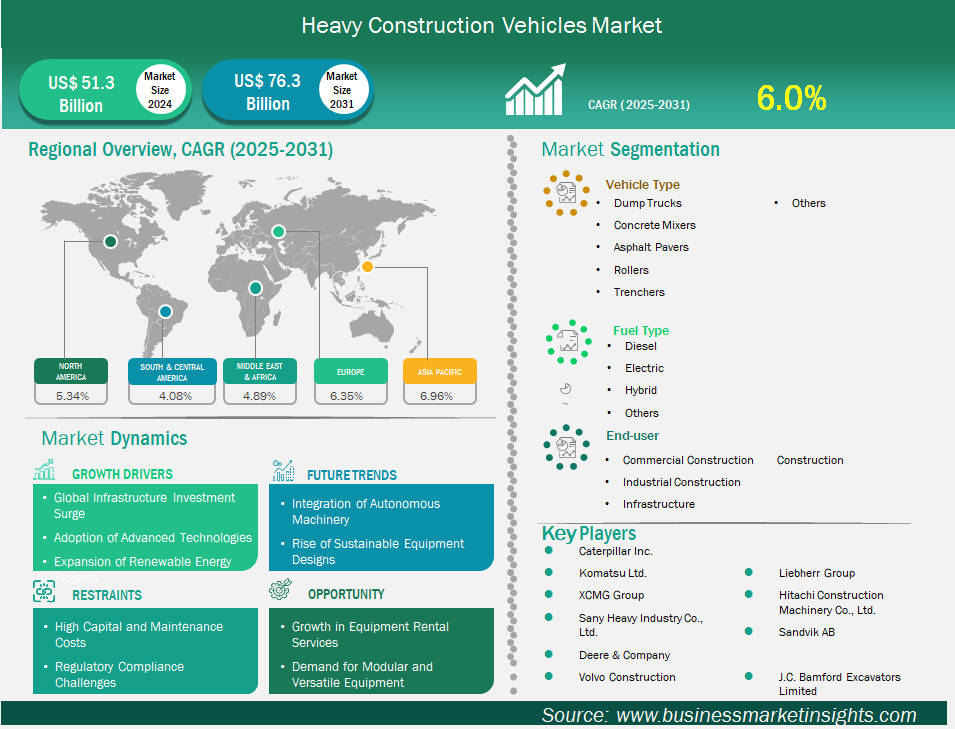

The heavy construction vehicles market size is expected to reach US$ 76.3 billion by 2031 from US$ 51.3 billion in 2024. The market is estimated to record a CAGR of 6.0% from 2025 to 2031.

The heavy construction vehicles market, encompassing equipment like dump trucks, concrete mixers, pavers, and trenchers, is experiencing robust global growth, driven by rapid urbanization, infrastructure development, and technological advancements. Valued at billions annually, the market is projected to expand steadily through 2030, fueled by rising demand for modern infrastructure in both developed and emerging economies. Key global drivers include government-led infrastructure investments, such as China's Belt and Road Initiative and India's smart city projects, alongside the adoption of sustainable technologies like electric and hydrogen-powered vehicles. Automation and smart systems, including AI-driven cranes and telematics-enabled trucks, are enhancing efficiency, further propelling market growth.

Regionally, Asia-Pacific dominates due to large-scale projects in China and India, supported by government funding and urban expansion. North America and Europe show strong demand for eco-friendly vehicles, driven by stringent emission regulations and urban redevelopment. The Middle East, particularly Saudi Arabia, sees growth from oil-funded mega-projects like NEOM, while Africa’s market is emerging, driven by mining and infrastructure needs. However, high initial costs and skilled labor shortages pose challenges. Opportunities lie in leasing models and green technology adoption, with future trends pointing toward autonomous vehicles and IoT integration, reshaping the industry for enhanced productivity and sustainability.

Key segments that contributed to the derivation of the Heavy construction vehicles market analysis are vehicle type, fuel type, end-user, and geography.

The heavy construction equipment market is driven by substantial global investments in infrastructure. Governments are funding large-scale projects like highways, airports, and urban transit systems to boost economic growth. Initiatives such as the U.S. Infrastructure Investment and Jobs Act and India’s National Infrastructure Pipeline fuel demand for cranes, pavers, and concrete mixers. Rapid urbanization in emerging economies necessitates modern infrastructure, increasing equipment sales. Public-private partnerships are also enhancing project financing, further stimulating the market. This trend is expected to persist as nations prioritize connectivity and urban development to support growing populations and economic activities.

The increasing demand for modular and versatile equipment offers substantial opportunities in the heavy construction equipment market. Contractors seek machines that can perform multiple tasks, such as cranes with interchangeable attachments or multi-purpose pavers, to maximize efficiency and reduce costs. Modular designs allow for easy upgrades and customization, appealing to diverse project needs. This trend is particularly strong in urban areas with space constraints, where versatile equipment enhances productivity. Manufacturers investing in flexible, adaptable machinery can capture market share by meeting evolving customer demands, driving growth through innovative solutions tailored to modern construction challenges.

By vehicle type, dump trucks led the market in 2024– Dump trucks are specifically designed to efficiently transport large volumes of loose materials such as gravel, sand, asphalt, and debris, which are fundamental requirements for road, bridge, and building construction as well as mining activities. The construction and mining industries are expanding globally, especially in emerging economies, where rapid urbanization and industrialization are fuelling infrastructure development and, consequently, the demand for dump trucks.

By fuel type, diesel engines generate significantly higher torque than gasoline or most alternative fuel engines. This high torque is essential for moving heavy loads, towing, and operating in challenging conditions, which are core requirements for heavy construction vehicles. Despite rising environmental regulations, manufacturers continue to improve diesel engine technology to reduce emissions and enhance performance, maintaining diesel’s market leadership even as electric and alternative fuel options gain traction.

By end-user, governments worldwide are prioritizing large-scale infrastructure development as a key driver of economic growth and job creation. Significant public investments in road networks, urban transit, and utilities translate directly into high demand for heavy construction vehicles. Infrastructure projects are often massive in scale and require extensive use of heavy machinery for earthmoving, material transport, paving, and compaction. This makes infrastructure construction the primary end user for dump trucks, excavators, loaders, and graders.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 51.3 Billion |

| Market Size by 2031 | US$ 76.3 Billion |

| Global CAGR (2025 - 2031) | 6.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The "Heavy construction vehicles Market Outlook (2021–2031)" report provides a detailed analysis of the market covering below areas:

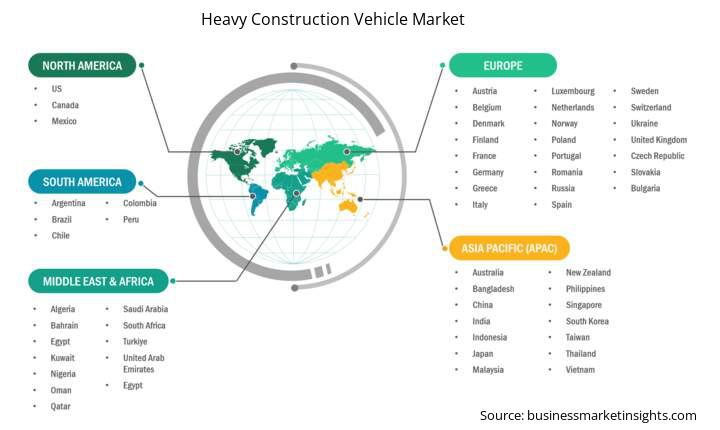

The geographical scope of the Heavy construction vehicles market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The Heavy construction vehicles market in Asia Pacific is expected to grow significantly during the forecast period.

The Asia Pacific region is the dominant force in the heavy construction vehicles market, primarily due to its ongoing and expansive infrastructure development, rapid urbanization, and strong industrial growth. Across the region, governments and private sector entities are investing heavily in large-scale projects such as highways, railways, airports, dams, and urban transit systems. These projects require substantial quantities of heavy construction vehicles to move materials, prepare sites, and complete construction tasks efficiently.

Additionally, Asia Pacific benefits from a dynamic construction sector driven by population growth and urban migration, which fuels demand for new residential, commercial, and industrial buildings. The region’s manufacturing and mining industries are also expanding, further increasing the need for robust and reliable construction vehicles. Technological advancements and the adoption of innovative construction methods are widespread, supporting the modernization of equipment and operational practices.

In contrast, while North America and Europe remain significant players with advanced technology and a focus on sustainability, their infrastructure needs are often more focused on maintenance and upgrades rather than large-scale new developments. The scale and pace of construction activity in Asia Pacific, particularly in countries like China and India, set it apart as the dominant region in the heavy construction vehicles market. This dominance is reinforced by the region’s ability to attract global manufacturers, foster local production, and integrate cutting-edge technologies into construction processes.

The Heavy construction vehicles market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Heavy construction vehicles market are:

The Heavy Construction Vehicles Market is valued at US$ 51.3 Billion in 2024, it is projected to reach US$ 76.3 Billion by 2031.

As per our report Heavy Construction Vehicles Market, the market size is valued at US$ 51.3 Billion in 2024, projecting it to reach US$ 76.3 Billion by 2031. This translates to a CAGR of approximately 6.0% during the forecast period.

The Heavy Construction Vehicles Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Heavy Construction Vehicles Market report:

The Heavy Construction Vehicles Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Heavy Construction Vehicles Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Heavy Construction Vehicles Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)