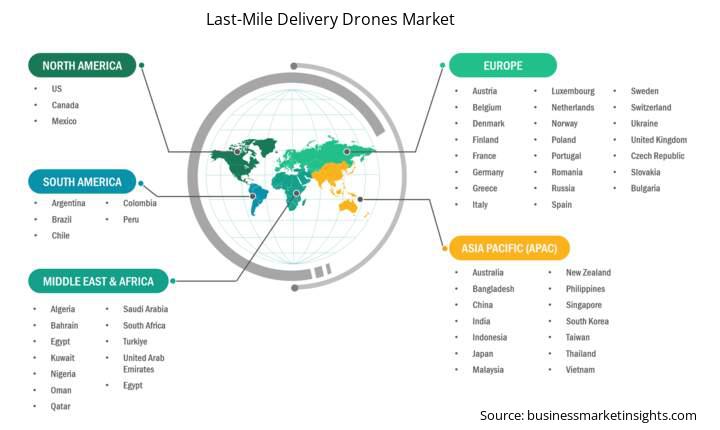

Regions and Countries Covered

North America

Europe

Asia-Pacific

South and Central America

Middle East and Africa

Market leaders and key company profiles

The "Last-mile delivery drones market Outlook (2021–2031)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the Last-mile delivery drones market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The Last-mile delivery drones market in Asia Pacific is expected to grow significantly during the forecast period.

North America is currently the dominant region in the last-mile drone delivery market, including the segment for drones. In 2024, this leadership is primarily due to the region’s advanced technological infrastructure, strong presence of major drone manufacturers and technology companies, and a robust regulatory framework that is increasingly supportive of commercial drone operations. The Federal Aviation Administration (FAA) has played a pivotal role by granting beyond visual line of sight (BVLOS) permissions, which has enabled more extensive and innovative drone delivery programs.

Additionally, North American consumers and businesses have shown a high readiness to adopt new technologies, making the region an early adopter of drone delivery solutions. The integration of drones into commercial delivery systems has been accelerated by the need for swift and flexible delivery options, especially in urban and suburban areas where traffic congestion can delay traditional methods. Significant investments from venture capitalists and leading tech companies, alongside partnerships with state governments for pilot programs, have further propelled the development and scaling of drone delivery services in North America. These factors collectively position North America as the leading region in the global last-mile drone delivery market.

Further, Asia-Pacific region is expected to grow the highest rate during the forecast period. The region is home to the world’s largest and fastest-growing e-commerce markets, led by China, India, Japan, and Southeast Asian countries. The surge in online shopping has created unprecedented demand for efficient, last-mile delivery solutions, especially in densely populated urban centers and remote rural areas.

The Last-mile delivery drones market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Last-mile delivery drones market are:

The Last Mile Delivery Drones Market is valued at US$ 19,795.12 Million in 2024, it is projected to reach US$ 47,650.29 Million by 2031.

As per our report Last Mile Delivery Drones Market, the market size is valued at US$ 19,795.12 Million in 2024, projecting it to reach US$ 47,650.29 Million by 2031. This translates to a CAGR of approximately 13.3% during the forecast period.

The Last Mile Delivery Drones Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Last Mile Delivery Drones Market report:

The Last Mile Delivery Drones Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Last Mile Delivery Drones Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Last Mile Delivery Drones Market value chain can benefit from the information contained in a comprehensive market report.