Property technology (PropTech) is an innovative approach adopted by different end users to search, rent, buy, or manage properties. PropTech products for property management applications use IoT tools such as cameras, sensors, and wireless components for controlling the heating, ventilation, and air conditioning (HVAC) systems; lighting systems; utility lines; and access points. Owing to the growing cost of energy and concerns regarding the environment, facility operators are actively seeking for solutions such as energy management and IoT tools that help them curtail the cost of building utilities by enabling a remote control for utilities. Further, monitoring facilities with the use of sensors and cameras, and energy management systems can automatically optimize the lighting and air-conditioning consumption as well as costs. Moreover, such tools eliminate the need of manual workers for performing such maintenance tasks, further cutting down the operating costs. Thus, the increasing energy costs and growing environmental concerns boost the PropTech market growth.

Germany comprises more than 500 companies operating in the PropTech market with an investment of more than US $ 340 million. One of the crucial factors influencing the strong growth rate of the market in Germany is that the strong inclination toward the adoption of new technologies to improve the overall standard of living. The adoption of smart home system in Germany has risen from 2 million in 2016 to 6.6 million in 2020 and is expected to reach 9.3 million by 2022. Such rising adoptions are subsequently fueling the growth of the PropTech market in Germany. Moreover, the government has a strong inclination for improving the urban infrastructure.

Germany is a home to the most active backers of PropTech start-ups. As remote working is continuing and employees are no longer needed to go to office, they are moving outside urban areas and finding some suburban place for more greenery and space, and cheaper rents. Working remotely has made nomadic living trendy. It can also be seen that start-ups in this market are strengthening. For instance, Flatio announced that it is merged with NomadX. Both platforms experienced strong signs of growth and development between COVID 19 pandemic. Interest in co-living spaces is increasing. People who usually prefer to stay on their own are deciding to live in co-living spaces to overcome social isolation and loneliness.

Strategic insights for the Germany PropTech provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

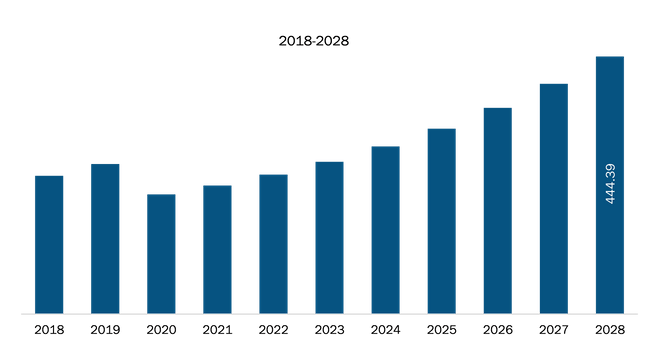

| Market size in 2020 | US$ 206.30 Million |

| Market Size by 2028 | US$ 444.39 Million |

| CAGR (2021 - 2028) | 10.4% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Offerings

|

| Regions and Countries Covered | Germany

|

| Market leaders and key company profiles |

|

The geographic scope of the Germany PropTech refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Germany PropTech Market Segmentation

Germany PropTech Market – by Offerings

Germany PropTech Market – by Component

Germany PropTech Market – by Building Type

Germany PropTech Market - Companies Mentioned

The List of Companies - Germany PropTech Market

The Germany PropTech Market is valued at US$ 206.30 Million in 2020, it is projected to reach US$ 444.39 Million by 2028.

As per our report Germany PropTech Market, the market size is valued at US$ 206.30 Million in 2020, projecting it to reach US$ 444.39 Million by 2028. This translates to a CAGR of approximately 10.4% during the forecast period.

The Germany PropTech Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Germany PropTech Market report:

The Germany PropTech Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Germany PropTech Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Germany PropTech Market value chain can benefit from the information contained in a comprehensive market report.