Cardiovascular Catheters Market Outlook (2022-2033)

No. of Pages: 450 | Report Code: BMIPUB00031920 | Category: Life Sciences

No. of Pages: 450 | Report Code: BMIPUB00031920 | Category: Life Sciences

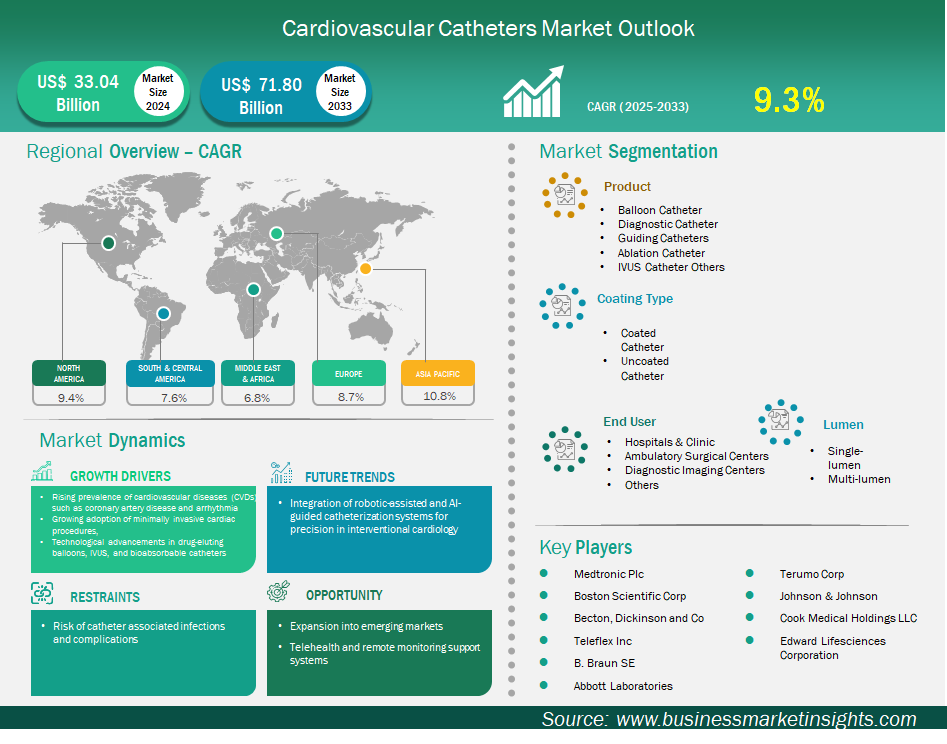

The cardiovascular catheters market size is expected to reach US$ 71,797.6 million by 2033 from US$ 33,038.7 million in 2024. The market is estimated to record a CAGR of 9.3% from 2025 to 2033.

The global market for cardiovascular catheters is experiencing substantial growth, propelled by the rising prevalence of CVDs such as coronary artery disease and arrhythmias. This growth is also driven by the surging adoption of minimally invasive cardiac procedures and technological advancements in drug-eluting balloons, intravascular ultrasound (IVUS), and bioabsorbable catheters. Despite these positive trends, there are concerns related to the risks concerning catheter-related infections and complications, which may hinder the market's evolution.

Geographically, North America currently holds the largest share of the global market, largely due to a high incidence of chronic diseases in the region. Meanwhile, the Asia Pacific is emerging as the fastest-growing market, driven by a combination of increasing chronic disease burden and rapid technological adoption.

Leading companies in this market, such as Medtronic Plc, Abbott Laboratories, and Boston Scientific Corp., are focusing on product innovation, partnerships, and expanding into growth markets. As the demand for cardiovascular catheters continues to rise, manufacturers are developing more advanced products. This is expected to lead to a noticeable increase in the availability of cardiovascular catheters, ultimately reducing costs, enhancing effectiveness, and improving patient outcomes worldwide.

Key segments that contributed to the derivation of the Cardiovascular Catheters market analysis are product, coating type, lumen, and end user.

Rising Prevalence of Cardiovascular Diseases Driving Cardiovascular Catheters Market

The surging worldwide incidence of cardiovascular diseases (CVDs) significantly drives the market for cardiovascular catheters. Also, CVDs, including coronary artery disease, heart failure, and arrhythmias, are major contributors to worldwide morbidity and mortality. They require advanced and often costly diagnostic and therapeutic techniques.

Cardiovascular catheters are thin, flexible tubes inserted into blood vessels to access the heart, making them crucial tools for many medical procedures. They play a vital role in diagnostic angiography, which detects blockages in the arteries, and in percutaneous coronary interventions (PCI), where they are used to perform balloon angioplasty and deploy stents to open narrowed arteries. Additionally, these catheters are essential in electrophysiology studies to assess and treat heart rhythm issues.

The demand for these catheters is further influenced by factors such as increasing age, obesity, diabetes, and a lack of physical activity. Cardiovascular catheters offer advantages such as shorter hospital stays, faster recovery times, and fewer complications as compared to traditional open-heart surgeries. The robust correlation between the growing heart disease incidences and the surging adoption of cardiovascular catheters highlights the increasing demand for CVD procedures, indicating significant growth potential for this market in the coming years.

Expansion into Emerging Markets

The expansion into emerging markets offers a huge opportunity for the players in the cardiovascular catheters market, driven by a combination of factors. Regions such as Asia-Pacific and Latin America are witnessing a rapid increase in cardiovascular diseases owing to urbanization, lifestyle changes, and an aging population. This surge in health issues has led to a growing number of patients requiring treatment.

Advancements in healthcare infrastructure have made it easier for patients to access care, while economic growth has increased disposable incomes, allowing more individuals to afford advanced medical treatments. The surging demand for surgical interventions, along with increased investments from both government and private sectors in healthcare facilities and services, creates a substantial opportunity for medical device companies to establish strategic partnerships with local distributors.

Effective strategies should involve collaboration with local manufacturers and the development of products that are more affordable and accessible to patients. By forming partnerships and investing in these regions, medical device companies can facilitate market growth, thereby diversify their revenue streams and ensure future growth in the medical device markets of North America and Europe.

Cardiovascular Catheters Market Size and Share Analysis

The cardiovascular catheters market is categorized by product type, including balloon catheters, diagnostic catheters, guiding catheters, ablation catheters, IVUS catheters, and others. Balloon catheters represent the largest segment of this market, primarily because they are a crucial component in the angioplasty procedure, one of the most common minimally invasive treatments for coronary artery disease. These catheters are essential for dilating narrowed arteries and removing plaque buildup that affects millions of people worldwide.

As more patients prefer non-surgical approaches over open-heart surgery, the demand for balloon catheters continues to rise due to their advantages, such as fewer complications and improved recovery times. Additionally, ongoing innovations have enhanced balloon catheters' applications, including drug-eluting properties to prevent restenosis and cutting or scoring features for addressing challenging lesions. Their diverse applications and significant role in a widely performed, high-volume procedure reinforce their status as the largest product category in the cardiovascular catheters market.

The cardiovascular catheters market is segmented by coating type into two categories: coated catheters and uncoated catheters. Coated catheters, especially those with hydrophilic and antimicrobial coatings, represent the largest segment owing to their enhanced performance in terms of patient safety and comfort. Hydrophilic coatings, when activated by water, provide high lubrication, which reduces friction during catheter insertion through the urethra. This helps to minimize urethral trauma, pain, and injury. Additionally, antimicrobial coatings play a crucial role in preventing Catheter-Associated Urinary Tract Infections (CAUTI), which are common and costly hospital-acquired infections.

There is an increasing emphasis on reducing healthcare-acquired infections and improving patient outcomes, making value-added coatings highly sought after. These hydrophilic and antimicrobial coatings are part of a broader trend towards safer and more biocompatible medical products, even though they often come with higher costs. As a result, coated catheters, which incorporate considerations of product safety and performance in the selection process, are becoming increasingly preferred. This growing preference makes coated catheters the largest and fastest-growing segment within coating types.

The cardiovascular catheters market is categorized by lumen type into single-lumen and multi-lumen catheters. Multi-lumen catheters are the largest segment because they offer unmatched versatility and efficiency. Unlike single-lumen catheters, which can only serve one purpose at a time, multi-lumen catheters have several independent pathways within a single catheter. This design enables clinicians to perform various tasks simultaneously from a single access point, such as administering multiple medications (including potentially incompatible ones), infusing fluids, drawing blood, and monitoring central venous pressure.

The cardiovascular catheters market is segmented by end users into hospitals and clinics, home care settings, and others. In 2024, the hospitals and clinics segment held the largest market share. This is because hospitals and clinics serve as the primary centers for high-quality cardiovascular care. Cardiac catheterization procedures, which are essential for assessing and treating cardiovascular disease, require advanced infrastructure. This includes catheterization labs equipped with state-of-the-art imaging technology and qualified medical professionals, such as interventional cardiologists and cardiac surgeons.

Cardiovascular Catheters Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 33,038.7 Million

Market Size by 2033

US$ 71,797.6 Million

Global CAGR (2025 - 2033) 9.3%

Historical Data

2022-2023

Forecast period

2025-2033

Segments Covered

By Product

By Coating Type

By Lumen

By End User

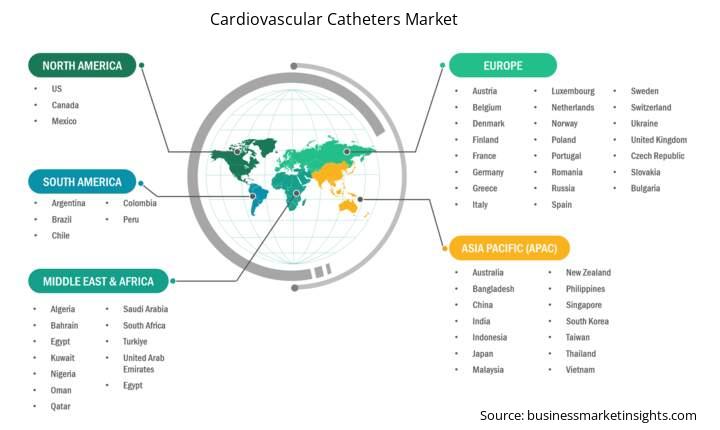

Regions and Countries Covered

North America

Europe

Asia-Pacific

South and Central America

Middle East and Africa

Market leaders and key company profiles

Cardiovascular Catheters Market Report Coverage and Deliverables

The "Cardiovascular Catheters Market Size and Forecast (2022–2033)" report provides a detailed analysis of the market covering below areas:

Cardiovascular Catheters Market Country and Regional Insights

The geographical scope of the cardiovascular catheters market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The Cardiovascular Catheters market in Asia Pacific is expected to grow significantly during the forecast period. The market for cardiovascular catheters in the Asia-Pacific region includes countries such as China, Japan, India, South Korea, Australia, Bangladesh, New Zealand, the Philippines, Singapore, Indonesia, Taiwan, Malaysia, Vietnam, and other areas of the Asia-Pacific. This region is experiencing the fastest growth in the cardiovascular catheter market due to a combination of favorable demographic and economic factors.

One significant factor is the rapidly growing aging population, which correlates with an increase in the incidence of cardiovascular diseases (CVD). Additionally, changes in lifestyle, including sedentary behavior, poor diets, and increased smoking due to urbanization and economic development, have contributed to more cases of CVD. As healthcare infrastructure improves and disposable incomes rise, there is a growing demand for advanced, minimally invasive treatments, such as those involving cardiovascular catheters. Healthcare practitioners are increasingly prioritizing these minimally invasive options over traditional treatment methods, like open-heart surgery. The evolving cardiology market is further supported by government initiatives that promote investment in healthcare system development and aim to attract international patients through medical tourism.

In this rapidly evolving region, the key markets of focus are China, India, and Japan, each with unique drivers supporting growth. The primary driver for the Chinese market is a large patient base, with an estimated 330 million individuals suffering from cardiovascular diseases. Strong government support, through initiatives like "Healthy China 2030," has further bolstered this sector. The nationwide rollout of chest-pain centers and various policy initiatives aimed at encouraging domestic medical device innovation are also facilitating the adoption of interventional technologies.

The catheter market in India is anticipated to experience significant growth due to several factors, including a large population, an increasing prevalence of chronic diseases, and a growing number of patients drawn to the country by medical tourism. Additionally, the availability of high-quality healthcare at lower costs is expected to further boost this market. Additionally, the evolving healthcare infrastructure and growing technology adoption in the country are anticipated to contribute to market growth.

Japan's market remains stable, driven by a high demand associated with the country's significant geriatric population, which is the largest in the world. Favorable reimbursement policies, including the government's decision to fully reimburse the cost of certain catheters, along with an increasing demand for high-quality healthcare services, are expected to promote steady growth in this market.

Cardiovascular Catheters Market Research Report Guidance

The cardiovascular catheters market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Cardiovascular Catheters market are:

The Cardiovascular Catheters Market is valued at US$ 33,038.7 Million in 2024, it is projected to reach US$ 71,797.6 Million by 2033.

As per our report Cardiovascular Catheters Market, the market size is valued at US$ 33,038.7 Million in 2024, projecting it to reach US$ 71,797.6 Million by 2033. This translates to a CAGR of approximately 9.3% during the forecast period.

The Cardiovascular Catheters Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Cardiovascular Catheters Market report:

The Cardiovascular Catheters Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Cardiovascular Catheters Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Cardiovascular Catheters Market value chain can benefit from the information contained in a comprehensive market report.