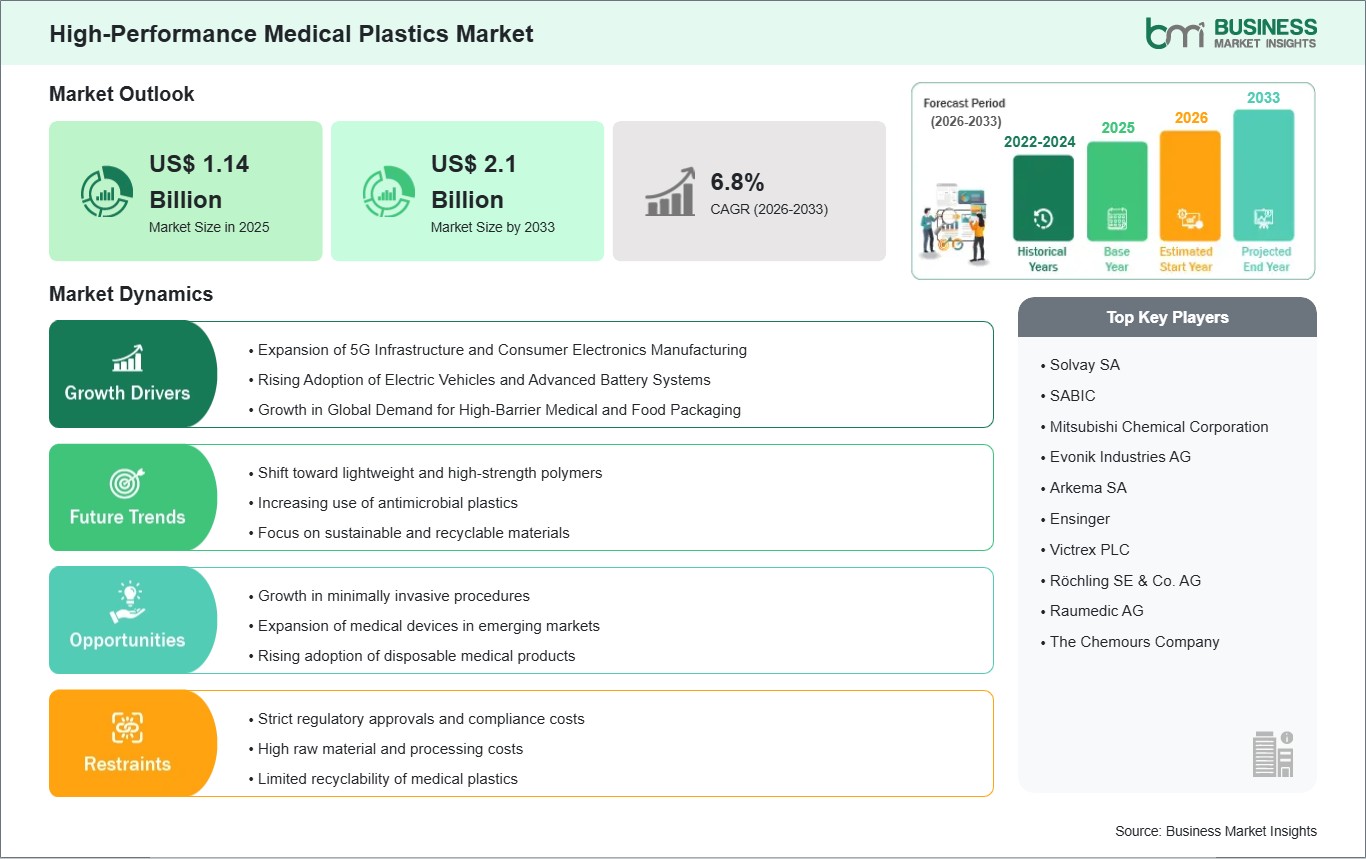

The High-Performance Medical Plastics market size is expected to reach US$ 2.10 billion by 2033 from US$ 1.14 billion in 2025. The market is estimated to record a CAGR of 6.83% from 2026 to 2033.

High-performance medical plastics are specialized, medical-grade polymers engineered to withstand extreme sterilization environments and maintain high mechanical integrity in critical healthcare applications, covering key product categories such as Fluoropolymers (FP), Polyaryletherketones (PAEK/PEEK), High-Performance Polyamides (HPPA), and Polyetherimide (PEI). These technologies deliver significant clinical and economic value by enabling the miniaturization of diagnostic tools, offering non-invasive and radiolucent (X-ray transparent) solutions for orthopedic implants, and ensuring the absolute sterility of reusable surgical equipment through thousands of autoclave cycles. Market expansion is primarily attributed to the rising global demand for minimally invasive surgeries (MIS), a massive surge in personalized medicine and 3D-printed implants, and the escalating need for lightweight, durable materials to replace metals in portable medical devices. Furthermore, the integration of Automated Work Cells in manufacturing and the adoption of PEEK-based trauma plates, which offer better fatigue resistance than titanium, are substantially improving procedural efficiency.

However, several challenges can restrain market growth: high initial procurement and processing costs, with specialty resins costing significantly more than commodity polymers, can limit adoption in price-sensitive emerging healthcare markets. Stringent regulatory hurdles, including the complex and time-consuming FDA and EU Medical Device Regulation (MDR) certification processes for implantable materials, lengthen the time-to-market and increase R&D overhead. Additionally, the industry faces constraints due to limited recycling infrastructure for medical-grade waste and a critical shortage of technical expertise in micro-injection molding and advanced polymer machining, which can result in sub-optimal design and manufacturing bottlenecks.

Despite these hurdles, the market holds immense opportunities in the universal mandate for sustainable and bio-resorbable polymers and the accelerating deployment of patient-specific 3D-printed instrumentation. The expansion of home-based healthcare and wearable diagnostic sensors and the development of anti-microbial high-performance plastics that reduce hospital-acquired infections (HAIs) are expected to create significant opportunities for market growth.

Key segments that contributed to the derivation of the High-Performance Medical Plastics market analysis are type and application.

The primary driver for the High-Performance Medical Plastics Market is the accelerating shift toward minimally invasive surgery (MIS) and the surging healthcare investments in emerging economies. As surgeons prioritize procedures that offer reduced patient trauma, shorter hospital stays, and lower infection risks, the demand for specialized polymers like PEEK and polyetherimide (PEI) has become non-discretionary. These materials are essential for manufacturing the complex, thin-walled catheters, endoscopic housings, and robotic surgical tools required for precision procedures such as transcatheter aortic-valve replacement (TAVR). This momentum is further amplified by the rapid expansion of healthcare infrastructure in regions like China and India, where government-backed incentives and rising disposable incomes are fueling a massive procurement of advanced medical devices.

Furthermore, the global aging population, increasing the prevalence of chronic cardiovascular and orthopedic conditions, ensures a sustained, high-volume growth path as manufacturers replace traditional metals and glass with biocompatible, lightweight, and sterilization-resistant plastics.

A significant high-value opportunity lies in the convergence of High-Performance Medical Plastics with 3D Printing (Additive Manufacturing) to produce patient-specific implants and prosthetics. The ability to use high-flow grades of PEEK and other engineering resins to print complex cranial plates, spinal cages, and dental abutments directly from patient CT data allows for hyper-customized care that was previously impossible. There is also a major growth frontier in the development of Sustainable and Bio-Based Medical Grade Plastics. As global healthcare systems face mounting pressure to reduce the environmental impact of single-use medical waste, there is a burgeoning market for polymers derived from renewable feedstocks, such as PLA and bio-polyurethanes, that maintain strict performance and sterilization standards.

Furthermore, the rise of Smart Medical Devices and Connected Drug-Delivery Systems presents an opportunity for advanced polymers that offer superior chemical resistance and electrical insulation for integrated sensors. Manufacturers who focus on "circular" medical plastics and those pioneering antimicrobial-infused polymers are positioned to lead the highest-margin segments of the global medtech landscape.

The High-Performance Medical Plastics market demonstrates steady growth, with size and share analysis revealing evolving trends and competitive positioning among key players. The report further examines subsegments categorized within type and application, offering insights into their contribution to overall market performance.

Based on type, the Fluoropolymers (FP) subsegment holds a significant market share, driven by their extensive use in Medical Supplies such as catheters, vascular grafts, and surgical tubing. Fluoropolymers like PTFE and FEP are indispensable for these applications because of their exceptional chemical inertness, low friction, and biocompatibility. A notable trend in 2026 is the rising demand for PVDF in high-performance coatings and diagnostic consumables, where its durability supports the miniaturization of complex medical devices. These innovations are particularly vital in the U.S. and European markets, where strict regulatory standards from the FDA and EMA stimulate the adoption of high-purity fluoropolymers to ensure patient safety and device longevity.

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 1.14 Billion |

| Market Size by 2033 | US$ 2.1 Billion |

| Global CAGR (2026 - 2033) | 6.8% |

| Historical Data | 2022-2024 |

| Forecast period | 2026-2033 |

| Segments Covered | By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The "High-Performance Medical Plastics Market Size and Forecast (2022 - 2033)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the High-Performance Medical Plastics market report is divided into five regions: North America, Asia Pacific, Europe, Middle East &Africa, and South &Central America.

The Asia-Pacific High-Performance Medical Plastics Market is segmented into China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, Taiwan, Bangladesh, and the Rest of Asia. This region is emerging as the fastest-growing market globally. The expansion is primarily fueled by rapid industrialization and the massive modernization of healthcare infrastructure in developing nations. China and India lead the regional growth, supported by "Made in China 2025" and similar domestic manufacturing incentives that prioritize high-end medical equipment. These initiatives, combined with the rise of medical tourism and a burgeoning middle class, have turned the region into a critical hub for high-volume production of diagnostic tools and drug-delivery systems.

Growth is further bolstered by a significant shift toward minimally invasive surgical procedures, which necessitate the use of lightweight, high-strength plastics like PEEK and fluoropolymers. The integration of 3D printing for patient-specific implants, alongside the rising demand for single-use medical disposables to enhance infection control in the post-pandemic era, solidifies Asia-Pacific as a primary center for innovation and the future scaling of the high-performance medical plastics industry.

The High-Performance Medical Plastics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the High-Performance Medical Plastics market are:

The High-Performance Medical Plastics Market is valued at US$ 1.14 Billion in 2025, it is projected to reach US$ 2.1 Billion by 2033.

As per our report High-Performance Medical Plastics Market, the market size is valued at US$ 1.14 Billion in 2025, projecting it to reach US$ 2.1 Billion by 2033. This translates to a CAGR of approximately 6.8% during the forecast period.

The High-Performance Medical Plastics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the High-Performance Medical Plastics Market report:

The High-Performance Medical Plastics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The High-Performance Medical Plastics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the High-Performance Medical Plastics Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)