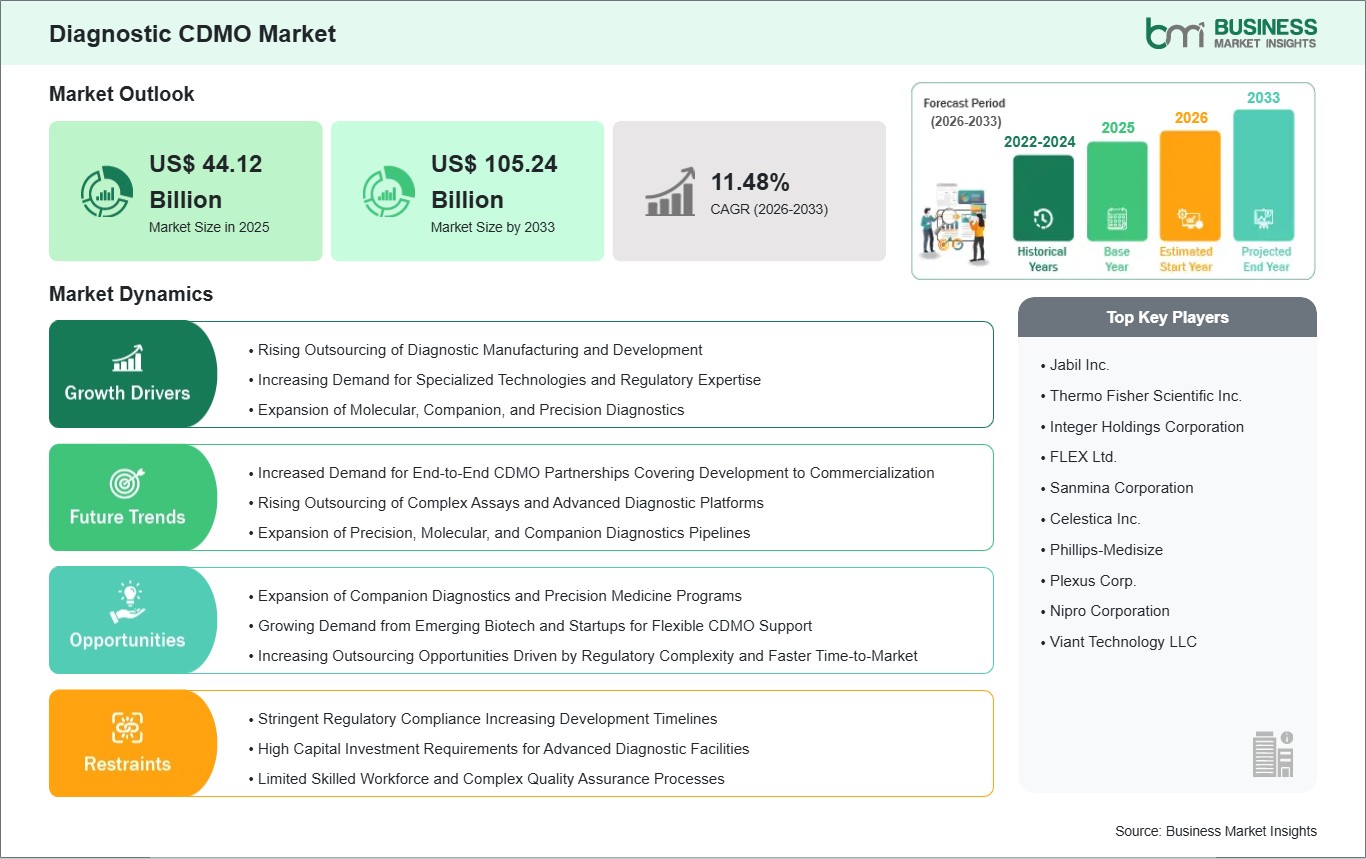

The Diagnostic CDMO market size is expected to reach US$105.24 billion by 2033 from US$44.12 billion in 2025. The market is estimated to record a CAGR of 11.48% from 2026 to 2033.

The Diagnostic Contract Development and Manufacturing Organization (CDMO) market is experiencing a profound transformation as diagnostic companies increasingly pivot toward outsourcing to manage rising R&D costs and complex regulatory environments. Diagnostic CDMOs provide end-to-end services, from initial product design and component manufacturing to final assembly and regulatory filing. This shift is primarily driven by the "decentralization of diagnostics," where there is an urgent demand for rapid, point-of-care (POC) testing and home-based diagnostic kits. By partnering with CDMOs, OEMs can leverage advanced manufacturing technologies like automation, microfluidics, and 3D printing without the heavy capital expenditure of building in-house facilities.

While the market is bolstered by the rising global burden of chronic and infectious diseases, it faces challenges such as stringent and evolving regulatory frameworks (like the EU's IVDR) and the high technical barrier for Class III (high-risk) device manufacturing. However, massive opportunities are emerging in the integration of AI-driven digital diagnostics, the growth of personalized medicine requiring companion diagnostics, and the expansion of manufacturing hubs in the Asia-Pacific region, which offers both cost advantages and skilled technical talent.

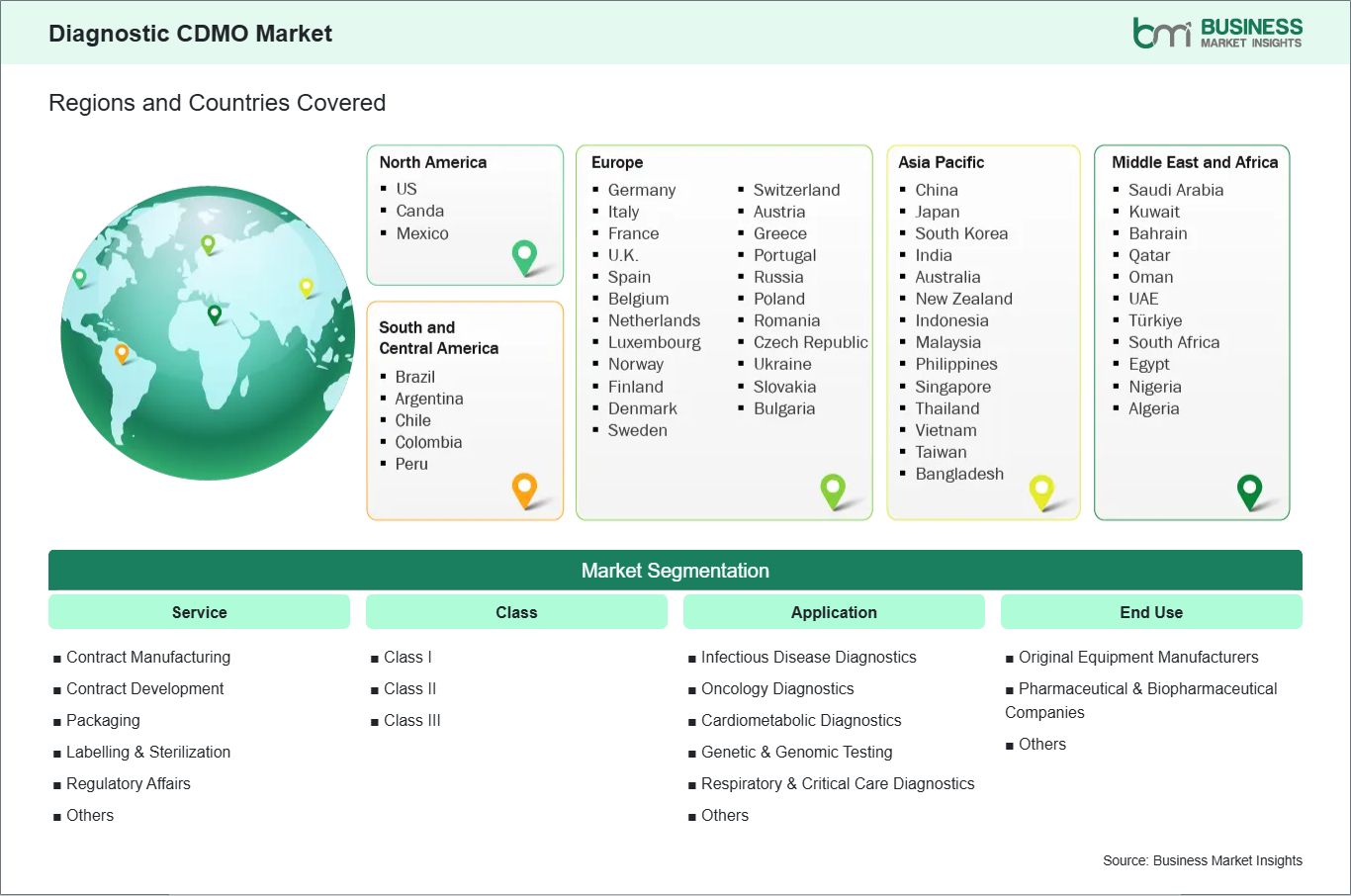

Key segments that contributed to the derivation of the Diagnostic CDMO market analysis are service, class, application, and end use.

The ongoing shift from traditional centralized laboratory testing to rapid, patient-side diagnostics is emerging as a powerful catalyst across the healthcare and diagnostics market. Both consumers and healthcare providers now expect near-instant results for a wide range of health parameters, from routine glucose monitoring and cholesterol checks to the rapid detection of infectious diseases. This demand for speed, convenience, and real-time decision-making is pushing OEMs to redesign complex laboratory assays into compact, user-friendly, point-of-care solutions. As a result, CDMOs with specialized capabilities in miniaturization, microfluidics, assay integration, and portable device engineering are increasingly sought after. These partners play a critical role in enabling OEMs to deliver accurate, reliable diagnostic tools that function seamlessly outside centralized lab environments.

The rapid expansion of genetic and genomic testing has created a significant opportunity for CDMOs that possess deep expertise in molecular biology and advanced analytical technologies. As pharmaceutical companies increasingly develop companion diagnostics to pair with highly targeted therapies, particularly in oncology, they depend on specialized CDMO partners to support the intricate R&D, validation, and precision manufacturing these diagnostics require. These tools must meet rigorous regulatory standards and deliver exceptionally accurate results, making the role of CDMOs crucial. By offering capabilities such as assay design, biomarker validation, and scalable production, CDMOs enable pharma companies to accelerate personalized medicine development.

The Diagnostic CDMO market demonstrates steady growth, with size and share analysis revealing evolving trends and competitive positioning among key players. The report further examines subsegments categorized within service, class, application, and end use, offering insights into their contribution to overall market performance.

Diagnostic CDMO is a highly specialized market where growth is driven due to massive demand for Class II infectious disease kits and the high-value innovation in genetic and oncology diagnostics. Contract Manufacturing currently serves as the market's financial anchor, accounting for nearly half of all revenue, as global OEMs move away from in-house production to optimize their supply chains and reduce capital expenditure. However, a significant shift is occurring toward Contract Development and Class III devices, fueled by the "precision medicine" boom, which requires sophisticated, high-risk diagnostic tools and end-to-end design services. While Hospitals and Labs remain the traditional end users, the convergence of drug and device development is making Pharmaceutical Companies a high-growth vertical for CDMOs, particularly in the creation of companion diagnostics. Ultimately, the market is transitioning from a simple "build-to-print" model to a strategic partnership ecosystem where CDMOs act as critical innovation hubs for the next generation of rapid, molecular, and point-of-care testing.

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 44.12 Billion |

| Market Size by 2033 | US$ 105.24 Billion |

| Global CAGR (2026 - 2033) | 11.48% |

| Historical Data | 2022-2024 |

| Forecast period | 2026-2033 |

| Segments Covered | By Service

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The "Diagnostic CDMO Market Size and Forecast (2022–2033)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the Diagnostic CDMO market report is divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America.

North America is a high-growth market supported by a robust ecosystem of biotech startups and a stringent, yet clear, FDA regulatory pathway. Europe is currently navigating the implementation of the In Vitro Diagnostic Regulation (IVDR), which has increased the demand for CDMOs with high-tier regulatory affairs expertise. Asia Pacific is a rapidly growing region, as global OEMs "resell" or "de-risk" their supply chains by moving manufacturing to hubs in China, India, and Southeast Asia. In the Middle East and Africa, the market is growing through the development of local diagnostic manufacturing to reduce reliance on imports. South and Central America are witnessing growth as clinical laboratory networks modernize and expand.

The Diagnostic CDMO market is evaluated by gathering qualitative and quantitative data post-primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Diagnostic CDMO market are:

The Diagnostic CDMO Market is valued at US$ 44.12 Billion in 2025, it is projected to reach US$ 105.24 Billion by 2033.

As per our report Diagnostic CDMO Market, the market size is valued at US$ 44.12 Billion in 2025, projecting it to reach US$ 105.24 Billion by 2033. This translates to a CAGR of approximately 11.48% during the forecast period.

The Diagnostic CDMO Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Diagnostic CDMO Market report:

The Diagnostic CDMO Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Diagnostic CDMO Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Diagnostic CDMO Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)