Asia Pacific Naval System Surveillance Radar Market Forecast to 2028– COVID-19 Impact and Regional Analysis– by Type (X-band and Ku-band, L-Band and S-band, and Others) and Application (Weapon Guidance System and Surveillance)

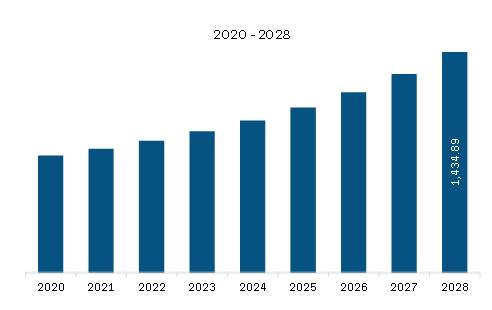

The naval system surveillance radar market in Asia Pacific is expected to grow from US$ 856.56 million in 2022 to US$ 1,434.89 million by 2028. It is estimated to grow at a CAGR of 9.0% from 2022 to 2028.

Integration of Advanced Technology with Naval Radars

The rise of modern naval traffic and advanced naval radar technologies is increasing demand for operators capable of operating with modern-day naval on-ground naval ship-related equipment and naval technology. Naval system surveillance radar deals with large volumes of unprocessed radar signal data to uncover unidentified airborne threats, naval threats, or other objects within the defined perimeters. There has been an increase in the adoption of radar among the navy across various countries, which will trigger high investment in the development and research of radar technology. The fact that demand is expected to increase in the coming years presents a huge growth opportunity for the key market players and the overall naval system surveillance radar market in the coming years. As the naval sectors are expected to grow during the forecast period, this is expected to boost the demand for advanced technology naval radar for navigation, national security, and land borders obstacles of countries. Hence, the demand for advanced technology naval radar across the naval forces will create opportunities for the market.

Market Overview

Australia, China, India, Japan, South Korea, and the rest of Asia Pacific are the key contributors to the naval system surveillance radar market in the Asia Pacific. The region significantly experienced a rise in military expenditure due to the government initiatives to establish a strong military base across these countries. As per the report published by SIPRI in 2021, the total military spending in the Asia Pacific reached US$ 586 billion in 2021, which accounted for a rise of 3% compared to 2020. Moreover, it is expected to be on an upward trend in the coming years. China and India are two major economies that are increasing their military spending, resulting in the rise in manufacturing and procurement of naval ships, boats, radar, surveillance systems, and others. China and India together accounted for 63% of the total military expenditure till now in the Asia Pacific region. This rise in the military expenditure by China and India supports the growth of the APAC naval system surveillance radar market in the region. Additionally, the simmering territorial disputes in the South and the East China Sea have been at the forefront of the news in recent years. In addition, the region is expected to see more than 100 submarines operational by 2030, mostly belonging to China. The country will also include some frigates and corvettes for surveillance, directly influencing the Asia Pacific naval system surveillance radar market growth in Asia Pacific region. Further, in April 2022, Hyundai Heavy Industries and Israel Aerospace Industries (IAI) agreed to equip the Philippine Navy with IAI's ALPHA 3D Radar Systems. The systems will be integrated into the Philippine Navy's new Corvette ships. Asia Pacific is witnessing a surge in radar technology and radar systems development and deployment among emerging economies such as India, Singapore, Thailand, Indonesia, the Philippines, Sri Lanka, and Vietnam. Moreover, the rising investment of key market players to fulfill the growing demand for radar systems is fueling the Asia Pacific naval system surveillance radar market growth across the region.

Asia Pacific Naval System Surveillance Radar Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

Asia Pacific Naval System Surveillance Radar Market Segmentation

The Asia Pacific naval system surveillance radar market is segmented into type, application, and country.

- Based on type, the market is segmented into x-band and ku-band, l-band and s-band, and others. The x-band and ku-band segment registered the largest market share in 2022.

- Based on application, the market is bifurcated into weapon guidance system and surveillance. The surveillance segment held a larger market share in 2022.

- Based on country, the market is segmented into Australia, China, India, Japan, South Korea, Rest of APAC. China dominated the market share in 2022.

Lockheed Martin Corporation; Northrop Grumman Corporation; Raytheon Technologies Corporation; Saab AB; Thales Group; BAE Systems; Israel Aerospace Industries Ltd; Leonardo S.p.a; Ultra; and HENSOLDT. are the leading companies operating in the Asia Pacific naval system surveillance radar market in the region.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. APAC Naval System Surveillance Radar Market Landscape

4.1 Market Overview

4.2 Porter’s Five Force Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

5. APAC Naval System Surveillance Radar Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Importance of Naval Surveillance Systems

5.1.2 Rise in Procurement of Naval System Surveillance Radar

5.2 Market Restraints

5.2.1 Design Constraints and Component Failure Due to Environment Conditions

5.3 Market Opportunities

5.3.1 Modernization of Conventional Naval System Surveillance Radar

5.4 Trends

5.4.1 Integration of Advanced Technology with Naval Radars

5.5 Impact Analysis of Drivers and Restraints

6. Naval System Surveillance Radar Market – APAC Market Analysis

6.1 Naval System Surveillance Radar Market Forecast and Analysis

7. APAC Naval System Surveillance Radar Market Analysis – by Type

7.1 Overview

7.2 Naval System Surveillance Radar Market, By Type (2021 and 2028)

7.3 X-band and Ku-band

7.3.1 Overview

7.3.2 X-Band and Ku-Band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

7.4 L-band and S-band

7.4.1 Overview

7.4.2 L-band and S-band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

8. APAC Naval System Surveillance Radar Market Analysis – by Application

8.1 Overview

8.2 Naval System Surveillance Radar Market, By Application (2021 and 2028)

8.3 Weapon Guidance System

8.3.1 Overview

8.3.2 Weapon Guidance System: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Surveillance

8.4.1 Overview

8.4.2 Surveillance: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9. APAC Naval System Surveillance Radar Market – Country Analysis

9.1 Asia Pacific: Naval System Surveillance Radar Market

9.1.1 APAC: Naval System Surveillance Radar Market, by Key Country

9.1.2 APAC: Naval System Surveillance Radar Market, by Key Country

9.1.2.1 Australia: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.1.1 Australia: Naval System Surveillance Radar Market, by Type

9.1.2.1.2 Australia: Naval System Surveillance Radar Market, by Application

9.1.2.2 China: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.2.1 China: Naval System Surveillance Radar Market, by Type

9.1.2.2.2 China: Naval System Surveillance Radar Market, by Application

9.1.2.3 India: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.3.1 India: Naval System Surveillance Radar Market, by Type

9.1.2.3.2 India: Naval System Surveillance Radar Market, by Application

9.1.2.4 Japan: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.4.1 Japan: Naval System Surveillance Radar Market, by Type

9.1.2.4.2 Japan: Naval System Surveillance Radar Market, by Application

9.1.2.5 South Korea: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.5.1 South Korea: Naval System Surveillance Radar Market, by Type

9.1.2.5.2 South Korea: Naval System Surveillance Radar Market, by Application

9.1.2.6 Rest of APAC: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.6.1 Rest of APAC: Naval System Surveillance Radar Market, by Type

9.1.2.6.2 Rest of APAC: Naval System Surveillance Radar Market, by Application

10. Industry Landscape

10.1 Overview

10.2 Market Initiative

10.3 New Product Development

11. Company Profiles

11.1 Lockheed Martin Corporation

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Northrop Grumman Corporation

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Raytheon Technologies Corporation

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Saab AB

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Thales Group

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 BAE Systems

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Israel Aerospace Industries Ltd.

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Leonardo S.p.A.

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Ultra

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 HENSOLDT

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Word Index

LIST OF TABLES

Table 1. APAC Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. Australia: Naval System Surveillance Radar Market, by Type– Revenue and Forecast to 2028 (US$ Million)

Table 3. Australia: Naval System Surveillance Radar Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 4. China: Naval System Surveillance Radar Market, by Type– Revenue and Forecast to 2028 (US$ Million)

Table 5. China: Naval System Surveillance Radar Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 6. India: Naval System Surveillance Radar Market, by Type– Revenue and Forecast to 2028 (US$ Million)

Table 7. India: Naval System Surveillance Radar Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 8. Japan: Naval System Surveillance Radar Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 9. Japan: Naval System Surveillance Radar Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 10. South Korea: Naval System Surveillance Radar Market, by Type– Revenue and Forecast to 2028 (US$ Million)

Table 11. South Korea: Naval System Surveillance Radar Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 12. Rest of APAC: Naval System Surveillance Radar Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 13. Rest of APAC: Naval System Surveillance Radar Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 14. List of Abbreviation

LIST OF FIGURES

Figure 1. APAC Naval System Surveillance Radar Market Segmentation

Figure 2. APAC Naval System Surveillance Radar Segmentation, By Country

Figure 3. APAC Naval System Surveillance Radar Market Overview

Figure 4. APAC Naval System Surveillance Radar Market, By Type

Figure 5. APAC Naval System Surveillance Radar Market – By Application

Figure 6. APAC Naval System Surveillance Radar Market, By Country

Figure 7. APAC Naval System Surveillance Radar Market: Porter’s Five Forces Analysis

Figure 8. APAC Ecosystem Analysis

Figure 9. APAC Naval System Surveillance Radar Market: Impact Analysis of Drivers and Restraints

Figure 10. APAC Naval System Surveillance Radar Market Forecast and Analysis (US$ Million)

Figure 11. APAC Naval System Surveillance Radar Market Revenue Share, by Type (2021 and 2028)

Figure 12. APAC X-band and Ku-band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. APAC L-band and S-band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. APAC Others: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. APAC Naval System Surveillance Radar Market Revenue Share, by Application (2021 and 2028)

Figure 16. APAC Weapon Guidance System: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. APAC Surveillance: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. APAC: Naval System Surveillance Radar Market Revenue Share, by Key Country (2021 and 2028)

Figure 19. APAC: Naval System Surveillance Radar Market Revenue Share, by Key Country (2021 and 2028)

Figure 20. Australia: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. China: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. India: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Japan: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. South Korea: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Rest of APAC: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

- BAE Systems.

- HENSOLDT.

- Israel Aerospace Industries Ltd.

- Leonardo S.p.a.

- Lockheed Martin Corporation.

- Northrop Grumman Corporation.

- Raytheon Technologies Corporation.

- Saab AB.

- Thales Group.

- Ultra.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific naval system surveillance radar market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific naval system surveillance radar market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the naval system surveillance radar market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution