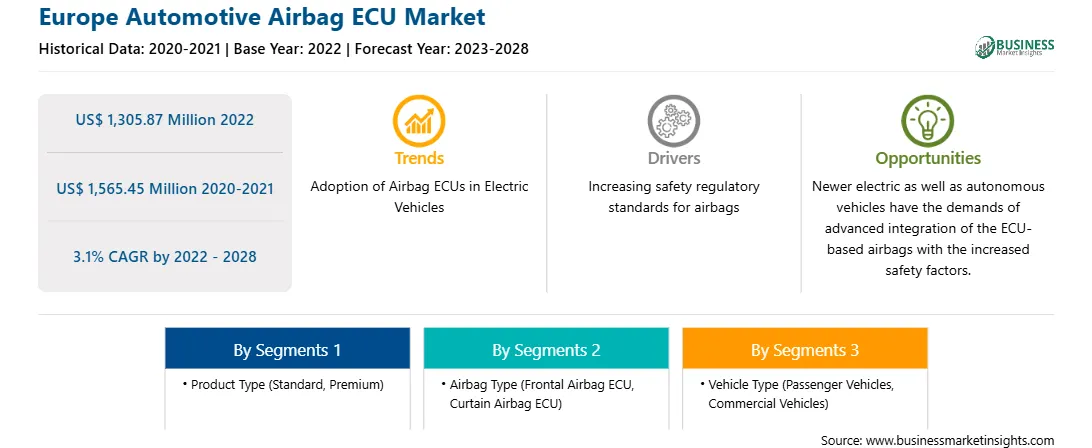

The automotive airbag ECU market in Europe is expected to grow from US$ 1,305.87million in 2022 to US$ 1,565.45 million by 2028. It is estimated to grow at a CAGR of 3.1% from 2022 to 2028.

Airbag ECUs Witnessing Various Technological Advancements

With the rapid expansion of clientele, manufacturers in the automotive sector are primarily focusing on enhancing fuel and cost efficiencies, driving experience, and overall passenger and driver safety. Airbag control units (ACU) play a central role in the new E/E architecture and adopt functions that provide more protection for occupants. Control units provide the highest crash safety standards and reliable airbag deployment. Apart from sensors, ACUs receive signals from pressure satellites, which detect and report the pressure wave of a collision. Advancements in airbag and ECUs technologies are propelling their adoption across passenger vehicles. Continental AG offers ECUs converted into software-based products in reorganizing the E/E architecture with centralization and a few high-performance computers.

Computer-operated dual airbags or dual-stage airbags are deployed at two vehicle speed limits. In less severe accidents, airbags are deployed in a lower first stage, usually ~70.0% of full force. However, they deployed at both stages in more severe accidents. Further, side airbags effectively protect drivers and passengers from crucial head injuries caused by side-impact collisions. In September 2019, Hyundai Mobis developed a “Safety Integrated Control Module” that ensures greater efficiency and safety in the operations of automotive safety devices. The new product combines two separate ECUs for airbags and electronic seatbelts into a single unit.

Market Overview

Europe includes various major economies, such as France, Germany, Russia, the UK, and Italy. The western part of Europe is characterized for its higher standards of living, with high GDP. The automotive industry directly contributed ~7% to the GDP of the region. Europe comprises several major automotive manufacturing assembly and production plants. There are ~298 vehicle assembly plants across the region. The demand for electric vehicles is expanding rapidly across Europe, owing to increased technical breakthroughs in the electrified fleet sector. Furthermore, the growth of the automotive airbag ECU market in Europe is driven by the rising awareness of smart safety systems, increasing count of deaths due to road accidents, growing production of EVs with inbuilt airbags, and surging regulatory compliances for compulsory provision of airbags.

In 2020, the EU produced 16.7% of the world’s motor cars, or about 13 million of them, a decrease of 5 million units from the previous year. Production of automobiles fell by 21% in the same year. While producing a trade surplus for the European Union of US$ 80 Billion in 2020, exports of cars made in the EU also fell by about 15%. The production of cars has a direct impact on market growth, since the number of airbags is directly related to automotive production. The combined technological developments in the transportation industry and the electric vehicles in general, and the presence of numerous top rated OEM manufacturers-such as Audi, BMW, and Volkswagen, the prospect for airbags appears promising for passenger cars as well as business cars. The OEMs in Europe are exporting their cars to many countries across the world, so the exports perform a main role in the European automobile market. The demand for electric powered cars is growing across the region with a totally excessive rate. In 2019, 564,206 plug-in electric vehicles were produced in Europe, a direct increase of 45% as compared to 2018. Further, European Union registered an increase of 5% in road fatalities accounting to 44 road deaths a million (average) inhabitants in 2021 when compared to 2020. Rise in the number of accidents demands the increased adoption of airbag systems to minimize the losses.

Strategic insights for the Europe Automotive Airbag ECU provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Automotive Airbag ECU refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Automotive Airbag ECU Strategic Insights

Europe Automotive Airbag ECU Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,305.87 Million

Market Size by 2028

US$ 1,565.45 Million

CAGR (2022 - 2028) 3.1%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product Type

By Airbag Type

By Vehicle Type

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Automotive Airbag ECU Regional Insights

Europe Automotive Airbag ECU Market Segmentation

The Europe automotive airbag ECU market is segmented into product type, airbag type, vehicle type, and country.

The product type segment is bifurcated into standard and premium. Premium segment is expected to lead the automotive airbag ECU market in 2022.

Aptiv; Autoliv Inc.; Continental AG; Denso Corporation; HELLA GmbH and Co. KGaA; Hyundai Mobis; Mitsubishi Electric Corporation; Robert Bosch GmbH; Veoneer Inc; and ZF Friedrichshafen AG are the leading companies operating in the automotive airbag ECU market in the region.

The Europe Automotive Airbag ECU Market is valued at US$ 1,305.87 Million in 2022, it is projected to reach US$ 1,565.45 Million by 2028.

As per our report Europe Automotive Airbag ECU Market, the market size is valued at US$ 1,305.87 Million in 2022, projecting it to reach US$ 1,565.45 Million by 2028. This translates to a CAGR of approximately 3.1% during the forecast period.

The Europe Automotive Airbag ECU Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Automotive Airbag ECU Market report:

The Europe Automotive Airbag ECU Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Automotive Airbag ECU Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Automotive Airbag ECU Market value chain can benefit from the information contained in a comprehensive market report.