Increasing Need for Communications in Automobiles are Driving the Europe Automotive Transceivers Market

The growing regulatory support for zero-emission vehicles in different countries through subsidies and tax rebates encourages the manufacturing and adoption of electric vehicles. EV sales also grew strongly in Europe by 65% to reach 2.3 million units in 2021. Supportive government initiatives to strengthen EV charging infrastructure further propels EV sales. In May 2022, PMI Electro, an Electric bus maker, announced the plan to set up its largest commercial EV manufacturing plant, having an annual production capacity of 2,500 vehicles.

Such huge growth of electric vehicles worldwide, there is an increasing demand for data exchange due to which there is a growing need to implement a range of automotive networks that efficiently send and receive large quantities of data through protocols such as CAN (Controller Area Network) and LIN (Local Interconnect Network) bus systems. Nowadays, electric cars are equipped with advanced features and transceivers for better communication and safety. Thus, such growing production and sales of electric vehicles are expected to hold potential demand for incorporating the Europe automotive transceivers market, which drives the Europe automotive transceivers market growth during the forecast timeframe.

Market Overview

The Europe automotive transceivers market growth is attributed to increasing sales of vehicles, coupled with growing initiatives for incorporating ADAS and advanced communication electronics devices, such as transceivers. As per the data published by the International Organization of Motor Vehicle Manufacturers, the sale of new vehicles registered in Europe increased from 16.71 million units in 2020 to 16.87 million units in 2021, registering a growth rate of 1%, which is expected to grow in the coming years. As a result, the rising sale of vehicles is expected to grow rapidly, which is likely to boost the demand for Europe automotive transceivers market during the forecast period.

In 2022, the European Commission mandated the advanced safety systems in vehicles to protect passengers, pedestrians, and cyclists. The initiative was undertaken with the aim of reducing the number of fatalities and injuries on roads, as 90% of such incidents occur due to human error. For example, cars, vans, trucks, and buses must be equipped with advanced safety systems such as warning of driver drowsiness, intelligent speed assistance, reversing safety with a camera or sensors, and data recorders in case of an accident. Thus, such favorable government policies for protection against fatal accidents are increasing the adoption of ADAS and V2X communication, which is creating more demand for in-vehicle communication modules that support the Europe automotive transceivers market growth over the forecast period.

The presence of a large number of leading players for providing automotive transceivers is also augmenting the Europe automotive transceivers market growth. The key players are significantly focused on the advancement of transceiver features to deliver more efficiency and reliability in communicating the signals for providing ease in driving the vehicle. For instance, in March 2020, Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, introduced multiple Cellular Vehicle-to-Everything (C-V2X) products for leading automotive and infrastructure suppliers. The product features Qualcomm® 9150 C-V2X Platform that has achieved the certification in accordance with the European Radio Equipment Directive (“RED”) Certification in Europe. Also, in March 2021, Continental Engineering Services, a pioneering developer of technologies and services for sustainable and connected mobility, announced its plan to expand into three new branches in England, Germany (Sindelfingen), and Italy. The expansion initiative aims to develop and integrate advanced driver assistance systems (ADAS), which would create a demand for automotive transceivers in European countries. In addition, as per the study conducted by the Autopromotec Observatory based on Boston Consulting Group in May 2021, 54% of the car fleet running on Europe's roads is likely to be equipped with ADAS by 2030. Thus, the wide scope in the deployment of ADAS in European vehicles is anticipated to increase the demand for automotive transceivers, which is expected to fuel the Europe automotive transceivers market growth over the coming years.

Europe Automotive Transceivers Market Segmentation

Europe Automotive Transceivers Market Segmentation

The Europe automotive transceivers market is segmented into protocol, application, vehicle type, and country.

Based on protocol, the Europe automotive transceivers market is segmented into CAN, LIN, FLEXRAY, and others. The CAN segment held the largest market share in 2022.

Based on application, the Europe automotive transceivers market is segmented into safety, body control module, chassis, powertrain, steering wheel, engine, and door/seat. The safety segment held the larger market share in 2022.

Based on vehicle type, the Europe automotive transceivers market is bifurcated into passenger vehicles, and commercial vehicles. The passenger vehicles segment held the larger market share in 2022.

Based on country, the Europe automotive transceivers market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Germany dominated the market share in 2022.

Broadcom Inc; Maxim Integrated Products Inc; Microchip Technology Inc; NXP Semiconductors NV; Renesas Electronics Corp; Robert Bosch; STMicroelectronics NV; Texas Instruments Inc; and Toshiba Corp are the leading companies operating in the Europe automotive transceivers market.

| Report Attribute | Details |

|---|---|

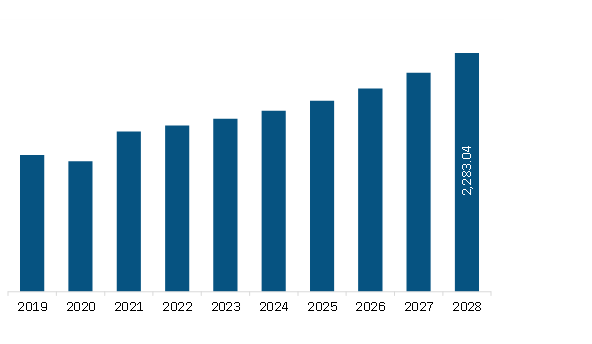

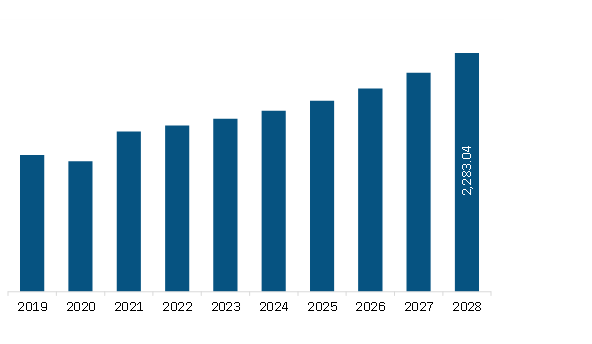

| Market size in 2022 | US$ 1,587.45 Million |

| Market Size by 2028 | US$ 2,283.04 Million |

| CAGR (2022 - 2028) | 6.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Protocol

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

The Europe Automotive Transceivers Market is valued at US$ 1,587.45 Million in 2022, it is projected to reach US$ 2,283.04 Million by 2028.

As per our report Europe Automotive Transceivers Market, the market size is valued at US$ 1,587.45 Million in 2022, projecting it to reach US$ 2,283.04 Million by 2028. This translates to a CAGR of approximately 6.2% during the forecast period.

The Europe Automotive Transceivers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Automotive Transceivers Market report:

The Europe Automotive Transceivers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Automotive Transceivers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Automotive Transceivers Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)