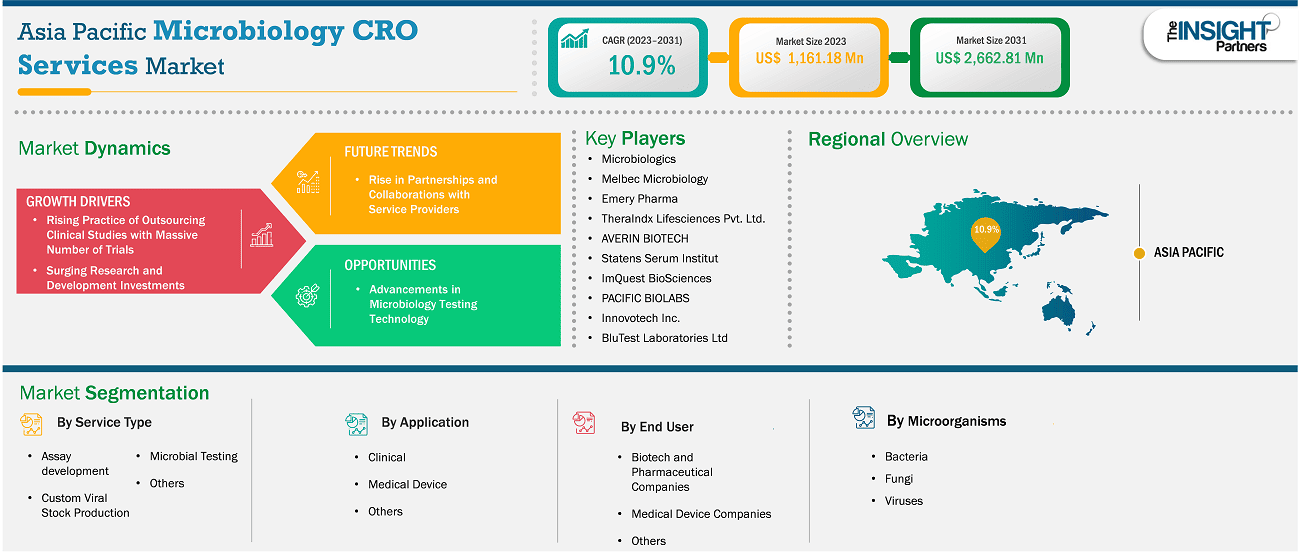

The Asia Pacific microbiology CRO services market size is expected to reach US$ 2,662.81 million by 2031 from US$ 1,161.18 million in 2023. The market is estimated to record a CAGR of 10.9% from 2023 to 2031.

The microbiology CRO services market in Asia Pacific is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. Countries such as Australia, India, and South Korea are estimated to witness various growth opportunities due to the development in the healthcare sector. In addition, governments of these countries are increasing their efforts to provide clinical trials. Also, the rise in the incidence of chronic diseases is likely to offer more significant growth opportunities to the market players in the coming years.

Key segments that contributed to the derivation of the Asia Pacific microbiology CRO services market analysis are application, service type, microorganisms, and end user.

Research is a significant and essential part of the pharmaceutical, biopharmaceutical, and medical device industries, among others, which enables them to develop new solutions for various therapeutic applications with significant medical and commercial potential. The pharmaceutical industry is one of the most research and development-intensive industries in the world. Efforts are being made to achieve greater effectiveness and efficiency in fulfilling patients' needs. The cost of medicines has been a prime concern for pharmaceutical companies as they bank on their research and development activities to achieve intended cost targets. Over the last decade, the number of new drugs approved yearly has also increased.

Research and development expenditure is instrumental in companies' efforts to discover, examine, and produce new products; make upfront payments; improve existing outcomes; and demonstrate product efficacy and regulatory compliance before launch. These investments differ as per the need and demand for clinical trials. The cost includes materials, supplies used, and employee salaries, along with the cost of developing quality control. According to PhRMA Member Companies 2021 report, in terms of revenue, the top 15 largest pharmaceutical companies invested US$ 133 billion in research and development cumulatively, and ~44% of the total research and development investment was allocated to clinical trials. Pharmaceutical companies are investing heavily in research and development to create new antibiotics, vaccines, and treatments for infectious diseases. These developments require thorough testing and validation of microbial strains. Similarly, medical device companies are working on innovative products, such as implantable devices, wound care products, and surgical instruments, which also require rigorous testing to ensure sterility and prevent contamination. Microbial testing CROs offer specialized services, including bacterial identification, antimicrobial susceptibility testing, sterility testing, bioburden testing, and molecular testing, to support these research and development efforts. The increasing demand for personalized medicine, targeted therapies, and implantable devices is also increasing the need for microbial testing CROs to provide customized testing services. Thus, increasing research and development investments fuel the microbiology CRO market growth.

Based on country, the Asia Pacific microbiology CRO services market comprises China, Japan, India, Australia, South Korea and the Rest of Asia Pacific. China held the largest share in 2023.

China is expanding its support for clinical trials of drugs, resulting in the acceleration of new drug development. According to the Annual Report on the Progress of Clinical Trials for New Drug Registration in China, a total of 3,358 clinical trials of medications were registered in the country in 2021, 3,410 in 2022, and 4,300 in 2023—indicating constant growth. In addition, 500 biological products were approved, with oncology, dermatology, and endocrinology being key therapy areas. Further, the country has emerged as an increasingly attractive R&D outsourcing destination for international pharmaceutical companies aiming to reduce their product timeline and cost to the market. According to Clinical Trials Arena, the involvement of Western commercial companies in trial runs in the country has increased gradually from 100 trials per year in 2010 to ~350 trials in 2021. With the rising demand for clinical trials in China, there is an increasing need for advanced microbial testing services. Chinese microbial testing CROs are increasingly collaborating with international companies to offer global testing services while also enhancing their expertise and capabilities.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,161.18 Million |

| Market Size by 2031 | US$ 2,662.81 Million |

| CAGR (2023 - 2031) | 10.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered |

Asia Pacific

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Microbiologics; Melbec Microbiology; Emery Pharma; TheraIndx Lifesciences Pvt. Ltd.; AVERIN BIOTECH; Statens Serum Institut; ImQuest BioSciences; PACIFIC BIOLABS; Innovotech Inc.; and BluTest Laboratories Ltd among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Asia Pacific Microbiology CRO Services Market is valued at US$ 1,161.18 Million in 2023, it is projected to reach US$ 2,662.81 Million by 2031.

As per our report Asia Pacific Microbiology CRO Services Market, the market size is valued at US$ 1,161.18 Million in 2023, projecting it to reach US$ 2,662.81 Million by 2031. This translates to a CAGR of approximately 10.9% during the forecast period.

The Asia Pacific Microbiology CRO Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Microbiology CRO Services Market report:

The Asia Pacific Microbiology CRO Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Microbiology CRO Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Microbiology CRO Services Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)