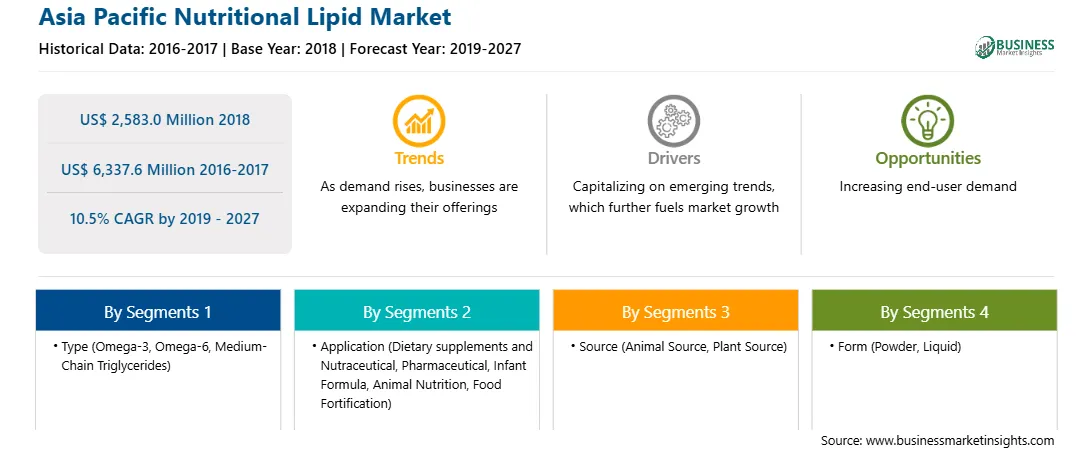

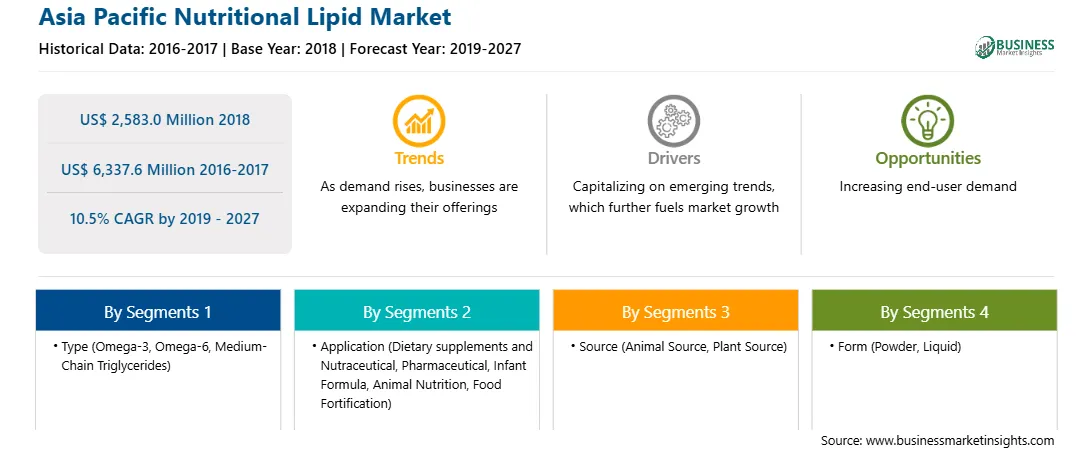

The Asia Pacific nutritional lipid market is accounted to US$ 2,583.0 Mn in 2018 and is expected to grow at a CAGR of 10.5% during the forecast period 2019 – 2027, to account to US$ 6,337.6 Mn by 2027.

A certain amount of fat is vital for healthy body functions. Even though there are various types of fats and some have benefits for the body. Lipids are fats and are the most energy-rich component of food. Lipids do not dissolve in water because they are different from carbohydrates and proteins. Nutrition lipid markets and innovates scientifically that enhance and maintain health and well-being. Nutrition lipid delivers different functionalities and used in processed foods to improve product characteristics and nutrient composition. International Life Sciences Institute, a non-profit organization, based in Asia Pacific, sponsored a workshop to discuss the health effects of fats, identify research needs, and outline considerations for the design of future studies.

Strategic insights for the Asia Pacific Nutritional Lipid provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 2,583.0 Million |

| Market Size by 2027 | US$ 6,337.6 Million |

| CAGR (2019 - 2027) | 10.5% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

|

The geographic scope of the Asia Pacific Nutritional Lipid refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Chronic diseases are swiftly increasing. Nearly half of chronic disease deaths are attributable to cardiovascular diseases. However, obesity and diabetes are also affecting a large proportion of the population. Several factors have progressed in the prevention of chronic diseases such as low fat intake, healthy diet, etc. Omega 3, a type of nutrition lipid, is swiftly becoming an essential tool in mainstream medicine. Omega 3 has health benefits for every age group. They provide protection against chronic disease such as asthma, cancer, arthritis, etc. and other major diseases. Omega-3 tune down the body’s infection and help prevent chronic diseases. Also, a lower ratio of omega-6 to omega-3 is more appropriate to reduce the risk of numerous chronic diseases and have become epidemics in Asia Pacific. Hence, these factors are anticipated to drive the Asia Pacific nutrition lipid market.

The Asia Pacific nutritional lipid market is segmented based of product type as omega-3, omega-6, medium-chain triglycerides, others. The omega-3 segment holds the largest share in the Asia Pacific nutritional lipid market followed by omega-6. Omega-6 fatty acids, like omega-3, are vital fatty acids that can only be obtained through supplements and food. Omega-6 is not produced in the body. They are very significant to the brain and play an essential role in growth and development. It also stimulates hair and skin growth, maintain good bone health, keeps the reproductive system healthy, helps regulate metabolism, etc. Omega-6 fats get mainly from vegetable oils. Omega-6help keep blood sugar in check by enhancing the body's sensitivity to insulin. The omega-6 fatty acid is a type of polyunsaturated fatty acid. Omega-6 fatty acids biological effects are mostly produced during & after the physical activity of promoting growth and it halt cell damage and promote cell repair.

The Asia Pacific nutritional lipid market is segmented on the basis of application as dietary supplements and nutraceutical, pharmaceutical, infant formula, animal nutrition, food fortification, and others. The dietary supplements and nutraceutical holds the largest share in the Asia Pacific nutritional lipid market followed by animal nutrition. In livestock diets, energy is the important nutritional components. Nutrition lipid is a rich source of energy; hence, the inclusion of lipids to diet positively affects health. Nutrition lipids have concentrated mainly on the effects of feeding high-quality lipids on growth performance, metabolism, and digestion in animals. Advances in post-absorption metabolism, lipid digestion, and physiological processes affect the value of lipid supplementation to livestock diets.

Asia Pacific nutritional lipid market is segmented based on source as plant source and animal source. The animal source holds the largest share in the Asia Pacific nutritional lipid market. Health nutrition is facing numerous and major challenges. Due to the rapid increase in the burden of obesity and the increasing age of populations, there is a growing risk of the chronic disease considerably. Foods resulting from animals are a significant source of nutrients in the diet. Though, definite aspects of some of these foods have led to concerns regarding the contribution of these foods to the increased risk of cardiovascular disease and other conditions. The fatty acid composition of numerous animal-derived foods is not constant and can be improved by animal nutrition. The future role of animal source in creating foods for long term human health would be increasingly important.

Strategic insights for the Asia Pacific Nutritional Lipid provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 2,583.0 Million |

| Market Size by 2027 | US$ 6,337.6 Million |

| CAGR (2019 - 2027) | 10.5% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

|

The geographic scope of the Asia Pacific Nutritional Lipid refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The List of Companies - Asia Pacific Nutritional Lipid Market

The Asia Pacific Nutritional Lipid Market is valued at US$ 2,583.0 Million in 2018, it is projected to reach US$ 6,337.6 Million by 2027.

As per our report Asia Pacific Nutritional Lipid Market, the market size is valued at US$ 2,583.0 Million in 2018, projecting it to reach US$ 6,337.6 Million by 2027. This translates to a CAGR of approximately 10.5% during the forecast period.

The Asia Pacific Nutritional Lipid Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Nutritional Lipid Market report:

The Asia Pacific Nutritional Lipid Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Nutritional Lipid Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Nutritional Lipid Market value chain can benefit from the information contained in a comprehensive market report.