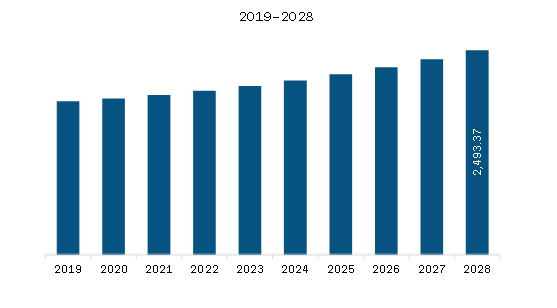

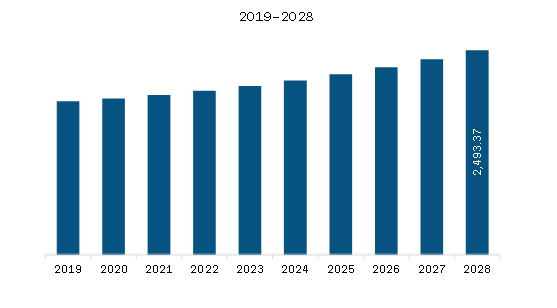

The diagnostic imaging market in Europe is expected to grow from US$ 11,168.77 million in 2021 to US$ 15,311.23 million by 2028; it is estimated to grow at a CAGR of 5.4% from 2021 to 2028.

According to the World Health Organization (WHO) report, diagnostic imaging has developed rapidly and plays a central role in healthcare by supporting the diagnosis and treatment of diseases. Diagnostic imaging services include confirming, assessing, and documenting the course of many conditions for ultimately drawing the response to treatment. The WHO collaborates with partners and manufacturers to develop a technical solution for improving the diagnostic imaging services for patients' safety. In March 2018, GE Healthcare announced launching a new diagnostic imaging product supported by AI technology and involved in quickly capturing data and reconstructing images as the product was fast approved by the FDA. The newly launched product is efficient for fast connectivity and advanced algorithm, ensuring 48 times more data throughput and ten times the processing power of the previous system. On the other hand, through the support of technological advancements, diagnostic imaging has played a crucial role in cancer diagnosis. For example, diagnostic imaging takes pictures inside of the body and has a pivotal role in diagnosing and managing cancer patients. The first method is the utilization of CT and MRI, which offers detailed information on the location, size, morphology, and structural changes of the surrounding tissues of the tumor. The second method is the utility of PET and SPECT, which offers insights related to tumor physiology with anatomical details. Combining these two methods enables the integration of anatomy and function in a single approach, and applying such "hybrid" imaging techniques allows the characterization of tumors at all stages. Additionally, integration of various diagnostic imaging techniques such as X-ray spectrometry-related techniques and methodologies can be deployed more efficiently intended for different interdisciplinary uses. With the advent of such advanced technologies, the diagnostic imaging market will grow exponentially during the forecast period.

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Europe diagnostic imaging market at a substantial CAGR during the forecast period.

Europe Diagnostic Imaging Market Segmentation

The Europe diagnostic imaging market is segmented based on modality, application, end user, and country. Based on modality, the market is segmented into X-ray, computed tomography, endoscopy, ultrasound, magnetic resonance imaging (MRI), nuclear, imaging, mammography, and others. In 2021, the computed tomography segment held a larger share of the market. And it is also expected to register a higher CAGR during the forecast period. Based on application, the Europe diagnostic imaging market is segmented into cardiology, oncology, neurology, orthopedics, gastroenterology, obstetrics/gynecology, and others. The cardiology segment held the largest market share in 2021 and oncology is expected to register the highest CAGR in the market during the forecast period. Based on end user, the market is segmented into hospitals and clinics, diagnostic imaging centers, ambulatory surgical centers (ASCs), others. In 2021, the hospitals and clinics segment held the largest market share. However, the diagnostic imaging centers segment is expected to register the highest CAGR during the forecast period. Based on country, the Europe diagnostic imaging market is segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. In 2021, Germany held the largest market share. It is also expected to register the highest CAGR during the forecast period.

General Electric Company; Siemens Healthineers; Koninklijke Philips N.V.; KARL STORZ SE & Co. KG; FUJIFILM Holdings Corporation; Canon Inc.; Hologic, Inc.; Carestream Health Inc.; Stryker Corporation; and Olympus Corporation are among the leading companies in the Europe diagnostic imaging market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 11,168.77 Million |

| Market Size by 2028 | US$ 15,311.23 Million |

| CAGR (2021 - 2028) | 5.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Device

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

The Europe Diagnostic Imaging Market is valued at US$ 11,168.77 Million in 2021, it is projected to reach US$ 15,311.23 Million by 2028.

As per our report Europe Diagnostic Imaging Market, the market size is valued at US$ 11,168.77 Million in 2021, projecting it to reach US$ 15,311.23 Million by 2028. This translates to a CAGR of approximately 5.4% during the forecast period.

The Europe Diagnostic Imaging Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Diagnostic Imaging Market report:

The Europe Diagnostic Imaging Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Diagnostic Imaging Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Diagnostic Imaging Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)