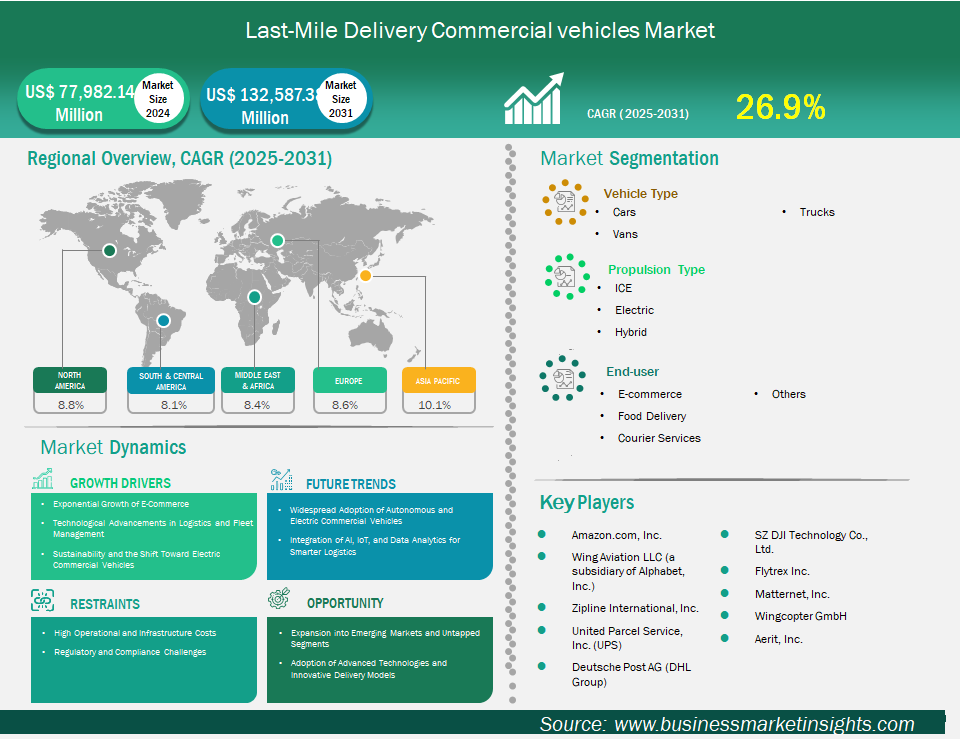

The Last-mile delivery commercial vehicles market size is expected to reach US$ 1,32,587.38 million by 2031 from US$ 77,982.14 million in 2024. The market is estimated to record a CAGR of 26.9% from 2025 to 2031.

The last-mile delivery commercial vehicles market is a cornerstone of the modern logistics ecosystem, propelled by the exponential growth of e-commerce, rising consumer expectations for speed and convenience, and ongoing urbanization. In 2024, the global last-mile delivery commercial vehicles market is estimated at approximately USD 77 billion, with commercial vehicles—such as vans and light trucks—accounting for the largest share of deliveries due to their capacity and versatility. As online shopping continues to reshape retail, businesses and logistics providers are investing heavily in advanced technologies, sustainable solutions, and infrastructure to optimize delivery networks and meet evolving customer demands.

North America and Europe currently lead the market, supported by robust logistics infrastructure and high e-commerce penetration, while Asia-Pacific is the fastest-growing region, driven by rapid digital adoption and urbanization. The market is characterized by fierce competition among established logistics giants and innovative startups, all striving to enhance efficiency, reduce costs, and improve customer satisfaction. Environmental concerns are prompting a shift toward electric and low-emission commercial vehicles, further accelerating market transformation.

Key segments that contributed to the derivation of the Last-mile delivery commercial vehicles market analysis are drive type, propulsion, sales channel, and geography.

Growing environmental concerns and stricter emission regulations are driving the adoption of electric and alternative fuel-powered commercial vehicles in last-mile delivery. Governments and businesses are increasingly prioritizing green logistics to reduce carbon footprints and comply with sustainability goals. For example, major logistics players like Amazon and FedEx are investing heavily in electric vans and trucks for their delivery fleets. This shift not only addresses regulatory requirements but also appeals to eco-conscious consumers and helps companies build a positive brand image. The transition to electric vehicles is further supported by advances in battery technology and the expansion of charging infrastructure, making sustainable last-mile delivery more feasible and cost-effective.

The integration of advanced technologies and innovative delivery models offers significant opportunities for differentiation and growth. The rise of autonomous commercial vehicles, drones, and delivery robots promises to transform last-mile logistics by reducing costs and increasing efficiency. The adoption of crowdsourced delivery models and micro-fulfillment centers enables logistics providers to offer faster and more flexible services. Additionally, the use of data analytics and predictive modeling allows for better demand forecasting and resource allocation. Companies that invest in these technologies and embrace innovative delivery solutions will be well-positioned to meet evolving customer expectations and gain a competitive edge in the market.

By vehicle type, the vans segment led the market in 2024 – The vans segment led the last-mile delivery commercial vehicle market by vehicle type due to a combination of versatility, efficiency, and adaptability that make them indispensable for urban logistics and modern delivery needs. Vans are uniquely suited for a wide range of delivery tasks, from small parcel deliveries to bulk shipments. They offer a balance between cargo capacity and maneuverability, allowing them to navigate congested city streets and tight urban spaces more easily than larger trucks while carrying significantly more goods than two-wheelers or cargo bikes.

By propulsion type, the ICE commercial vehicles benefit from an extensive and well-established fuel infrastructure, making them highly practical for last mile delivery. Petrol stations are ubiquitous globally, ensuring easy refuelling in urban and rural areas alike, unlike electric vehicles (EVs) which rely on limited charging networks. This accessibility minimizes downtime for delivery riders, critical for time-sensitive services like e-commerce and food delivery. In regions like Asia-Pacific and Latin America, where charging infrastructure is still developing, ICE comer vehicles offer unmatched convenience. The robust fuel supply chain supports continuous operations, making ICE vehicles the preferred choice for logistics companies and gig workers.

By end-user, the e-commerce channels the dominant end-user in the last mile delivery commercial vehicles market due to its explosive growth, high delivery volume, and alignment with consumer expectations for fast, efficient service. he global surge in online shopping has propelled e-commerce as the leading end-user in last mile delivery. Platforms like Amazon, Alibaba, and Flipkart have seen exponential growth, driven by convenience and wider product availability. This translates into millions of daily deliveries, requiring agile vehicles like cars and vans to navigate urban areas. In Asia-Pacific, where e-commerce penetration is high, companies rely on scooters for rapid parcel delivery. Consumer preference for quick turnaround, especially in urban centers, fuels the demand for vans and car fleets, making e-commerce the largest contributor to the last mile delivery market’s growth.

By geography, the Last-mile delivery commercial vehicles are experiencing robust but regionally varied growth, shaped by economic development, urbanization, government policies, and evolving consumer preferences. Asia Pacific is the fastest-growing Last-mile delivery commercial vehicles, led by China, India, and Japan. Southeast Asian countries like Indonesia, Vietnam, and the Philippines are also witnessing surges in demand due to rising incomes and urbanization.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 77,982.14 Million |

| Market Size by 2031 | US$ 132,587.38 Million |

| Global CAGR (2025 - 2031) | 26.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The "Last-mile delivery commercial vehicles Market Outlook (2021–2031)" report provides a detailed analysis of the market covering below areas:

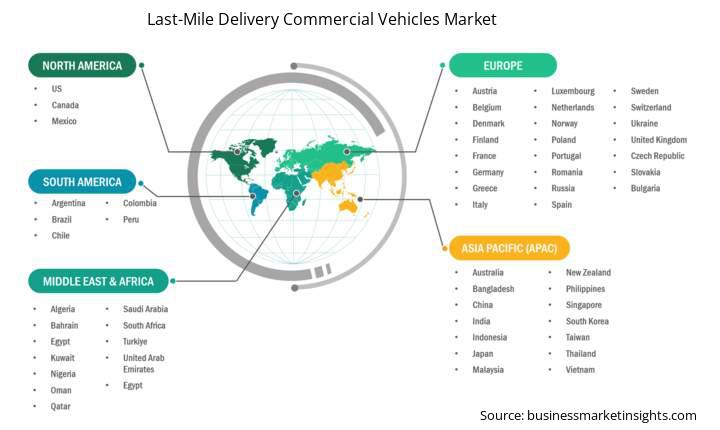

The geographical scope of the Last-mile delivery commercial vehicles market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The Last-mile delivery commercial vehicles market in Asia Pacific is expected to grow significantly during the forecast period.

North America is currently the dominant region in the last-mile delivery market, including the segment for commercial vehicles. In 2024, North America is expected to hold approximately over 35% of the global market share. North America benefits from a highly developed transportation network, including extensive road systems, distribution centers, and fulfillment hubs. This infrastructure supports efficient, multi-stop delivery routes that keep costs low and delivery times short.

The region is home to major e-commerce players such as Amazon, Walmart, and Target, which have set high standards for fast and reliable delivery. The surge in online shopping has led to increased demand for last-mile delivery services, with consumers expecting same-day or next-day delivery as the norm. North American companies are at the forefront of adopting advanced logistics technologies, including real-time monitoring, route optimization, and automation. The integration of electric vehicles (EVs) and autonomous delivery solutions is accelerating, further enhancing the efficiency and sustainability of last-mile operations.

While North America leads in market size, Asia-Pacific is the fastest-growing region for last-mile delivery services, including commercial vehicle deliveries. The rise of a middle class, increased smartphone penetration, and growing internet connectivity are driving a surge in online shopping. Platforms like Alibaba, Flipkart, and local quick-commerce apps are investing heavily in last-mile logistics to meet rising consumer expectations.

The Last-mile delivery commercial vehicles market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Last-mile delivery commercial vehicles market are:

The Last Mile Delivery Commercial Vehicle Market is valued at US$ 77,982.14 Million in 2024, it is projected to reach US$ 132,587.38 Million by 2031.

As per our report Last Mile Delivery Commercial Vehicle Market, the market size is valued at US$ 77,982.14 Million in 2024, projecting it to reach US$ 132,587.38 Million by 2031. This translates to a CAGR of approximately 26.9% during the forecast period.

The Last Mile Delivery Commercial Vehicle Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Last Mile Delivery Commercial Vehicle Market report:

The Last Mile Delivery Commercial Vehicle Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Last Mile Delivery Commercial Vehicle Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Last Mile Delivery Commercial Vehicle Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)