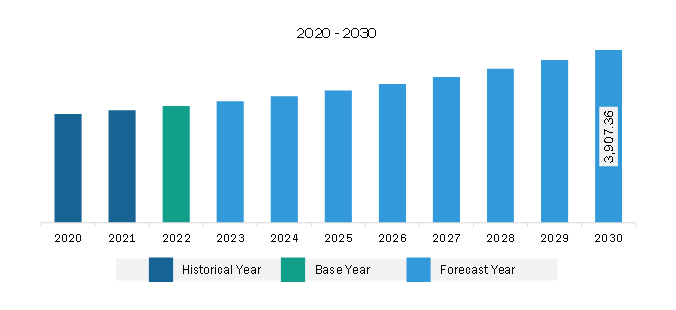

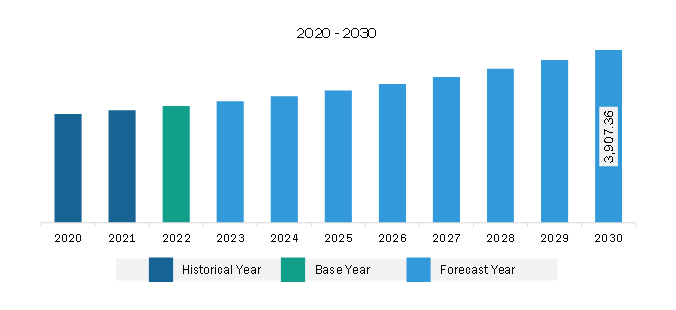

The Europe cooling water treatment chemicals market was valued at US$ 2,641.62 million in 2022 and is expected to reach US$ 3,907.36 million by 2030; it is estimated to register a CAGR of 5.0% from 2022 to 2030.

Growing Emphasis on Water Recycling and Reuse Drives Europe Cooling Water Treatment Chemicals Market

Quick urbanization, rising monetary improvement, and expanding industrial activities have resulted in a tremendous demand for water across the world. It is crucial to maintain the hydrological cycle for ensuring a sustainable future. The four fundamental procedures used for water treatment are heater treatment, cooling treatment, and filtration. The consumption of freshwater is surging globally due to climate change and population growth, and increased land use and energy generation, which has resulted in water scarcity, in turn, requiring prompt considerations. Additionally, rising costs of industrial water are rerouting industries’ focus on water recycling and reuse. The adoption of cooling water treatment is high among industries such as oil & gas, pulp & paper, electric power generation, and chemicals due to the high-water requirement. These industries incorporate various technologies to recycle and reuse water for industrial applications to save water. For instance, the power industry uses water softener systems to reduce water hardness for preventing scale build-up, clogging, and expense. Such practices have accelerated the use of different cooling water treatment chemicals among these industries, thereby boosting the market growth.

Europe Cooling Water Treatment Chemicals Market Overview

The cooling water treatment chemicals market in Europe is segmented into Germany, France, Italy, the UK, and the Rest of Europe. The Rest of Europe mainly includes Switzerland, Russia, Sweden, Denmark, and the Netherlands, among others. The rising use of cooling water treatment chemicals such as corrosion inhibitors, scale inhibitors, and biocides owing to the increased awareness about water pollution and the subsequent need for water recycling to reduce the dependence on the shrinking sources of fresh water is expected to drive the cooling water treatment chemicals market growth during the forecast period. Europe is one of the prominent consumers of cooling water treatment chemicals owing to the prominent activity of industries such as power, steel, mining and metallurgy, petrochemicals, oil & gas, food & beverages, and textile, which require huge quantities of water. A few of the most commonly used cooling water treatment chemicals in Europe are corrosion inhibitors, scale inhibitors, and biocides. Regulations developed by the European Industrial Emission Directive (IED) regulate the emission of pollutants from the industrial sector, thereby playing a crucial role in the progress of the cooling water treatment chemicals market. As a result, the proper treatment of industrial water before its disposal has become one of the priorities of industries in European countries, which favors the cooling water treatment chemicals market in the region. However, the high costs of production of these chemicals and their harmful effects on the environment, when not disposed of properly, hamper market growth. The rising popularity of environment-friendly electrocoagulation (EC) and biofiltration technologies is also likely to hamper the demand for cooling water treatment chemicals in Europe.

Europe Cooling Water Treatment Chemicals Market Revenue and Forecast to 2030 (US$ Million)

Europe Cooling Water Treatment Chemicals Market Segmentation

The Europe cooling water treatment chemicals market is categorized into type, end use, and country.

Based on type, the Europe cooling water treatment chemicals market is segmented into scale inhibitor, corrosion inhibitor, biocide, and others. The scale inhibitor segment held the largest market share in 2022.

In terms of end use, the Europe cooling water treatment chemicals market is segmented into power; steel, mining, and metallurgy; petrochemicals, oil, and gas; food and beverages; textile; and others. The power segment held the largest market share in 2022.

By country, the Europe cooling water treatment chemicals market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. Germany dominated the Europe cooling water treatment chemicals market share in 2022.

Accepta Ltd, Albemarle Corp, Buckman Laboratories lnternational Inc, Ecolab Inc, Kemira Oyj, Kurita Water Industries Ltd, and Veolia Water Solutions & Technologies SA are some of the leading companies operating in the Europe cooling water treatment chemicals market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,641.62 Million |

| Market Size by 2030 | US$ 3,907.36 Million |

| CAGR (2022 - 2030) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

1. Accepta Ltd

2. Albemarle Corp

3. Buckman Laboratories lnternational Inc

4. Ecolab Inc

5. Kemira Oyj

6. Kurita Water Industries Ltd

7. Veolia Water Solutions & Technologies SA

The Europe Cooling Water Treatment Chemicals Market is valued at US$ 2,641.62 Million in 2022, it is projected to reach US$ 3,907.36 Million by 2030.

As per our report Europe Cooling Water Treatment Chemicals Market, the market size is valued at US$ 2,641.62 Million in 2022, projecting it to reach US$ 3,907.36 Million by 2030. This translates to a CAGR of approximately 5.0% during the forecast period.

The Europe Cooling Water Treatment Chemicals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Cooling Water Treatment Chemicals Market report:

The Europe Cooling Water Treatment Chemicals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Cooling Water Treatment Chemicals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Cooling Water Treatment Chemicals Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)