The increasing adoption of unmanned aerial vehicles (UAVs) by military personnel for the applications such as surveillance, combat operations, transportation and delivery, and battle damage management is expected to boost the market growth. Battery testing equipment providers, such as Arbin Instruments, offer enhanced testing equipment that enables batteries that are used in drones to have a longer lifespan, higher capacity, efficiency, and reliability. Moreover, the growing number of initiatives taken by governments of European countries to develop urban air mobility infrastructure is also expected to fuel the growth of the market in the coming years. For example, in 2020, the European Union Aviation Safety Agency (EASA) published a set of guidelines for the certification of new electric vertical-takeoff-and-landing aircraft (eVTOLs). It provides a framework for manufacturers aiming to manufacture small eVTOLs according to European certification standards. Battery packs are used in eVTOLs for hovering the aircraft, landing, and takeoff. As a result, enhanced battery systems are required to provide an enhanced range, efficiency, and reliability to eVTOLs. Therefore, battery testing is required to avoid overheating the battery and battery failure to prevent accidents by offering enhanced safety to pilots and passengers.

Strategic insights for the Europe Battery Testing Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

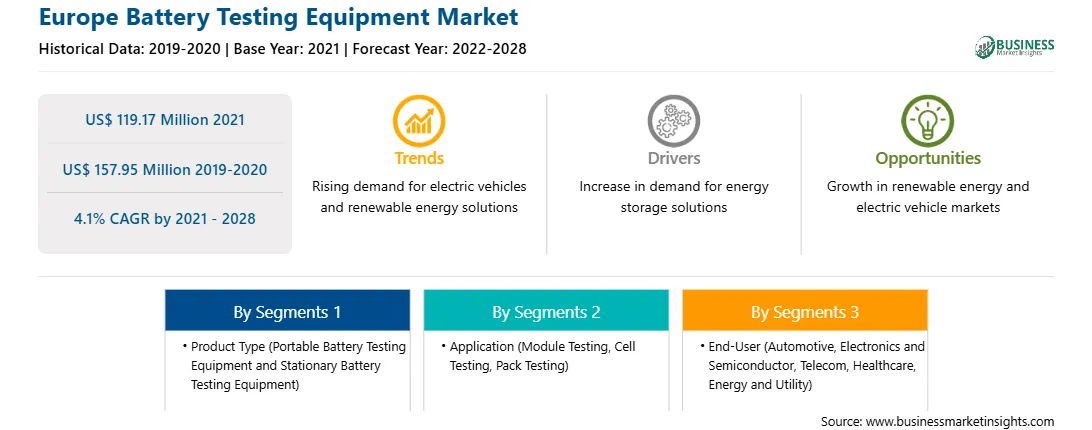

| Market size in 2021 | US$ 119.17 Million |

| Market Size by 2028 | US$ 157.95 Million |

| CAGR (2021 - 2028) | 4.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

|

The geographic scope of the Europe Battery Testing Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Battery Testing Equipment Market Segmentation

The Europe battery testing equipment market is segmented into product type, application, end-user, and country. Based on product type, the market is divided into portable battery testing equipment and stationary battery testing equipment. In 2020, the stationary battery testing equipment segment held a larger market share. Based on application, the market is categorized into module testing, cell testing, and pack testing. In 2020, the cell testing segment held the largest market share. Based on end-user, the Europe battery testing equipment market is segmented into automotive, electronics and semiconductor, telecom, healthcare, energy and utility, and others. In 2020, the electronics and semiconductor segment held the largest share in the market. Similarly, based on country, the market is categorized into the UK, Germany, France, Italy, Russia, and the Rest of Europe. Germany contributed a substantial share in 2020.

Ametek Scientific Instruments; Arbin Instruments; Biologic; Bitrode Corporation; Chroma Systems Solutions, Inc; Digatron Power Electronics GmbH; EA Elektro-Automatik; HEiNZINGER; HORIBA FuelCon GmbH; KEYSIGHT TECHNOLOGIES, INC.; Maccor Inc.; PEC; Unico, LLC; and Webasto Group are among the leading companies operating in the Europe battery testing equipment market.

The Europe Battery Testing Equipment Market is valued at US$ 119.17 Million in 2021, it is projected to reach US$ 157.95 Million by 2028.

As per our report Europe Battery Testing Equipment Market, the market size is valued at US$ 119.17 Million in 2021, projecting it to reach US$ 157.95 Million by 2028. This translates to a CAGR of approximately 4.1% during the forecast period.

The Europe Battery Testing Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Battery Testing Equipment Market report:

The Europe Battery Testing Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Battery Testing Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Battery Testing Equipment Market value chain can benefit from the information contained in a comprehensive market report.