The SiP technology system market in APAC is further segmented into India, Japan, Australia, China, South Korea, and Rest of APAC. India and China are leading semiconductor manufacturing countries in APAC. Rising disposable income in developing countries, especially India and China—leading to large client base for high-tech consumer electronics such as smart wearables, smartphones, and electric vehicles—is driving the SiP technology market growth. China is a leading manufacturing hub for the SiP technology-based products, while India and Japan are also significant contributors to the regional growth. Many of the APAC countries are characterized by the mass production of electronic devices required for consumer electronics, automotive components, telecommunication devices, and other industrial machineries. Rising electronics manufacturing companies in India and China owing to strong availability of skilled human resources is driving the system in package technology market growth. Also, growing need of smartphone and PC to enhance the overall performance is a major factor driving the APAC SiP technology market.

COVID-19 outbreak was first reported in China. China, India, South Korea, Japan, and other countries are increasingly moving toward the new networking solution such as 5G, 4G, and VoLTE. China and India are the biggest manufacturing hubs in the region and have increasing focus toward the industrialization. Lockdown, imposed due to COVID-19 outbreak, is hindering the market growth as businesses are remaining close. Manufacturing industry is also hampered, but soon its growth is expected to get recovered by enhancing the production capabilities in second half of the year 2021. The demand for many advanced electronics products such as smartwatch, smart wearable, and healthcare machines is rising at the significant rate. Companies in Asia are also restructuring their capabilities by adopting various strategies such as automation, partnership, and acquisition. For instance, Universal Scientific Industrial (Shanghai) Co., Ltd. acquired the Asteelflash Group to utilize their production facilities for increasing production of SiP modules and other electronics devices.

Strategic insights for the Asia Pacific SiP Technology provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 6,843.3 Million |

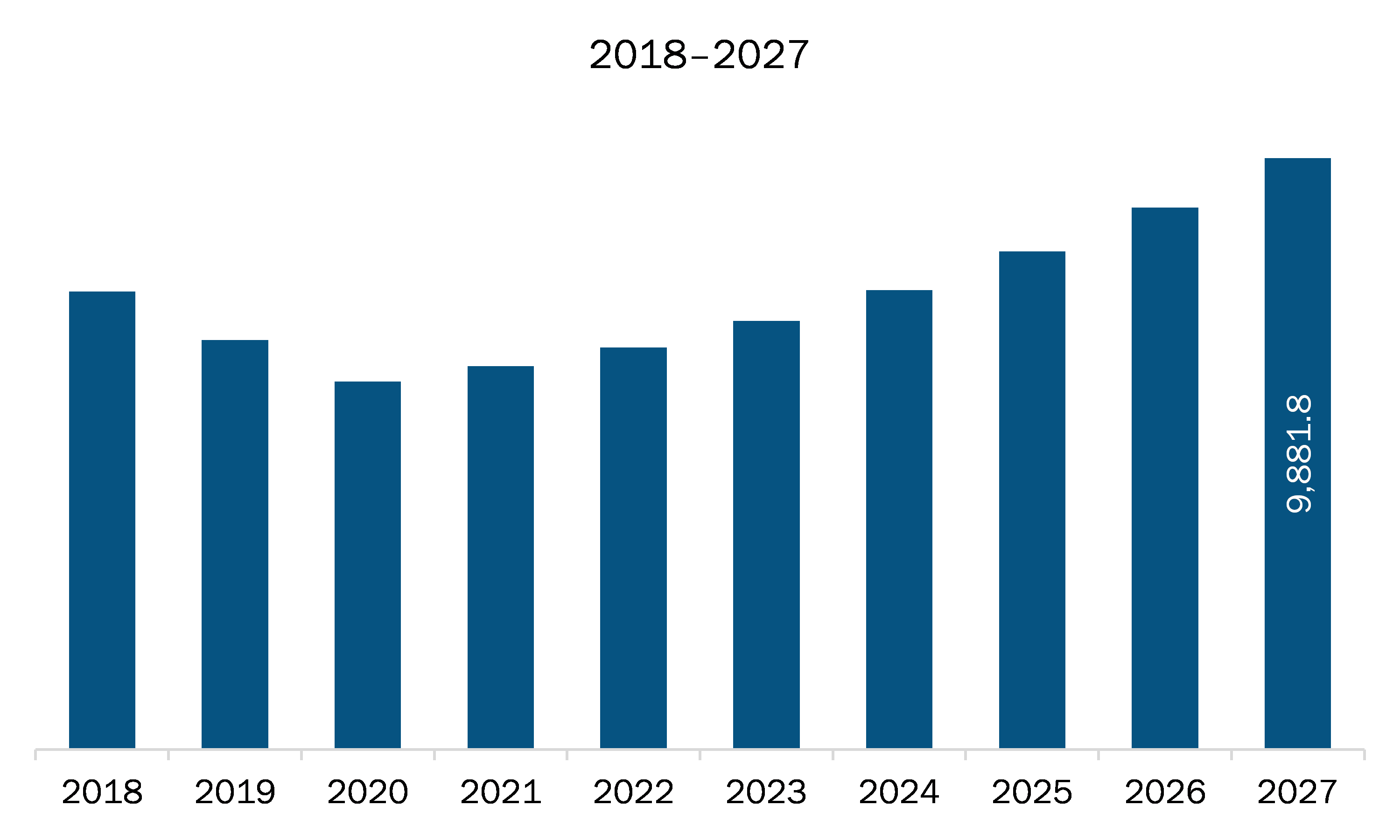

| Market Size by 2027 | US$ 9,881.8 Million |

| CAGR (2020 - 2027) | 7.0% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Packaging Technology

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

|

The geographic scope of the Asia Pacific SiP Technology refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC SiP technology market is expected to grow from US$ 6,843.3 million in 2019 to US$ 9,881.8 million by 2027; it is estimated to grow at a CAGR of 7.0% from 2020 to 2027. Growing trend of the small form factor based handheld electronic devices is one of the major factors, which accelerates market growth. The technological advancement in electronics forming such as miniaturization has influenced various markets such as military, aerospace, medical, media, retail and consumer electronics. The devices with small form factor-based packages embed more functionality and becoming alternative for traditional packaging systems. Personalized healthcare gadgets, thin sized smartphone, compact PCs and others devices are occupied with system in package technology-based components such as processor, sensors, RF modules and others. Continuous development in advanced packaging technology such as 3D IC, 2.5D IC and others are further supplementing the market by resolving the technical challenges.

In terms of packaging technology, the 2D IC segment accounted for the largest share of the APAC SiP technology market in 2019. Based on packaging type, the flip-chip/wire-bond SiP segment held a larger market share of the APAC SiP technology market in 2019. On basis of interconnection technique, pin grid arrays held a substantial share throughout the forecast period. Based on end-user industry, consumer electronics segment is expected to be hold largest market share during the forecast period.

A few major primary and secondary sources referred to for preparing this report on the SiP technology market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Amkor Technology, Inc.; ASE Technology Holding Co., Ltd.; ChipMOS TECHNOLOGIES INC.; JCET Group Co., Ltd.; Qualcomm Technologies, Inc.; Renesas Electronics Corporation; Samsung; Taiwan Semiconductor Manufacturing Company, Limited; and Texas Instruments Incorporated.

Some of the leading companies are:

The Asia Pacific SiP Technology Market is valued at US$ 6,843.3 Million in 2019, it is projected to reach US$ 9,881.8 Million by 2027.

As per our report Asia Pacific SiP Technology Market, the market size is valued at US$ 6,843.3 Million in 2019, projecting it to reach US$ 9,881.8 Million by 2027. This translates to a CAGR of approximately 7.0% during the forecast period.

The Asia Pacific SiP Technology Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific SiP Technology Market report:

The Asia Pacific SiP Technology Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific SiP Technology Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific SiP Technology Market value chain can benefit from the information contained in a comprehensive market report.