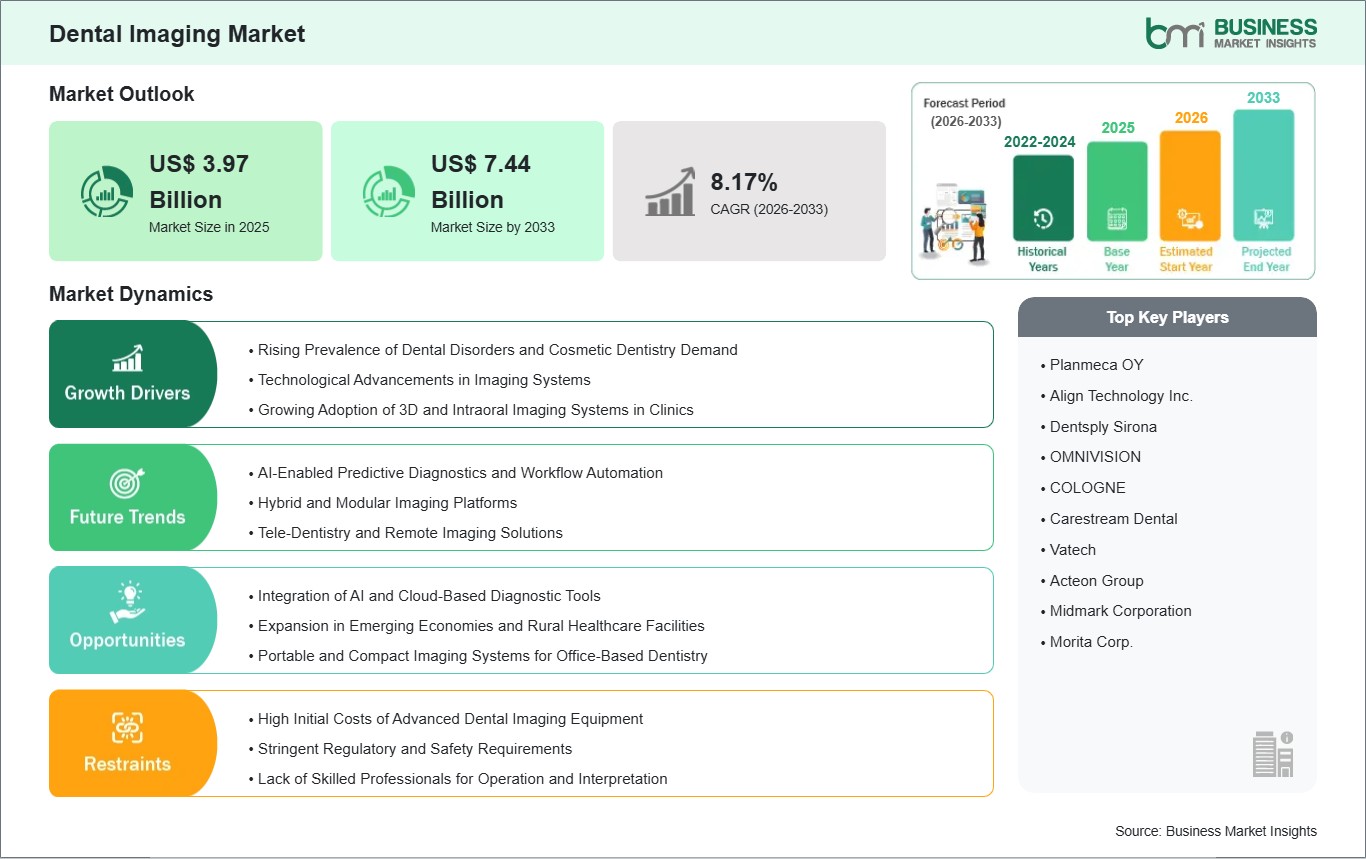

The Dental Imaging Market size is expected to reach US$ 7.44 billion by 2033 from US$ 3.97 billion in 2025. The market is estimated to record a CAGR of 8.17% from 2026 to 2033.

Dental imaging is an advanced diagnostic technique that provides a detailed visual representation of the dental structures and surrounding areas and thus supports the processes of diagnosis, treatment planning, and monitoring of the dental conditions accurately.

The global dental imaging market is expanding steadily globally, and this development can be attributed to the increasing incidence of dental diseases, heightened oral health awareness, and the rising need for timely and accurate diagnosis. Among the various factors contributing to this growth are the technological advancements represented by digital radiography, CBCT, intraoral scanning, and the use of artificial intelligence (AI) in imaging which are making afar the clinical workflow—improving the image quality, cutting down the radiation dose, and making the diagnosis more accurate at the same time. The market executive's picture shows a significant change in the market from traditional film-based systems to digital and cloud-connected ones, which is the case because the dental clinics are prioritizing effectiveness and the comfort of patients. For developed areas, the good dental-care infrastructure, high-tech adoption, and nice reimbursement conditions are the major advantages while the less developed places are experiencing rapid growth in the dental sector because of the better healthcare accessibility, more disposable income, and more investments in dental treatment facilities. Moreover, the combination of dental imaging and CAD/CAM system and digital dentistry platforms is totally changing the treatment planning and restoration procedures. Overall, the market is characterized by continuous innovation, strategic collaborations among manufacturers, and a growing emphasis on minimally invasive, data-driven dental care, positioning dental imaging as a critical component of modern dentistry worldwide.

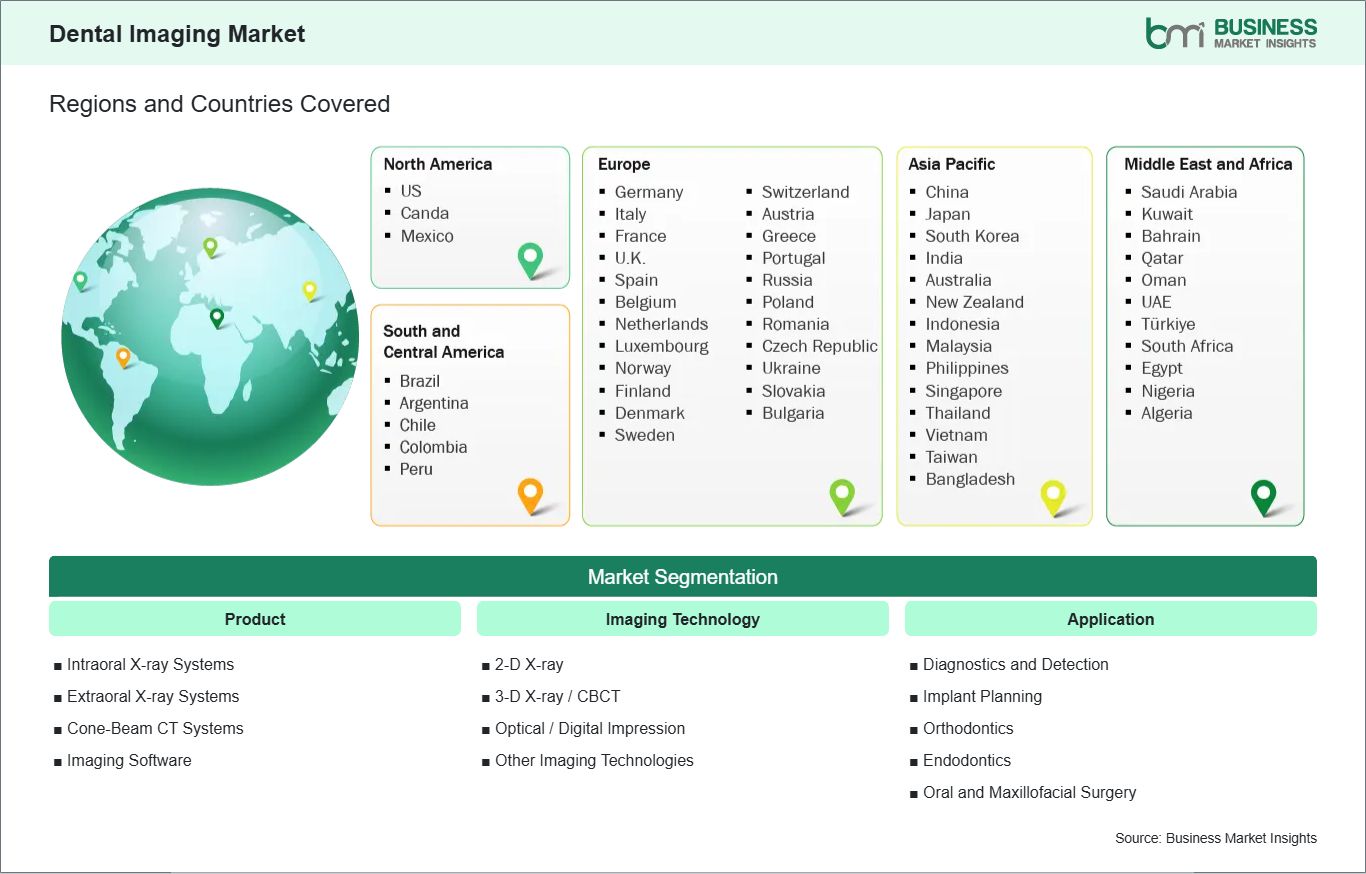

Key segments that contributed to the derivation of the dental imaging market analysis are product, imaging technology, application.

The dental imaging market is mainly driven by the rapid adoption of digital imaging systems and AI-based diagnostic tools in dental practices all over the world. The need for faster image acquisition, enhanced clarity, and lower radiation exposure as compared to the conventional methods has led more than 65% of dental clinics to switch from analog film systems to digital imaging platforms. The digital shift is being made better by AI — almost 48% of the contemporary dental imaging installations incorporate AI-assisted analysis for diagnostic accuracy and workflow efficiency thus reduction of errors in interpretation and faster decision-making support. For instance, advanced software can identify caries, bone loss, and anatomical anomalies with considerable accuracy which in turn benefits clinicians in providing better treatment planning and patient outcomes. These trends are indicative of the strong industry commitment to improve clinical efficiency, which is primarily driven by the demand from practitioners and the patients' expectations for quality, data-based dental care.

One of the main reasons the dental imaging market has such a high potential is the wider use of AI, machine learning, and cloud techniques. AI already plays a big part in the imaging area which is used for medical purposes. The computer is now diagnosing, predicting, and planning treatments, and almost fifty percent of new imaging devices are AI-based. This is not only a computer doctor but also a dentist teacher as it makes tele-dentistry and remote patient care easier through cloud technology that allows patient images to be stored and accessed easily. Thus, it is not just the needs of multi-site clinics and telehealth services that are catered to, but also the whole dental industry trend that is geared towards practitioners who are tech-savvy and/or provide mobile or decentralized care or even remote clinics and telehealth services. New product innovation—like AI-powered scanners, software that identifies anatomical landmarks faster, and imaging suites that are web-connected—are making it possible to have more and more workflows that are accurate and quick. Such new developments lead to a breakthrough in the establishment of software-as-a-service model and recurring revenue streams for the vendor while making it easier to introduce into the less developed markets where mobile and decentralized care is becoming more popular. Thus, technology-driven solutions will continue to bring dental imaging capabilities closer to the world's population.

By product, the dental imaging market is categorized into intraoral X-ray systems, extraoral X-ray systems, cone-beam CT systems, imaging software. The intraoral X-ray systems segment held the largest share of the market in 2025. Intraoral X-ray systems lead the dental imaging product segment due to their routine use in everyday dental practice for diagnostics and treatment planning. These systems are cost-effective, compact, and easy to integrate into small and mid-sized clinics, making them widely accessible. Their ability to deliver high-resolution images with low radiation exposure supports frequent use for caries detection, periodontal assessment, and endodontic evaluation, driving consistent demand across both developed and emerging markets.

By imaging technology, the market is segmented into 2-D x-ray, 3-D x-ray / CBCT, optical / digital impression, other imaging technologies. The 2-D x-ray segment held the largest share of the market in 2025. 2-D X-ray technology remains the leading imaging technology segment because it is the standard first-line diagnostic tool in dentistry. Its dominance is supported by lower equipment costs, faster image acquisition, minimal training requirements, and broad clinical applicability. Despite growth in 3-D imaging, 2-D X-rays continue to be preferred for routine examinations, follow-ups, and preventive care, particularly in general dentistry and high-volume practices where efficiency and affordability are critical.

By application, the dental imaging market is segmented into diagnostics and detection, implant planning, orthodontics, endodontics, oral and maxillofacial surgery. The diagnostics and detection segment dominated the market in 2025. Diagnostics and detection represent the leading application segment as imaging is fundamental to identifying dental conditions at early stages. Dental imaging is routinely used to detect cavities, infections, bone loss, impacted teeth, and structural abnormalities. The growing emphasis on preventive dentistry, early intervention, and regular oral health screenings significantly supports this segment. Additionally, nearly all dental specialties rely on diagnostic imaging, ensuring sustained and widespread utilization across clinical settings.

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 3.97 Billion |

| Market Size by 2033 | US$ 7.44 Billion |

| Global CAGR (2026 - 2033) | 8.17% |

| Historical Data | 2022-2024 |

| Forecast period | 2026-2033 |

| Segments Covered | By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The " Dental Imaging Market Size and Forecast (2022-2033)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the dental imaging market report is divided into five regions: North America, Asia Pacific, Europe, Middle East and Africa, and South and Central America. The dental imaging market in Asia Pacific is expected to grow significantly during the forecast period.

The Asia-Pacific dental imaging market is segmented into China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, Taiwan, Bangladesh, and the Rest of Asia. The Asia-Pacific dental imaging market is experiencing robust growth, due to a number of factors that are closely related to each other. One of the main causes is that large populations moving into cities and the growing middle-class have made people more conscious of and more demanding of quality dental care, which in turn has led both the private and public sectors to invest in up-to-date dental infrastructure. China, India, and Japan are among the countries that, by way of advanced imaging technologies like digital X-rays, cone-beam CT systems, and intraoral scanners, are fully scaling up the number of dental clinics and hospitals. The increasing occurrence of tooth decay, gum disease, and mouth cancers are some of the factors that are pushing the use of diagnostic imaging to a greater extent as it enables early detection and treatment planning. Additionally, the combination of government programs to provide oral healthcare access and the expansion of insurance coverage in city and semi-city areas has made the use of advanced imaging technology to be more common among the general public. Moreover, the technological advancements including the use of AI in diagnosis and the establishment of cloud-based imaging platforms are resulting in clinics transitioning from the use of traditional film to digital systems. The dental tourism boom in Thailand and Malaysia is another reason why the demand for high-quality dental imaging has increased, thus the Asia-Pacific area has become one of the fastest dental imaging markets worldwide.

The dental imaging market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the dental imaging market are:

The Dental Imaging Market is valued at US$ 3.97 Billion in 2025, it is projected to reach US$ 7.44 Billion by 2033.

As per our report Dental Imaging Market, the market size is valued at US$ 3.97 Billion in 2025, projecting it to reach US$ 7.44 Billion by 2033. This translates to a CAGR of approximately 8.17% during the forecast period.

The Dental Imaging Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Dental Imaging Market report:

The Dental Imaging Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Dental Imaging Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Dental Imaging Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)