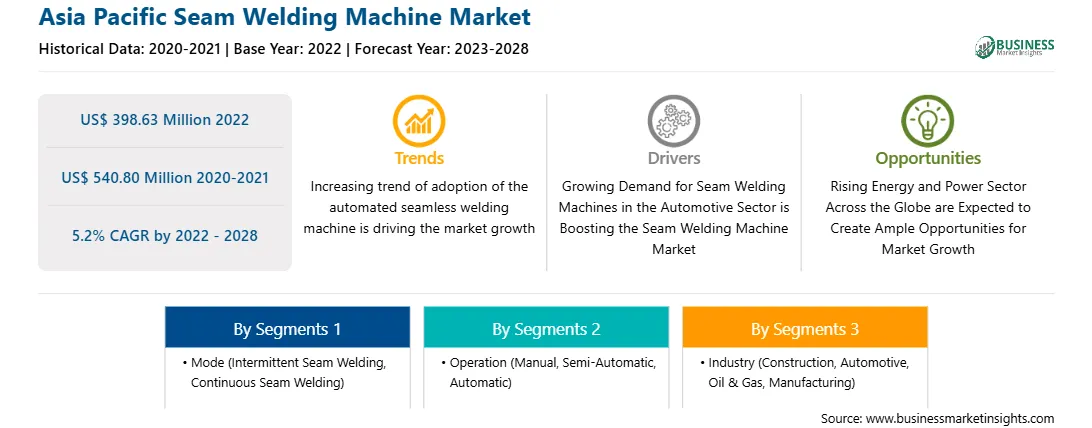

The seam welding machine market in Asia Pacific is expected to grow from US$ 398.63 million in 2022 to US$ 540.80 million by 2028. It is estimated to grow at a CAGR of 5.2% from 2022 to 2028.

Increasing Adoption in Energy, Shipbuilding, and Construction Industries in Asia Pacific

Robust expansion of the global energy (the wind power sector in particular), shipbuilding, and construction industries will provide robust growth for the seam welding machine market in the long term. In Asia Pacific, increasing number of foreign direct investments have boosted the growth of oil & gas industries, aviation, and heavy machinery sector. Several foreign automobile companies have formed their manufacturing base in developing economies such as China and India due to rising automotive industry. These trends have positively impacted the demand for seam welding equipment and consumables. Further, the growing demand for steel and other metal products in shipbuilding and construction sectors is boosting the use of innovative seam welded steel, which is anticipated to fuel the market growth.

The construction industry is growing rapidly in developing countries such as China and India. The growing demand for seam welding machines is due to augmented activities in manufacturing industries and commercial and noncommercial construction activities. For instance, the Indian Government planned to develop one hundred smart cities and five hundred Atal Mission for Rejuvenation and Urban Transformation (AMRUT) cities. According to the Ministry of MSME, the estimated investment in urban infrastructural projects is US$ 650 billion in India. The total planned investment in the infrastructure sector is US$ 1.0 trillion.

Moreover, the rising growth in aerospace, automotive, transportation, and shipbuilding industries is boosting the high growth in the seam welding machine market. The seam welding machine has high growth prospects in the shipbuilding construction business.

Market Overview

The seam welding machine market in APAC is segmented into China, India, Japan, Australia, South Korea, and the Rest of APAC. China, India, and Japan dominate the market in this region due to rapidly growing construction activities. Despite economic challenges, the construction industry in Asia Pacific recorded significant growth with notable investments and business expansions in 2021. Per the Building and Construction Authority (BCA), construction activities are expected to reach pre-pandemic levels, as contracts worth ~US$ 23.13 billion are likely to be awarded in 2022. Moreover, enormous potential for the development of single-family housing and multi-family housing units would trigger the demand for construction activities in the coming years. The proliferating construction industry in developing economies is further bolstering the demand for seam welding machines. For instance, in August 2022, Cambodia attracted construction investment projects with a total investment worth US$ 1.2 billion in the first half of 2022.

The automotive industry is another flourishing industry that benefitted from favorable government initiatives in Asia Pacific countries. According to the International Organization of Motor Vehicle Manufacturers, in 2020, China produced the highest number of vehicles globally, including 310,000 commercial vehicles and 1.77 million passenger cars. According to the India Brand Equity Foundation, India’s annual production of automobiles in 2021 was 22.65 million, and it produced thirteen million vehicles from April 2021 to October 2021. Furthermore, the Government of India expects to attract US$ 8–ten billion in local and foreign investments in the automobile sector by 2023. In this section, seam welding machines are used in every stage of the manufacturing process.

Government and financial institutions are increasingly supporting the development of the industrial sector in Asia Pacific. In July 2022, the Asian Development Bank (ADB) approved US$ 13 million for providing financial assistance to thrive the business activities in five Pacific countries. This support will help government-owned banks in Samoa, Fiji, Solomon Islands, Tonga, and Vanuatu to increase the number and volume of loans to micro, small, and medium-sized enterprises. The subsequently projected rise in industrialization is likely to favor the seam welding machine market growth in Asia Pacific countries in the coming years..

Strategic insights for the Asia Pacific Seam Welding Machine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 398.63 Million |

| Market Size by 2028 | US$ 540.80 Million |

| CAGR (2022 - 2028) | 5.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Mode

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

|

The geographic scope of the Asia Pacific Seam Welding Machine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Seam Welding Machine Market Segmentation

The Asia Pacific seam welding machine market is segmented into mode, operation, industry, and country. Based on mode, the Asia Pacific seam welding machine market is segmented into intermittent seam welding and continuous seam welding segment. The continuous seam welding segment accounted for the larger share of the seam welding machine market in 2022.

Based on operation, the Asia Pacific seam welding machine market is segmented into manual, semi-automatic and automatic segment. The automatic segment accounted for the largest share of the seam welding machine market in 2022.

Based on industry, the Asia Pacific seam welding machine market is categorized into construction, automotive, oil and gas, manufacturing, and others. The manufacturing segment accounted for the largest share of the seam welding machine market in 2022.

Based on country, the market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the market in 2022.

CRUXWELD; Dahching Electric Industrial Co. Ltd.; Emerson Electric Co; and LEISTER TECHNOLOGIES are the leading companies operating in the seam welding machine market in the region.

The Asia Pacific Seam Welding Machine Market is valued at US$ 398.63 Million in 2022, it is projected to reach US$ 540.80 Million by 2028.

As per our report Asia Pacific Seam Welding Machine Market, the market size is valued at US$ 398.63 Million in 2022, projecting it to reach US$ 540.80 Million by 2028. This translates to a CAGR of approximately 5.2% during the forecast period.

The Asia Pacific Seam Welding Machine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Seam Welding Machine Market report:

The Asia Pacific Seam Welding Machine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Seam Welding Machine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Seam Welding Machine Market value chain can benefit from the information contained in a comprehensive market report.