Military organizations heavily invest in defense equipment, weapons systems, and vehicles to strengthen their capabilities. Metal processing machines are crucial in fabricating armor plates, munitions, and other critical systems required in defense operations. The need to modernize defense forces, enhance national security, and respond to evolving threats compels governments to increase their military expenditures every year. The massive financial aid for military reinforcement would encourage defense-related component manufacturers to invest more in their operations, triggering the demand for metal processing machines, in the coming years. Advanced metal processing machines are required to produce cutting-edge weaponry and defense systems, as precise fabrication, shaping, and assembly of metal components are crucial for the optimal performance and durability of these products. The need for improved vehicle armor and military infrastructure upgrades further drives the demand for metal processing machines. These machines are used for processing specialized materials and manufacturing critical components in armored vehicles, tanks, and military aircraft. Many initiatives by companies would help domestic metal processing machine manufacturers extend their clientele. Further, the surge in defense expenditure is not limited to established defense powers; many economies have been exhibiting the rise in their defense budgets.

Metal processing machine manufacturers need to understand the unique requirements of the defense industry and develop solutions that comply with domestic and international quality standards and regulations. This can be achieved through close collaborations with defense organizations and the ability to provide customized solutions with continuous innovation efforts. Thus, a surge in defense expenditure worldwide provides a significant boost to the Europe metal processing machine market.

The Europe metal processing machine market in Europe is segmented into France, Germany, the UK, Spain, Russia, Poland, Austria, Switzerland, Sweden, Norway, Hungary, Belgium, Netherlands, and the Rest of Europe. Western Europe is a highly developed region and comprises different types of businesses. Europe has a well-established manufacturing industry using cutting-edge technologies, including the Internet of Things (IoT), Industrial Internet of Things (IIoT), and Industry 4.0. Across Europe, technological advancements have led to a highly competitive market. To stay relevant in the competition, key players in the Europe metal processing machine market are focusing on innovation, new product launches, partnerships, and collaborations. In March 2023, Eagle Lasers, a leading producer of fiber laser cutting systems, announced a launch of its 30kW iNspire fiber laser cutting machine in Poland. In October 2022, Eagle, a Polish manufacturer specializing in fiber laser cutting machines and automation systems, collaborated with Pivatic Oy to develop efficient coil-fed cutting solutions. Therefore, rising number of new product launches is expected to spur the growth of the Europe metal processing machine market in Europe.

Europe is one of the prominent automobile producers in the world. The presence of global leaders in the automobile industry such as Volkswagen AG, Stellantis NV, Mercedes-Benz Group AG, Bayerische Motoren Werke AG, and Renault SA fuels the growth of the industry. The presence of various leading automobile manufacturers is also contributing to fierce competition in this region. These players are focusing on delivering high-quality products at high volumes without error. The metal processing machines offers speed and precision, which contributes to less waste and faster production and creates a cost-effective manufacturing process. As a result, these machines are gaining popularity in the automotive manufacturing process. Thus, the growing automobile industry in Europe is expected to offer promising opportunities for the Europe metal processing machine market in the region during the forecast period.

Strategic insights for the Europe Metal Processing Machines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Metal Processing Machines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Metal Processing Machines Strategic Insights

Europe Metal Processing Machines Report Scope

Report Attribute

Details

Market size in 2023

US$ 8,200.42 Million

Market Size by 2030

US$ 11,260.37 Million

CAGR (2023 - 2030) 4.6%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Press Brake

By Laser Cutting Machine

By Bending Machine

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Metal Processing Machines Regional Insights

Europe Metal Processing Machines Market Segmentation

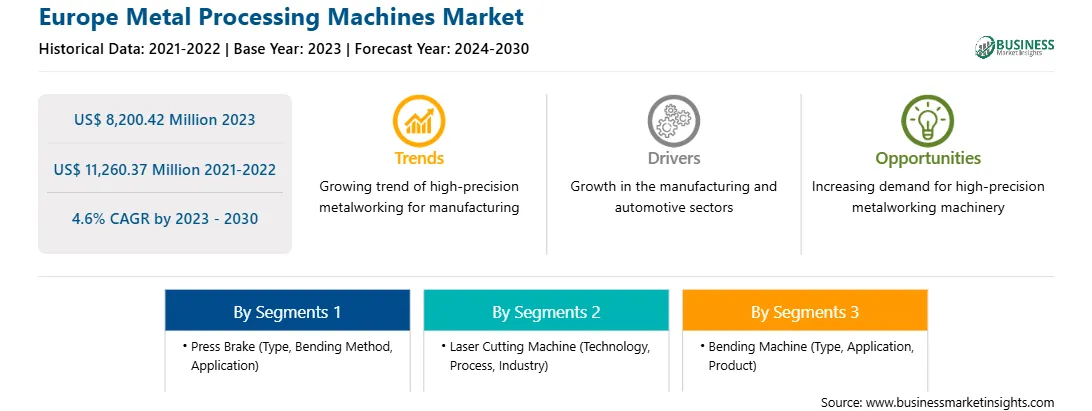

The Europe metal processing machines market is segmented into press brake, laser cutting machine, bending machine, and country.

The press brake market is further categorized into type, bending method, and application. By press brake, the type segment is further sub-segmented into manual, hydraulic, and electronic. The hydraulic sub-segment held the largest share of the Europe metal processing machines market in 2023. The bending method segment, by press brake, is classified into air bending, bottom bending, and coining. The air bending sub-segment held the largest share of the Europe metal processing machines market in 2023. Also, the application segment, by press brake, is sub-segmented into automotive, aerospace, metal, furniture, and others. The automotive sub-segment held the largest share of the Europe metal processing machines market in 2023.

The laser cutting machine market is further categorized into technology, process, and industry. By laser cutting machine, the technology segment is further sub-segmented into fiber laser and plasma laser. The fiber laser sub-segment held the largest share of the Europe metal processing machines market in 2023. The process segment, by press brake, is classified into fusion cutting, flame cutting, and sublimation cutting. The flame cutting sub-segment held the largest share of the Europe metal processing machines market in 2023. Also, the industry segment, by press brake, is sub-segmented into automotive, aerospace & defense, consumer electronics, industrial, and others. The industrial sub-segment held the largest share of the Europe metal processing machines market in 2023.

The bending machine market is further categorized into type, application and products. By bending machine, the type segment is further sub-segmented into electric, hydraulic, pneumatic, and electromagnetic. The hydraulic sub-segment held the largest share of the Europe metal processing machines market in 2023. The application segment, by bending machine, is classified into manufacturing, precision machinery, metals and mining, automotive, and building and construction. The automotive sub-segment held the largest share of the Europe metal processing machines market in 2023. Also, the products segment, by bending machine, is sub-segmented into sheets, tube, and others. The tube sub-segment held the largest share of the Europe metal processing machines market in 2023.

Based on country, the Europe metal processing machines market is segmented into France, Germany, the UK, Spain, Russia, Poland, Austria, Switzerland, Sweden, Norway, Hungary, Belgium, Netherlands, and the Rest of Europe. The Germany dominated the share of the Europe metal processing machines market in 2023.

Bystronic AG; Dener USA LLC; Durmazlar Machinery Inc; Ermaksan Machinery Industry and Trade Inc; LVD Company NV; Prima Industrie SpA; Salvagnini Italia SPA; and TRUMPF SE + Co KG are the leading companies operating in the Europe metal processing machines market.

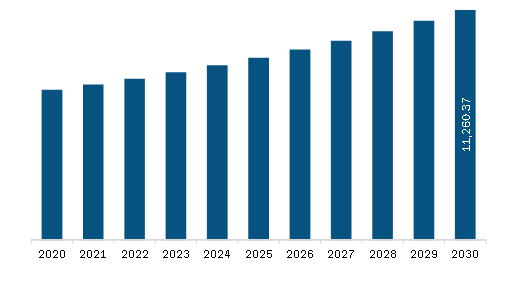

The Europe Metal Processing Machines Market is valued at US$ 8,200.42 Million in 2023, it is projected to reach US$ 11,260.37 Million by 2030.

As per our report Europe Metal Processing Machines Market, the market size is valued at US$ 8,200.42 Million in 2023, projecting it to reach US$ 11,260.37 Million by 2030. This translates to a CAGR of approximately 4.6% during the forecast period.

The Europe Metal Processing Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Metal Processing Machines Market report:

The Europe Metal Processing Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Metal Processing Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Metal Processing Machines Market value chain can benefit from the information contained in a comprehensive market report.