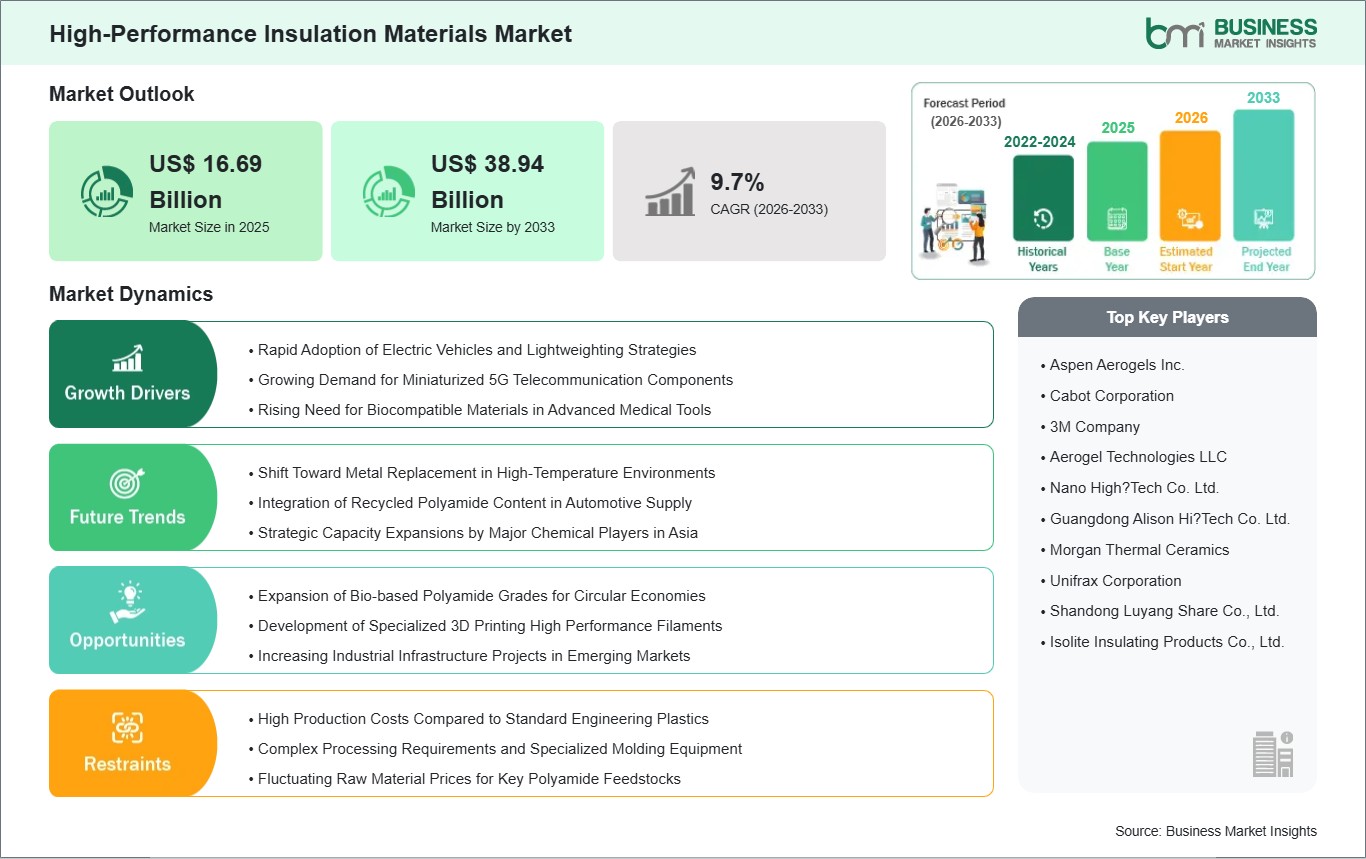

The high-performance insulation materials market size is expected to reach US$ 38.94 billion by 2033 from US$ 16.69 billion in 2025. The market is estimated to record a CAGR of 9.71% from 2026 to 2033.

High-performance insulation materials (HPIM) play a critical role in the thermal management of extreme environments, offering superior resistance to heat transfer compared to traditional materials. They are essential for industries such as oil and gas, automotive, aerospace, construction, and power generation. HPIMs have several advantages, including ultra-low thermal conductivity, lightweight profiles, and the ability to operate in space-constrained applications where thickness is a limiting factor. Increasing global energy efficiency mandates, the rise of electric vehicles (EVs) requiring advanced battery thermal barriers, and the growing demand for deep-sea and cryogenic logistics are fueling the market. Additionally, innovations in nanotechnology, bio-based precursors, and smart insulation with integrated sensors are enhancing material efficiency and reliability.

However, some challenges that can hamper the expansion of the market are the high production costs, the intricate process involved in manufacturing certain products (such as aerogels, which require supercritical drying), as well as the complexity involved in the regulations related to the handling of certain fibers. There are certain raw materials used in the process that are high-cost specialty raw materials, thus affecting the costs. Despite the challenges, the market invariably presents some opportunities, including the expansion of LNG infrastructures, the development of zero-energy buildings, the increased demand for industrial-grade high-performance coatings, and the development potential offered by investment in sustainable products with the ability to recycle insulation, amongst others.

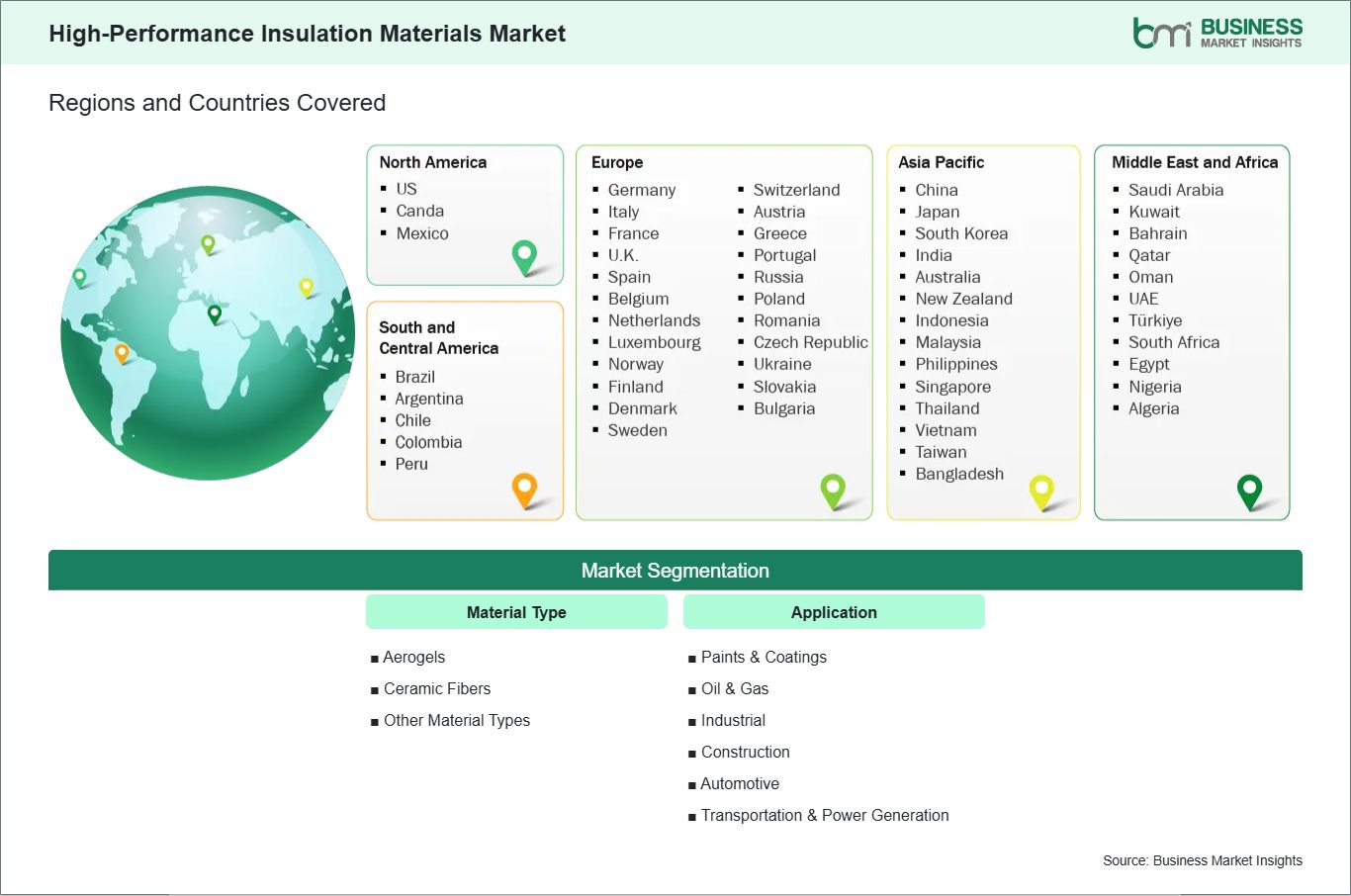

Key segments that contributed to the derivation of the high-performance insulation materials market analysis are material type and application.

The global push for decarbonization and energy conservation has emerged as a primary driver for the high-performance insulation materials market. Governments worldwide are implementing stringent building codes and industrial mandates to reduce greenhouse gas emissions and optimize energy consumption. In the European Union and North America, policies such as the Energy Performance of Buildings Directive (EPBD) are compelling builders to adopt materials with superior thermal resistance.

High-performance materials like aerogels and vacuum insulation panels (VIPs) allow for compliance with these strict R-value requirements without increasing the thickness of walls or equipment linings. This is particularly crucial in urban cities where floor spaces have become valuable and where traditional forms of insulation have become unsustainable due to their bulkiness. Moreover, with the climate change demands rising for increased efficiency in the reduction of the generated waste through the retention of less wanted types of waste generated in processes while keeping high levels of temperature in the processes of industries that are likely to become compliance with the new-age philosophy of corporations, high-performance insulations such as high-performance ceramic fibers and foams are rising at a rate that can only be referred to as the fastest rate ever. Such an environment boosts the importance of high-performance insulations as an expenditure rather than a choice.

The rapid global transition toward electric mobility is fundamentally reshaping the demand for high-performance insulation materials. Unlike internal combustion engine vehicles, electric vehicles (EVs) require sophisticated thermal management systems to protect sensitive battery packs and ensure passenger safety. High-performance materials, particularly aerogels and specialty ceramic mats, are increasingly used as "thermal runaway" barriers. These materials prevent the heat from a single failing battery cell from spreading to adjacent cells, thereby mitigating the risk of vehicle fires. Because weight and space are critical factors in EV design, the ultra-thin and lightweight nature of high-performance insulation provides a significant advantage over traditional alternatives.

Manufacturers are investing heavily in these materials to extend battery life and improve vehicle range by maintaining optimal operating temperatures in various climates. Additionally, the need for acoustic insulation in the quiet cabins of EVs is driving the adoption of high-performance foams that offer dual thermal and noise-reduction properties. As EV production scales globally, particularly in China and North America, the automotive application segment is becoming a dominant force in the high-performance insulation market, fostering continuous innovation in material science to meet the rigorous safety standards of the next generation of transportation.

The high-performance insulation materials market demonstrates steady growth, with size and share analysis revealing evolving trends and competitive positioning among key players. The report further examines subsegments categorized within material type and application, offering insights into their contribution to overall market performance.

Based on material type, the ceramic fibers typically represent a significant share. These fibers are widely utilized across various industries due to their unmatched thermal stability in environments exceeding 1000°C, making them essential for furnaces and kilns.

In terms of applications, the Construction sector is also a significant contributor, utilizing these materials to achieve LEED and green building certifications. Paints &Coatings with high-performance insulation properties are gaining traction as they provide a versatile, sprayable thermal barrier for irregular industrial surfaces and marine applications.

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 16.69 Billion |

| Market Size by 2033 | US$ 38.94 Billion |

| Global CAGR (2026 - 2033) | 9.7% |

| Historical Data | 2022-2024 |

| Forecast period | 2026-2033 |

| Segments Covered | By Material Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The "High-Performance Insulation Materials Market Size and Forecast (2022 - 2033)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the market is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The Asia-Pacific high-performance insulation materials market is segmented into China, Japan, South Korea, India, and the Rest of Asia. The region is experiencing robust growth, driven by the rapid expansion of industrial manufacturing, massive infrastructure investments, and the development of free trade zones. Major economies like China and India are leading the way, fueled by increasing power generation needs and the growth of the regional EV supply chain.

The region is also witnessing increased adoption of advanced logistics technologies and temperature-controlled storage systems, particularly relevant for sectors like petrochemicals and heavy industry. Capacity expansion by regional manufacturers, alongside fleet modernization efforts in the transportation sector, is enhancing operational efficiency. Additionally, the rise of regional trade agreements (such as RCEP) further solidifies the region's dominant market position.

The North American market, led by the U.S. and Canada, is projected to witness the fastest growth rate during the forecast period. This acceleration is attributed to the strict enforcement of building codes and energy standards, such as California's Title 24. Significant investments in retrofitting aging industrial infrastructure and the rapid expansion of the electric vehicle (EV) supply chain are creating a robust market for advanced thermal barriers. Meanwhile, Europe remains a mature yet innovative market, driven by the European Green Deal and a strong focus on high-performance materials like vacuum insulation panels (VIPs) for zero-energy building projects.

The High-Performance Insulation Materials market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the high-performance insulation materials market are:

The High-Performance Insulation Materials Market is valued at US$ 16.69 Billion in 2025, it is projected to reach US$ 38.94 Billion by 2033.

As per our report High-Performance Insulation Materials Market, the market size is valued at US$ 16.69 Billion in 2025, projecting it to reach US$ 38.94 Billion by 2033. This translates to a CAGR of approximately 9.7% during the forecast period.

The High-Performance Insulation Materials Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the High-Performance Insulation Materials Market report:

The High-Performance Insulation Materials Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The High-Performance Insulation Materials Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the High-Performance Insulation Materials Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)