The GCC ice cream market is accounted to US$

543.0 Mn in 2018 and is expected to grow at a CAGR of 6.7% during the forecast period 2019 – 2027, to account to US$ 969.1 Mn by 2027.

Most countries in GCC, such as Saudi Arabia, UAE, Kuwait, and Bahrain, have traditionally been oil economies, but in recent years they have started to promote themselves tourist hubs in the Gulf. Therefore, the demand for ice cream has also surged due to increasing tourism in some of the countries such as the UAE and Saudi Arabia. GCC countries enjoy hot sunny days during the most part of the year. Summer is an undisputed season for the consumption of ice cream and related products. The hot climate and sweltering afternoons in the GCC make for a perfect atmosphere to relish frozen desserts and ice creams. This further boosts the ice cream market in GCC.

Strategic insights for the GCC Ice Cream provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the GCC Ice Cream refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas. GCC Ice Cream Market, Revenue and Forecast, 2018

GCC Ice Cream Strategic Insights

GCC Ice Cream Report Scope

Report Attribute

Details

Market size in 2018

US$ 543.0 Million

Market Size by 2027

US$ 969.1 Million

CAGR (2019 - 2027) 6.7%

Historical Data

2016-2017

Forecast period

2019-2027

Segments Covered

By Type

By Distribution Channel

Regions and Countries Covered

GCC

Market leaders and key company profiles

GCC Ice Cream Regional Insights

Market Insights

Long summers and hot climate conditions are projected to boost the GCC ice cream market over the forecast period

The climate in GCC countries such as Saudi Arabia, UAE, Qatar, and Bahrain, among others, is very hot. The UAE has a desert climate, characterized by pleasantly mild winters and very hot, sunny summers. Summers in the UAE are very hot, and the temperature ranges from 38 °C to 42 °C. Likewise, Saudi Arabia is an extremely dry country, and rainfall is minimal. In summers, the country witnesses blistering heat and humid temperatures thus, making it uncomfortable to get around. The climate of Qatar can be described as a subtropical dry, hot desert climate with low annual rainfall, very high temperatures in summer. The harsh climatic condition results in high demand for cold food and beverages. Therefore, ice-cream remains the favorite frozen dessert in GCC countries such as Saudi Arabia, UAE, Qatar, and Bahrain. A large number of ice-cream manufacturers operating in the GCC ice cream market are focusing on introducing new ice-cream variants in the GCC market. Additionally, the growth of the tourism sector and restaurant businesses in the UAE, Qatar, and Bahrain is also expected to support the growth of the ice-cream market.

Growing demand for gluten- and lactose-free ice-creams provides an opportunity for the ice cream market growth

Lactose is one of the main constituent sugars in dairy milk. Lactose intolerance a condition found in many humans; it is characterized by the inability to digest sugar (lactose) in dairy products fully. It is usually caused by a deficiency of the lactase enzyme due to the inability of the body to synthesize it. The growing rate of lactose intolerances around the world has created a demand for gluten- and lactose-free products, including ice-creams. The rapidly expanding trend of veganism has further driven the market for vegan, lactose- and gluten-free ice-cream varieties made from ingredients that are devoid of animal products, based on other milk substitutes, such as almond milk and coconut milk. People of Arab ethnicity are more prone to lactose and gluten intolerances. The growing incidences of lactose intolerance in the GCC is expected to generate high demand for gluten- and lactose-free ice cream products during the forecast period. These factors lead to surge in demand for gluten- and lactose-free ice cream market.

Type Insights

The GCC ice cream market by type has been categorized in impulse ice cream, take-home ice cream, and artisanal ice cream. The demand for impulse ice cream is rising as they can be readily consumed without the need for portioning or preparation. Impulse Ice Cream includes ice cream products such as ice cream cones, ice cream sandwiches, chocolate-coated ice creams, and single-serve ice cream tubs. Impulse ice cream products such as ice cream cones and ice cream sandwiches are sold in individual packages while the traditional ice cream ball in the wafer is sold without a package. Impulse ice creams segment dominates the ice cream market owing to its high popularity among individuals of all age groups. Impulse ice creams offer the convenience of eating ice cream whenever and wherever one wants.

Distribution Channel Insights

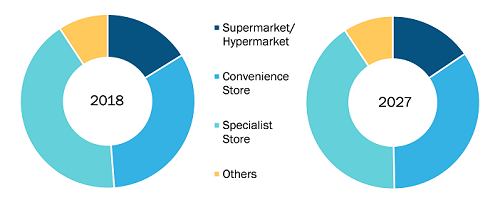

On the basis of the distribution channels, the GCC ice cream market is bifurcated into supermarket/hypermarket, convenience store, specialist store, and others. Under the distribution channel segment, the specialist store is the leading distribution segment in the GCC ice cream market. Specialist stores are shops that cater to a single retail market. Some instances of specialist stores include ice cream shops, pharmacies, book stores camera stores and stationeries. They specialize in sales of just one type of product of the range. Specialist stores have to compete with other types of stores such as grocery stores, department stores, supermarkets, general stores, and variety stores. Since specialty stores are category specialists, they use their buying power to negotiate lower prices, excellent terms and assured timely supply. The growing number of specialist stores selling a wide range of ice cream products is expected to drive the ice cream market in the forecast period.

Strategic insights for the GCC Ice Cream provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the GCC Ice Cream refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas. GCC Ice Cream Market by Distribution Channel

GCC Ice Cream Strategic Insights

GCC Ice Cream Report Scope

Report Attribute

Details

Market size in 2018

US$ 543.0 Million

Market Size by 2027

US$ 969.1 Million

CAGR (2019 - 2027) 6.7%

Historical Data

2016-2017

Forecast period

2019-2027

Segments Covered

By Type

By Distribution Channel

Regions and Countries Covered

GCC

Market leaders and key company profiles

GCC Ice Cream Regional Insights

Strategic Insights

Mergers & acquisition, strategy and business planning, and new product development were observed as the most adopted strategies in the GCC ice cream market. Few of the recent developments in the GCC ice cream market are listed below:

2019:

Mars Incorporated has recently acquired its Dubai subsidiary fully following the new GCC law on foreign ownership.

2019:

Mars Wrigley Confectionery expanded the range of its single-serve ice creams by adding of the snicker's dark chocolate and Twix triple chocolate ice cream bars in its range.

2019:

The Dubai Multi Commodities Centre (" DMCC "), the licensing authority for the Jumeirah Lakes Towers ("JLT") Free Zone, has witnessed and welcomed Dunkin’ Brands Group, Inc. parent and its two most recognizable brands, Dunkin’ Donuts and Baskin-Robbins

GCC ICE CREAM MARKET SEGMENTATION

The List of Companies

The GCC Ice Cream Market is valued at US$ 543.0 Million in 2018, it is projected to reach US$ 969.1 Million by 2027.

As per our report GCC Ice Cream Market, the market size is valued at US$ 543.0 Million in 2018, projecting it to reach US$ 969.1 Million by 2027. This translates to a CAGR of approximately 6.7% during the forecast period.

The GCC Ice Cream Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the GCC Ice Cream Market report:

The GCC Ice Cream Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The GCC Ice Cream Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the GCC Ice Cream Market value chain can benefit from the information contained in a comprehensive market report.