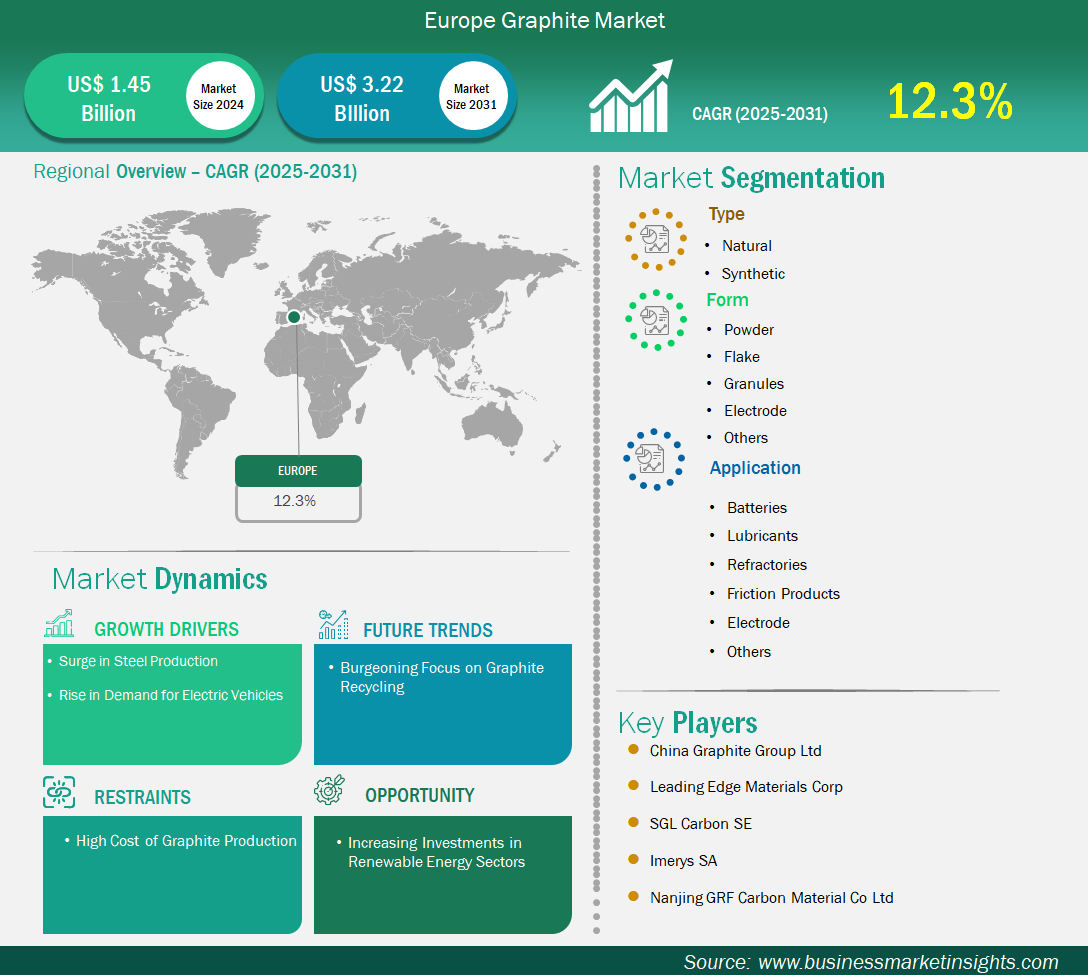

The Europe Graphite Market size is expected to reach US$ 3.22 billion by 2031 from US$ 1.45 billion in 2024. The market is estimated to record a CAGR of 12.3% from 2025 to 2031.

Automotive, electronics, and energy are the crucial sectors driving the growth of the graphite market in Europe. As the region focuses on sustainable energy solutions, the ongoing transition to electric vehicles (EVs) is fueling the need for high-performance graphite materials, particularly for lithium-ion batteries. Countries such as Germany, France, and the UK lead this transformation by making efforts to prioritize the advancement of green technologies, along with promoting the local production of essential raw materials.

Key segments that contributed to the derivation of the Europe graphite market analysis are type, form, and application.

The graphite market players in Europe are employing diverse strategies to strengthen their market presence, including investments in advanced production technologies, strategic partnerships, and supply chain optimization. For example, in 2023, Imerys Graphite & Carbon Switzerland SA expanded its production capacity for natural graphite products to meet the rising demand from the EV industry. Additionally, European governments support the growth of the graphite market through policies that encourage domestic sourcing of critical materials and reduce dependence on external markets. With a strong focus on sustainability and reducing carbon footprints, European companies are developing new, environmentally friendly methods for graphite extraction and processing, subsequently fueling the graphite market growth in Europe.

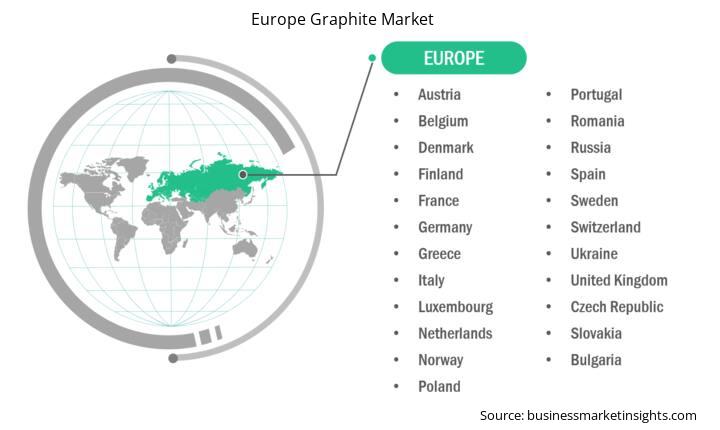

Based on country, the Europe graphite market is segmented into Germany, France, Italy, Spain, UK, Russia, Poland, Austria, Switzerland, Sweden, Czech Republic, Denmark, Belgium, Netherlands, Hungary, Finland, Portugal, Romania, Greece, Ukraine, and the rest of Europe. Germany held the largest share in 2024.

Germany has a robust industrial base with a significant presence in the automotive, energy, and manufacturing sectors, which underlines the critical role played by graphite in its economy. The graphite market in Germany is evolving with an increasing focus on sustainability and innovation, backed by partnerships aimed at reducing carbon footprints. In July 2024, BASF collaborated with Graphite Kropfmuhl, a subsidiary of AMG Critical Materials N.V. In this partnership, BASF supplies renewable energy certificates (Guarantees of Origin) to Graphit Kropfmühl's production site in Hauzenberg, Germany. This initiative is designed to reduce the product carbon footprint (PCF) of the graphite produced at these sites by at least 25%. This sustainable graphite would then be used as a raw material to produce BASF's lower-PCF Neopor variant, a key material for energy-efficient insulation. This collaboration highlights Germany's leadership in integrating sustainable practices into industrial production and reflects the growing importance of environmentally conscious manufacturing in the global graphite market.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.45 Billion |

| Market Size by 2031 | US$ 3.22 Billion |

| CAGR (2025 - 2031) | 12.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

GES Europe GmbH, Graphit Kropfmühl GmbH, Pingdingshan Wanhui Graphite Co., Ltd, China Graphite Group Limited, Leading Edge Materials Corp, SGL Carbon SE, Ceylon Graphite Corp, Imerys SA, Graphite Central, and Nanjing GRF Carbon Material Co., Ltd are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Europe Graphite Market is valued at US$ 1.45 Billion in 2024, it is projected to reach US$ 3.22 Billion by 2031.

As per our report Europe Graphite Market, the market size is valued at US$ 1.45 Billion in 2024, projecting it to reach US$ 3.22 Billion by 2031. This translates to a CAGR of approximately 12.3% during the forecast period.

The Europe Graphite Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Graphite Market report:

The Europe Graphite Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Graphite Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Graphite Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)