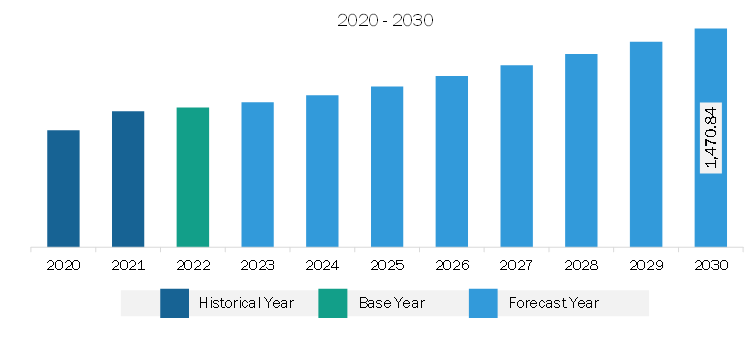

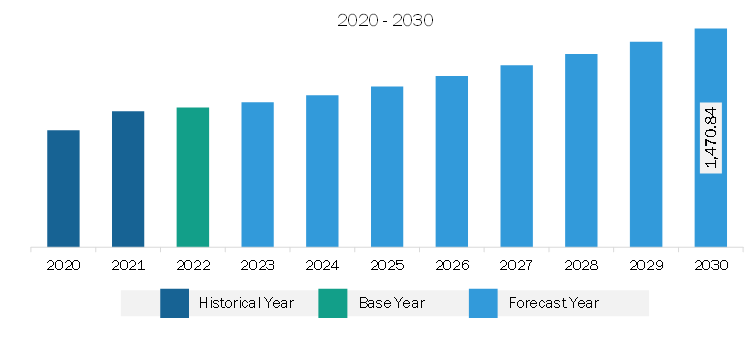

The Asia Pacific talc market is expected to grow from US$ 940.38 million in 2022 to US$ 1,470.84 million by 2030. It is estimated to grow at a CAGR of 5.8% from 2022 to 2030.

Increasing Demand from Various End-Use Industries Fuels Asia Pacific Talc Market

Talc is used in various end-use industries such as paints & coatings, plastics, agriculture, and food. In the paint industry, talc use reduces the use of primary pigment in paint production, which reduces manufacturing costs. Talc reinforces the paint film and improves the durability and stain resistance of paint. Owing to its rust-inhibitive and corrosion-resistance properties, the finish lasts longer. Also, talc as an extender increases the viscosity of a paint. The strong growth of the construction, automotive, and industrial sectors propels demand for paints and coatings. In the plastics industry, the use of talc improves the characteristics of plastics such as quality, aspect ratio, particle size distribution, and whiteness. The high demand for plastics in automotive, construction, consumer goods, electrical & electronics, and other industries boosts the need for talc. In the agriculture industry, talc is an effective anticaking agent and dispersing agent for pesticides and fertilizers. Also, in agricultural chemicals, talc has been considered as an ideal inert carrier. Increasing demand for fertilizers due to the growing agricultural production in different regions bolsters the need for talc. Further, food-grade talc is hydrophobic. Therefore, it functions as an anticaking agent by coating other substances and making them water-repellent. It also prevents lump formation. This property makes talc an ideal ingredient to be used in starch, chocolates, chewing gums, baked goods, dried fruits, cheese, seasoning, and table salt. The growing demand for all these products boosts the use of talc in the food industry. Therefore, the rising demand for talc from end-use industries is driving the growth of the talc market.

Asia Pacific Talc Market Overview

Australia, China, India, Japan, and South Korea are the key contributors to the talc market in Asia Pacific. Asia Pacific is one of the largest crudes and processed talc-producing regions globally. The region is home to major manufacturers producing lightweight plastics for automotive components. Rapid industrialization and a surge in disposable income of the middle-class population of emerging economies are expected to drive the demand for talc in Asia Pacific. According to the International Organization of Motor Vehicle Manufacturers (OICA), the Asia-Oceania region's vehicle production increased from 44.2 million in 2020 to 46.7 million vehicles in 2021. The development of automotive parts and components in the region with the rise of electric vehicle production will create lucrative opportunities for the talc market. Extensive innovation and prototyping from major automakers are driving the market growth. Rise in regional construction activities and growth of industrial and automotive sectors further accelerate the market growth. Low-cost production in the region provides an excellent opportunity for the global players in Asia Pacific, especially China and India. Under the Sustainable Development Goals 2030, the Asian Development Bank has planned to build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation in Asia Pacific. Moreover, the rise in the number of on-fleet vehicles in countries such as China, India, and South Korea is fueling the demand for building materials such as ceramics and paints & coatings. All these factors are propelling the growth of the talc market in Asia Pacific.

Asia Pacific Talc Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Talc Market Segmentation

The Asia Pacific talc market is segmented into type, application, and country.

Based on type, the Asia Pacific talc market is bifurcated into talc chlorite and talc carbonate. The talc carbonate segment held a larger share of the Asia Pacific talc market in 2022.

In terms of application, the Asia Pacific talc market is segmented into plastics, pulp and paper, ceramics, paints and coatings, rubber, pharmaceuticals, food, and others. The pulp and paper segment held the largest share of the Asia Pacific talc market in 2022.

By country, the Asia Pacific talc market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific talc market in 2022.

Elementis Plc, Golcha Minerals Pvt Ltd, Imerys SA, IMI Fabi SpA, Liaoning Aihai Talc Co Ltd, Minerals Technologies Inc, Nippon Talc Co Ltd, SCR-Sibelco NV, and Sun Minerals Pvt Ltd are some of the leading companies operating in the Asia Pacific talc market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 940.38 Million |

| Market Size by 2030 | US$ 1,470.84 Million |

| CAGR (2022 - 2030) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Deposit Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

1. Elementis Plc

2. Golcha Minerals Pvt Ltd

3. Imerys SA

4. IMI Fabi SpA

5. Liaoning Aihai Talc Co Ltd

6. Minerals Technologies Inc

7. Nippon Talc Co Ltd

8. SCR-Sibelco NV

9. Sun Minerals Pvt Ltd

The Asia Pacific Talc Market is valued at US$ 940.38 Million in 2022, it is projected to reach US$ 1,470.84 Million by 2030.

As per our report Asia Pacific Talc Market, the market size is valued at US$ 940.38 Million in 2022, projecting it to reach US$ 1,470.84 Million by 2030. This translates to a CAGR of approximately 5.8% during the forecast period.

The Asia Pacific Talc Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Talc Market report:

The Asia Pacific Talc Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Talc Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Talc Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)