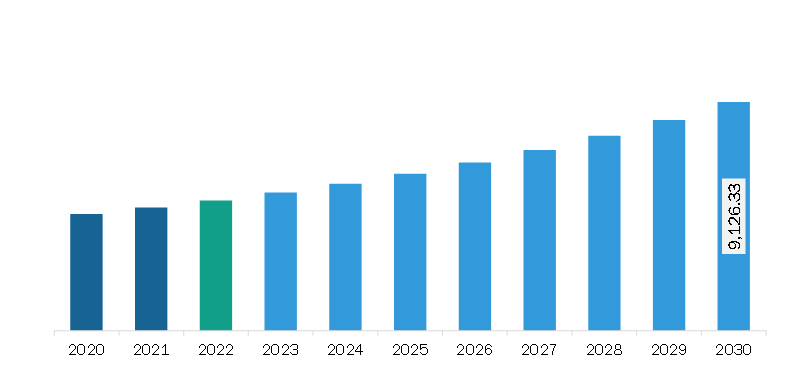

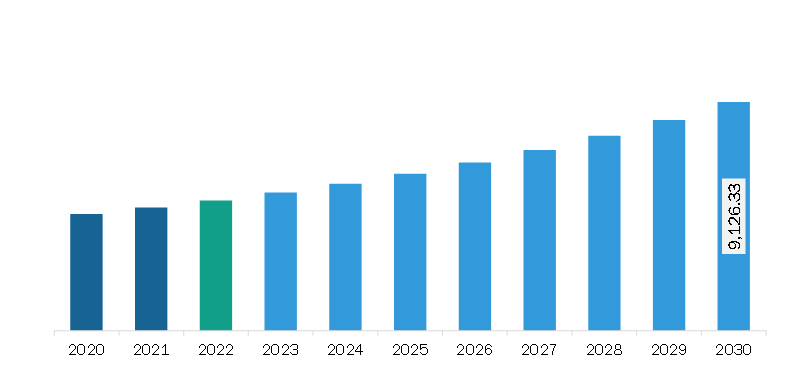

Asia Pacific metal scavenging agents market was valued at US$ 5,191.64 million in 2022 and is expected to reach US$ 9,126.33 million by 2030; it is estimated to register a CAGR of 7.3% from 2022 to 2030.

There are growing investments in water treatment infrastructure, especially in developing economies grappling with water scarcity and pollution issues. These investments are driven by the urgent need to address the challenges of inadequate access to clean and safe drinking water and the escalating concerns over water pollution caused by industrial, agricultural, and urban activities. Metal scavenging agents play a pivotal role in this scenario by offering effective solutions for removing heavy metals from wastewater streams, thereby maintaining the safety and quality of drinking water supplies.

In many developing economies, industrialization and urbanization have resulted in heightened levels of heavy metal contamination in water sources due to industrial effluents, mining activities, improper waste disposal, and agricultural runoff. The contamination poses significant health risks to communities reliant on these water sources for drinking, cooking, and sanitation purposes. Governments, private sector entities, and international organizations are increasing their investments in water treatment infrastructure to address the challenges of water contamination.

Metal scavenging agents, including chelating agents, ion exchange resins, and adsorbents, are integral components of water treatment systems designed to eliminate heavy metals from contaminated water. These agents effectively bind to metal ions, allowing for their removal through filtration, precipitation, or adsorption processes. By incorporating metal scavenging agents into water treatment processes, contaminants such as lead, mercury, arsenic, and cadmium can be efficiently removed, ensuring that treated water meets regulatory standards and is safe for human consumption.

Governments and water utilities prioritize investments in infrastructure upgrades and modernization projects. Thus, there is a heightened demand for innovative water treatment solutions, including metal scavenging agents, to improve water quality and ensure public health. The demand for metal scavenging agents in developing economies is amplified by the rising recognition of the importance of sustainable water management practices and the adoption of advanced technologies to address water-related challenges. Therefore, growing investments in water treatment infrastructure, especially in developing economies grappling with water scarcity and pollution issues, are expected to present substantial opportunities for the Asia Pacific metal scavenging agents market during the forecast period.

China is one of the fastest-growing economies in the world. Mining, manufacturing, pharmaceuticals, chemicals, and water treatment are among the major industries in the country. China's explosive industrial growth has led to an upsurge in the production of goods across many sectors. Population growth and industrialization place a significant strain on China's water resources. Metal scavenging agents play a critical role in the treatment of drinking water and industrial wastewater. These agents effectively remove harmful heavy metals, ensuring safe water for consumption and minimizing the environmental impact of industrial discharge. Furthermore, the electronics and chemical industries, significant in China, demand materials of exceptional purity. According to the European Chemical Industry Council, with US$ 2,513.1 billion in 2022, China is the largest chemical producer in the world. Metal impurities can interfere with delicate manufacturing processes or the properties of end products. Metal scavenging agents ensure these industries achieve the required purity levels, bolstering their output and product performance.

The Asia Pacific metal scavenging agents market is categorized into type, end-use industry, and country.

By type, the Asia Pacific metal scavenging agents market is segmented into alumina-based, carbon-based, silica-based, resin-based, and others. The others segment held the largest share of the Asia Pacific metal scavenging agents market share in 2022.

In terms of end-use industry, the Asia Pacific metal scavenging agents market is segmented into water treatment, food & beverages, pharmaceutical, oil & gas, chemicals, paper & pulp, and others. The paper & pulp segment held the largest share of the Asia Pacific metal scavenging agents market share in 2022.

Based on country, the Asia Pacific metal scavenging agents market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China segment held the largest share of Asia Pacific metal scavenging agents market in 2022.

BASF SE, Biosynth AG, Biotage AB, Fuji Silysia Chemical Ltd, Johnson Matthey Plc, Merck KGaA, SiliCycle Inc, Supra Sciences Pvt Ltd, and Vizag Chemicals Pvt Ltd are some of the leading companies operating in the Asia Pacific metal scavenging agents market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5,191.64 Million |

| Market Size by 2030 | US$ 9,126.33 Million |

| CAGR (2022 - 2030) | 7.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

The Asia Pacific Metal Scavenging Agents Market is valued at US$ 5,191.64 Million in 2022, it is projected to reach US$ 9,126.33 Million by 2030.

As per our report Asia Pacific Metal Scavenging Agents Market, the market size is valued at US$ 5,191.64 Million in 2022, projecting it to reach US$ 9,126.33 Million by 2030. This translates to a CAGR of approximately 7.3% during the forecast period.

The Asia Pacific Metal Scavenging Agents Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Metal Scavenging Agents Market report:

The Asia Pacific Metal Scavenging Agents Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Metal Scavenging Agents Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Metal Scavenging Agents Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)