India has the fastest growing economy, which has created intense competition with the country’s exposure to advanced technology, has necessitated the implementation of ERP solutions across various industries for streamlining different processes of operation, finance, and alignment of resources is increasing. The growing implementation and usage of technology and automation in the manufacturing sector and stringent regulatory compliances and growing need for its adherence are two of the major factors responsible for the growth of India Manufacturing ERP market. The Indian market comprises around 60% of the SME companies who already adopted these manufacturing ERP solutions that are attributed to the low-cost manufacturing ERP solutions as well as the availability of a considerable number of skilled technical and functional talent. There are various benefits of using ERP solutions such as reduced manufacturing cycle time, reduced inventory, reduced error in ordering reduced planning cycle time, reduced requirement of manpower, better utilization of resources, increased customer satisfaction, enable faster response to changing market situations, and enables outreach. Thus, due to the increasing number of SMEs leads to propel the growth of the India Manufacturing ERP market. Consequently, presenting tremendous opportunities for the rise in the business of India Manufacturing ERP market players.

Market Insights

Growing implementation and usage of technology and automation in the manufacturing sector propel the India Manufacturing ERP market

In the current business settings, almost everything in the end-to-end industrial and manufacturing environment is becoming intelligent, smart, and connected. There are new forms of discrete and process manufacturing, sensors, connected objects and smart machines that are emerging, and changing the ecosystem of how exchange and collaboration between people, machines, data, and technologies were done earlier. Today’s digital plant of smart manufacturing heavily relies on collecting, sorting, and analyzing the data and information, and turning them into business values, this increased demand is expected to fuel the growth of India Manufacturing ERP market.

High upfront costs involved in the implementation and up gradation may restrain the future growth of the India Manufacturing ERP market

Enterprises across the globe, especially Small and Medium-Sized enterprises are quite skeptical in investing in any new software or solutions, as it involves a high initial CAPEX and cost associated with its constant up-gradation and maintenance in the later part, due to their budget constraints. SMEs is no exception in this list, and it’s obvious that new enterprises are a bit hesitant in adopting this solution.

Enterprises that want to adopt ERP solutions need to be well educated and informed by solution providers in advance, about the intricacies of its implementations, such as the cost associated with the software license and its renewal, maintenance, service charges, training and consulting among others. Thus, these factors may hinder the growth of the India Manufacturing ERP market.

Deployment Model Segment Insights

Speed has become an essential competitive differentiator in the present market scenario, and the companies investing in new solutions expect to see the results quickly. The cloud-based manufacturing ERPs are best suited for small and midsize enterprise businesses, which has lower upfront costs, ease of access, and system stability. Cloud service is used for offering high service accessibility at minimum costs, as well as many organizations are taking advantage of cloud service to offers services and storing critical data, thus, creating a massive demand for manufacturing ERP across different sector. Thus, anticipated to create significant market space for India Manufacturing ERP market players.

End-User Industry Segment Insights

The India Manufacturing ERP market on the basis of end-user industry is segmented into automotive, consumer electronics, metallurgy, pharmaceuticals, energy, food & beverage, chemicals, retail & garments, and others. The food & beverages segment led the India Manufacturing ERP market, by offerings and is anticipated to continue its dominance during the forecast period. With the growing consumer choice, and demand for high quality fresh, chilled as well as frozen products, the F&B industry is demanding manufacturing ERP solution to streamline the overall process which varies from selecting the products to packaging and dispatching are the major factor driving the revenue generation of the end-user industry segment in the India Manufacturing ERP market.

Strategic Insights

Market Initiatives was observed as the most adopted strategy in India Manufacturing ERP market. Few of the recent market initiatives are listed below;

2019: Epicor has been selected by Taiwan’s Chin Fong Machine Industrial Co., Ltd. to execute global ERP. The solution will support the business operations.

2018: Fujitsu Limited has successfully completed design efforts of the preparation for a full-scale implementation of SAP S/4HANA manufacturing solution. The solution is used for the production, engineering and operation purpose.

.

2017: Epicor partnered with Redington India, for distributing Epicor ERP industry-specific solutions to boosting the growth and presence in Indian manufacturing industry.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 262.7 Million |

| Market Size by 2027 | US$ 712.7 Million |

| CAGR (2019 - 2027) | 11.9% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Deployment Model

|

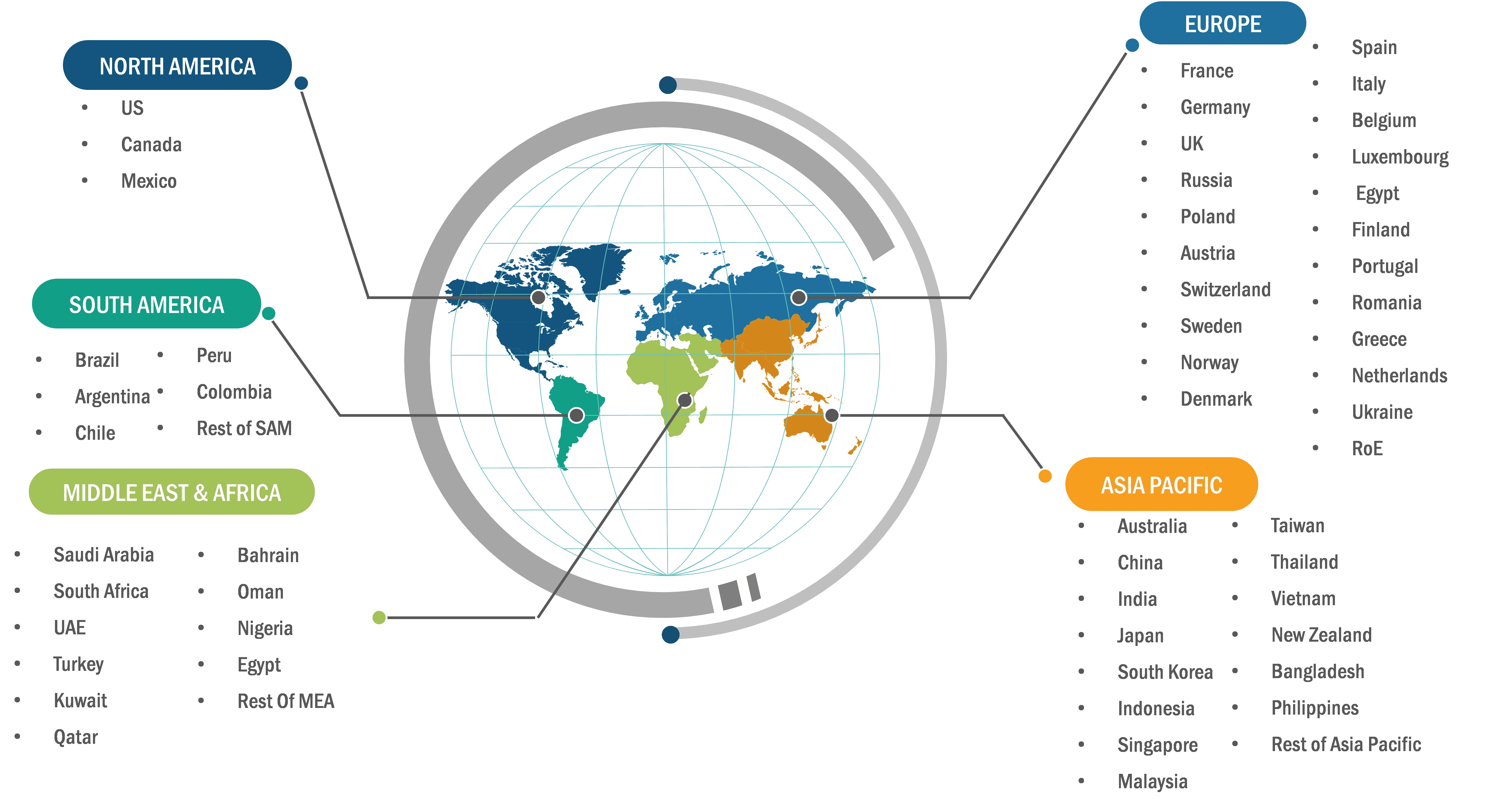

| Regions and Countries Covered |

India

|

| Market leaders and key company profiles |

|

The India Manufacturing ERP Market is valued at US$ 262.7 Million in 2018, it is projected to reach US$ 712.7 Million by 2027.

As per our report India Manufacturing ERP Market, the market size is valued at US$ 262.7 Million in 2018, projecting it to reach US$ 712.7 Million by 2027. This translates to a CAGR of approximately 11.9% during the forecast period.

The India Manufacturing ERP Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the India Manufacturing ERP Market report:

The India Manufacturing ERP Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The India Manufacturing ERP Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the India Manufacturing ERP Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)