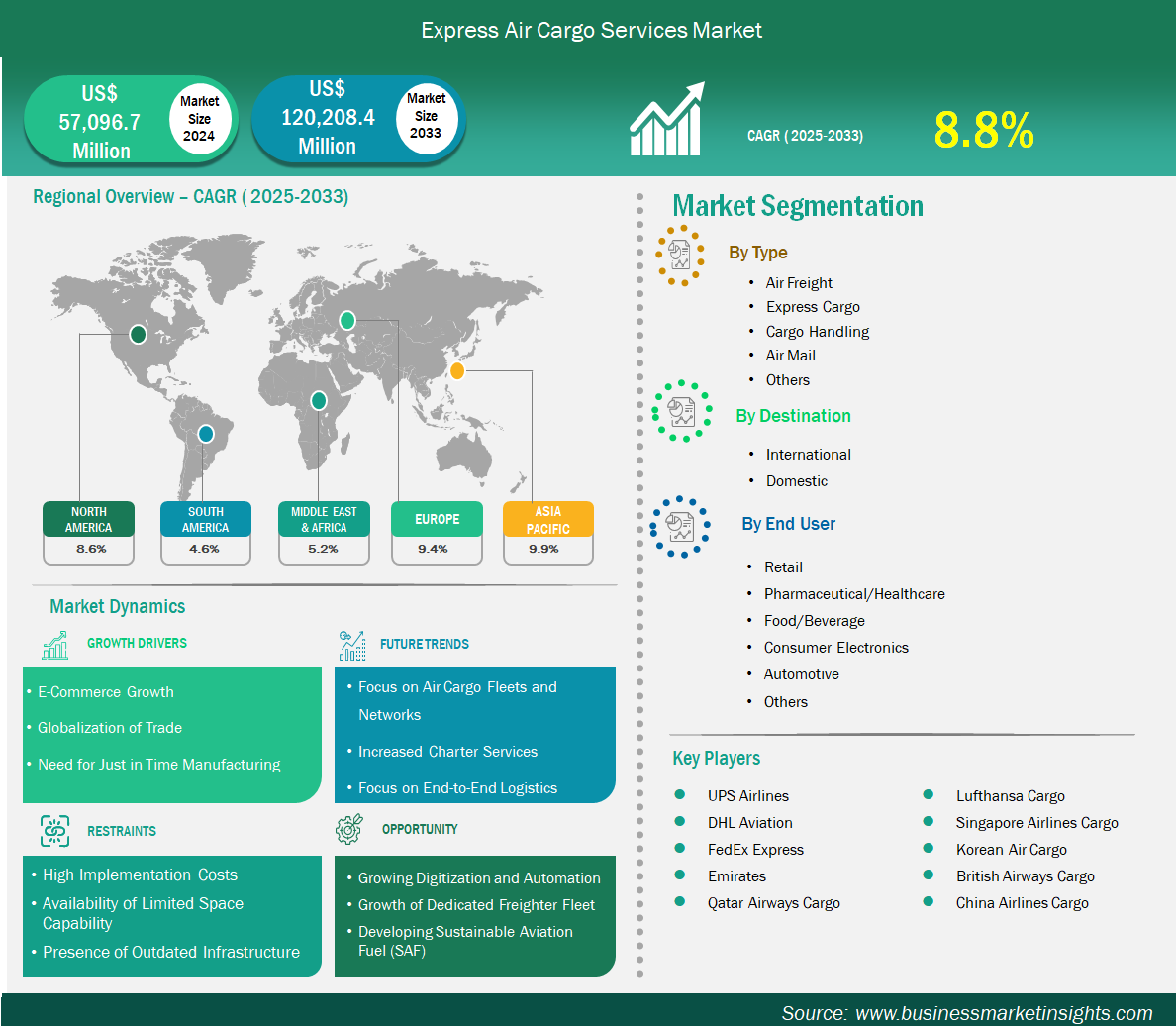

The express air cargo services market size is expected to reach US$ 120,208.4 million by 2033 from US$ 57, 096.7 million in 2024. The market is estimated to record a CAGR of 8.8% from 2025 to 2033.

The Express Air Cargo Services market refers to specialized air freight solutions designed for time-critical shipments requiring rapid, reliable, and secure delivery. These services are widely used in sectors such as e-commerce, healthcare, electronics, and automotive where just-in-time logistics and next-day delivery expectations are driving demand. The market is witnessing robust growth owing to rising international trade, the proliferation of online shopping platforms, and increasing consumer demand for faster delivery cycles.

Several key factors are driving the growth of the express air cargo services market, reflecting evolving business needs and global economic shifts. First and foremost, the rapid expansion of e-commerce has significantly increased the demand for time-definite and reliable delivery solutions, particularly for last-mile and cross-border shipments. Businesses are increasingly relying on express air cargo to meet consumer expectations for fast delivery and to maintain competitive service levels. Additionally, globalization and the growth of international trade have accelerated the movement of high-value, perishable, and time-sensitive goods, reinforcing the need for efficient air cargo services. The healthcare and pharmaceutical industries are also contributing to market expansion, with the growing need for swift transportation of medical supplies, vaccines, and temperature-sensitive products.

Key segments that contributed to the derivation of the express air cargo services market analysis are type, destination, and end user.

The rapid rise of global e-commerce has emerged as a major driver for the Express Air Cargo Services market. Consumers increasingly expect same-day or next-day delivery, which has placed pressure on retailers and logistics providers to optimize speed and reliability in shipping. Express air cargo plays a critical role in enabling this fast turnaround by ensuring the timely movement of high-priority goods across long distances. The growth of cross-border online shopping, particularly in emerging markets, is further intensifying the demand for express air freight solutions, especially in sectors like fashion, electronics, and consumer goods.

In recent years, trade liberalization policies, reduced tariffs, and the establishment of free trade zones have opened new markets, encouraging cross-border commerce and the flow of goods between developed and emerging economies. High-value, time-sensitive products such as electronics, pharmaceuticals, automotive parts, and fashion apparel are often transported by air due to the speed and security the mode offers. These goods are frequently sourced, manufactured, and consumed in different regions, underscoring the need for a dependable global air freight network.

By type, the express air cargo services market is segmented into air freight, express cargo, cargo handling, air mail, and others. The express cargo segment led the market in 2024, primarily driven by the increasing demand for fast, time-definite deliveries across e-commerce and critical industries. Express cargo services are characterized by guaranteed delivery windows, high reliability, and real-time tracking making them ideal for time-sensitive shipments such as medical supplies, spare parts, and urgent documents.

Based on destination, the market is divided into international and domestic air cargo services. The international segment held the largest share of the market in 2024, owing to the strong demand for cross-border e-commerce, global supply chain integration, and international trade in high-value goods. Industries such as pharmaceuticals, electronics, and luxury retail rely on international express services to move products quickly and securely across borders. Additionally, growing trade flows between Asia-Pacific, North America, and Europe continue to expand the reach of international express.

By end user, the express air cargo services market is segmented by end user into retail, pharmaceuticals/healthcare, food & beverage, consumer electronics, automotive, and others. The pharmaceuticals/healthcare segment dominated the market in 2024. This is due to the growing need for reliable and temperature-controlled delivery of vaccines, biologics, diagnostic samples, and medical devices. Express air cargo provides the speed and precision required to meet regulatory standards and ensures the integrity of medical shipments.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 57, 096.7 Million |

| Market Size by 2033 | US$ 120,208.4 Million |

| Global CAGR (2025 - 2033) | 8.8% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2033 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The "Express Air Cargo Services Market Size and Forecast (2022–2033)" report provides a detailed analysis of the market covering below areas:

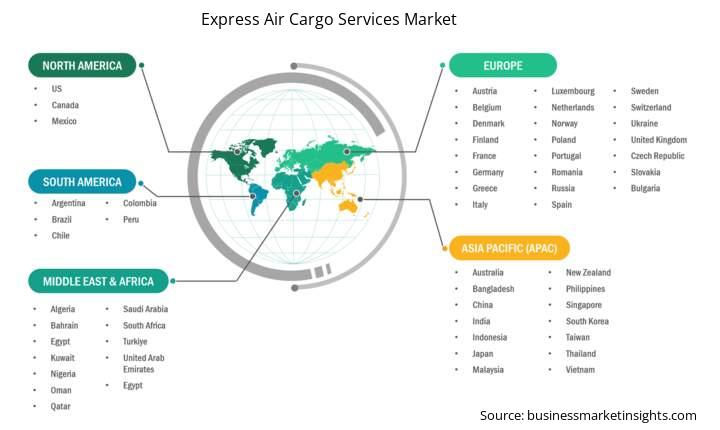

The geographical scope of the Express Air Cargo Services market report is divided into five key regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. Among these, the Asia Pacific Express Air Cargo Services market is expected to witness the most significant growth during the forecast period, driven by rapid industrialization, booming e-commerce, and expanding international trade routes.

The Asia Pacific Express Air Cargo Services market includes major economies such as China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, Taiwan, Bangladesh, and the Rest of Asia. The region’s growth is fueled by increasing demand for fast, reliable logistics to support e-commerce fulfillment, rising cross-border trade, and government initiatives to modernize logistics infrastructure, including investments in smart airports and dedicated cargo terminals.

Countries like China, India, and Japan are key contributors, driven by their expanding manufacturing bases, digital transformation in retail, and strong air connectivity. Additionally, strategic partnerships between local logistics providers and global express cargo players are enhancing service efficiency and geographic coverage. The rise of temperature-sensitive and high-value shipments from the pharmaceutical and electronics sectors is also amplifying demand for express air cargo services.

The express air cargo services market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the express air cargo services market are:

The Express Air Cargo Services Market is valued at US$ 57, 096.7 Million in 2024, it is projected to reach US$ 120,208.4 Million by 2033.

As per our report Express Air Cargo Services Market, the market size is valued at US$ 57, 096.7 Million in 2024, projecting it to reach US$ 120,208.4 Million by 2033. This translates to a CAGR of approximately 8.8% during the forecast period.

The Express Air Cargo Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Express Air Cargo Services Market report:

The Express Air Cargo Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Express Air Cargo Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Express Air Cargo Services Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)