Asia-Pacific Industrial Radiography Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Technique (Film-Based Radiography and Digital Radiography) and End-User Industry (Manufacturing, Aerospace, Automotive and Transportation, Power Generation, Petrochemical and Gas, and Others)

Market Introduction

The APAC industrial radiography market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The region holds enormous growth potential for businesses owing to the presence of fast-growing economies, such as India and China. It also comprises major industries, such as chemicals, automobiles, manufacturing, and aerospace. China, the world's largest manufacturing hub, is witnessing a hike in labor costs due to the country's aging population. This has piqued the interest of manufacturers in investing in Southeast Asian countries. A few other factors attracting manufacturing companies to APAC countries include developing infrastructure and increasing domestic demand. Further, government policies, such as Make in India and Made in China 2025, promote the establishment of manufacturing plants to make the respective economies self-sufficient and capable of exporting surplus goods. Thus, the growing manufacturing sector across the region is subsequently influencing the adoption of industrial radiography. APAC has a robust automotive sector, which is supported by the growing automotive manufacturing industry in China, India, and South Korea. India, China, South Korea, and Japan are among the leading vehicle manufacturing countries across the world. Further, APAC has the presence of major automotive manufacturers, such as Suzuki, Mitsubishi, Hyundai-Kia, Nissan, Tata Motors Limited, Lexus, and Toyota. In addition, brands such as Ford, Mercedes, BMW, VW, Tesla, Audi, and JLR have established their manufacturing facilities in the region. Moreover, governments of APAC countries have established initiatives for the development of the automotive industry. For instance, in 2019, the government of India announced its plan worth US$ 388.5 million to set up research and development centers to enable the automotive industry to meet global standards.

Asia-Pacific constitutes the world’s two most populated countries—India and China—that are also manufacturing hubs. China virtually imposed strict lockdown and social isolation due to the COVID-19 outbreak, which almost halted the manufacturing and production for several weeks. Moreover, the country suspended the import and export of critical raw materials and components in early 2020. India also imposed a nationwide lockdown to keep a check on the growing COVID-19 cases across the country. As a result, lockdown, and disruption of industrial activities across China and India restricted the supply chain of various raw material and goods. However, these countries had to permit the manufacturing of a few essential goods. Additionally, the industries have begun to recover from the impact of the pandemic. Due to significant breakthroughs and technological innovations in manufacturing industries, the industrial radiography market in APAC is quickly expanding. Because of the region's developing manufacturing sector, industrial radiography systems are widely used. The industrial radiography market in this region is being driven by the adoption of automation in production and increasing infrastructural growth in countries such as India and China. As several countries in APAC are active in the construction of defense aircraft, the aerospace & defense sector also contribute to the growth of the industrial radiography market. The COVID-19 pandemic has a negative impact on the industrial radiography market in major APAC countries.

Get more information on this report :

Market Overview and Dynamics

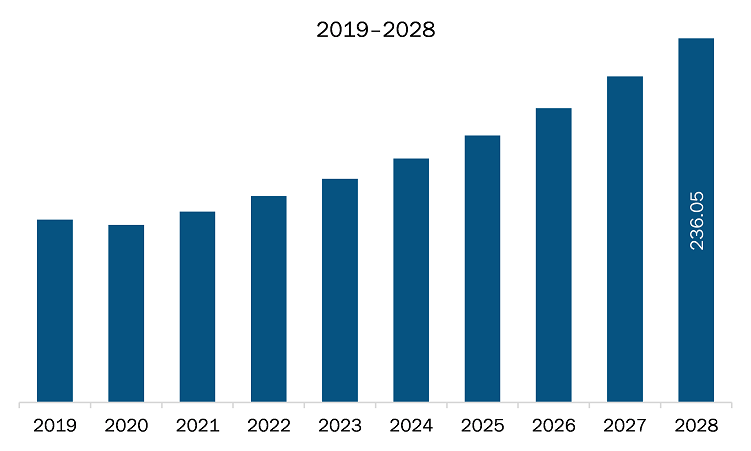

The industrial radiography market in APAC is expected to grow from US$ 123.83 million in 2021 to US$ 236.05 million by 2028; it is estimated to grow at a CAGR of 9.7% from 2021 to 2028. Increasing importance for border security; innovative active interrogation approaches to identify threats to national security are required to protect a country’s airports, borders, and ports. All detection approaches need a source of energetic particles for inducing specific reactions that are major signatures for detecting fissile material or conventional explosives or to perform imaging. The most instant perceived threats and their essential materials comprise conventional explosives, special nuclear materials, mass destruction weapons, chemical agents, and contraband. The radiography technology can be utilized to scan cargo to guarantee that nothing is being smuggled into the country. By utilizing industrial radiography technology, it is possible to distinguish between different materials. Also, the governments are investing a significant amount in border security by deploying the latest technologies at borders. For instance, the Chinese government plans to construct additional 215 airports by 2035. Also, by 2024, the Indian government plans to build 100 new airports across the country. The growth in the construction and expansion of airports is anticipated to boost the demand for industrial radiography. This is bolstering the growth of the industrial radiography market.

Key Market Segments

Based on technique, the market is bifurcated into digital radiography and film-based radiography. In 2020, the digital radiography segment held the largest share APAC industrial radiography market. By end-user industry, the market is segmented into petrochemical and gas, power generation, manufacturing, aerospace, automotive & transportation, and others. In 2020, the automotive & transportation segment held the largest share APAC industrial radiography market.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the industrial radiography market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Anritsu, Comet Group, Fujifilm Corporation, GENERAL ELECTRIC, METTLER TOLEDO, Nikon Corporation, SHIMADZU CORPORATION, and ZEISS International among others.

Reasons to buy report

- To understand the APAC industrial radiography market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for APAC industrial radiography market

- Efficiently plan M&A and partnership deals in APAC industrial radiography market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form APAC industrial radiography market

- Obtain market revenue forecast for market by various segments from 2021-2028 in APAC region.

APAC INDUSTRIAL RADIOGRAPHY MARKET SEGMENTATION

By Technique

- Film-based Radiography

- Digital Radiography

By End-User Industry

- Manufacturing

- Aerospace

- Automotive and Transportation

- Power Generation

- Petrochemical and Gas

- Others

By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

Company Profiles

- Anritsu

- Comet Group

- Fujifilm Corporation

- GENERAL ELECTRIC

- METTLER TOLEDO

- Nikon Corporation

- SHIMADZU CORPORATION

- ZEISS International

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. APAC Industrial Radiography Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 APAC

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. APAC Industrial Radiography Market – Key Market Dynamics

5.1 Key Market Drivers

5.1.1 Growing Importance of Quality Control

5.1.2 Increasing Importance for Border Security

5.2 Market Restraints

5.2.1 Radiation Hazards, Government Regulations, and Lack of High Skilled Labour

5.3 Market Opportunities

5.3.1 Growing MRO Operation in APAC

5.4 Future Trends

5.4.1 Integration of AI and ML

5.5 Impact Analysis of Drivers and Restraints

6. Industrial Radiography Market – APAC Analysis

6.1 Industrial Radiography Market APAC Overview

6.2 APAC Industrial Radiography Market –Revenue and Forecast to 2028 (US$ Million)

7. APAC Industrial Radiography Market Analysis – By Technique

7.1 Overview

7.2 APAC Industrial Radiography Market, By Technique (2020 and 2028)

7.3 Film-based Radiography

7.3.1 Overview

7.3.2 Film-based Radiography: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Digital Radiography

7.4.1 Overview

7.4.2 Digital Radiography: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

8. APAC Industrial Radiography Market – By End-User Industry

8.1 Overview

8.2 APAC Industrial Radiography Market, by End-User Industry (2020 and 2028)

8.3 Manufacturing

8.3.1 Overview

8.3.2 Manufacturing: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Aerospace

8.4.1 Overview

8.4.2 Aerospace: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Automotive and Transportation

8.5.1 Overview

8.5.2 Automotive and Transportation: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

8.6 Power Generation

8.6.1 Overview

8.6.2 Power Generation: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

8.7 Petrochemical and Gas

8.7.1 Overview

8.7.2 Petrochemical and Gas: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

8.8 Others

8.8.1 Overview

8.8.2 Others: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

9. APAC Industrial Radiography Market – Country Analysis

9.1 APAC Industrial Radiography Market, Revenue and Forecast to 2028

9.1.1 Overview

9.1.2 APAC Industrial Radiography Market Breakdown, by Country

9.1.2.1 China Industrial Radiography Market, Revenue and Forecast to 2028 (US$ Mn)

9.1.2.1.1 China Industrial Radiography Market Breakdown, by Technique

9.1.2.1.2 China Industrial Radiography Market Breakdown, by End-user Industry

9.1.2.2 Japan Industrial Radiography Market, Revenue and Forecast to 2028 (US$ Mn)

9.1.2.2.1 Japan Industrial Radiography Market Breakdown, by Technique

9.1.2.2.2 Japan Industrial Radiography Market Breakdown, by End-user Industry

9.1.2.3 India Industrial Radiography Market, Revenue and Forecast to 2028 (US$ Mn)

9.1.2.3.1 India Industrial Radiography Market Breakdown, by Technique

9.1.2.3.2 India Industrial Radiography Market Breakdown, by End-user Industry

9.1.2.4 South Korea Industrial Radiography Market, Revenue and Forecast to 2028 (US$ Mn)

9.1.2.4.1 South Korea Industrial Radiography Market Breakdown, by Technique

9.1.2.4.2 South Korea Industrial Radiography Market Breakdown, by End-user Industry

9.1.2.5 Australia Industrial Radiography Market, Revenue and Forecast to 2028 (US$ Mn)

9.1.2.5.1 Australia Industrial Radiography Market Breakdown, by Technique

9.1.2.5.2 Australia Industrial Radiography Market Breakdown, by End-user Industry

9.1.2.6 Rest of APAC Industrial Radiography Market, Revenue and Forecast to 2028 (US$ Mn)

9.1.2.6.1 Rest of APAC Industrial Radiography Market Breakdown, by Technique

9.1.2.6.2 Rest of APAC Industrial Radiography Market Breakdown, by End-user Industry

10. Impact of COVID-19 Pandemic on APAC Industrial Radiography Market

10.1 Asia Pacific: Impact Assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

12. Company Profiles

12.1 Anritsu

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Comet Group

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Fujifilm Corporation

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 GENERAL ELECTRIC

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 METTLER TOLEDO

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Nikon Corporation

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 SHIMADZU CORPORATION

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 ZEISS International

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. APAC Industrial Radiography Market, Revenue and Forecast To 2028 – By Country (US$ Mn)

Table 3. China Industrial Radiography Market, Revenue and Forecast to 2028 – By Technique (US$ Mn)

Table 4. China Industrial Radiography Market, Revenue and Forecast to 2028 – By End-user Industry (US$ Mn)

Table 5. Japan Industrial Radiography Market, Revenue and Forecast to 2028 – By Technique (US$ Mn)

Table 6. Japan Industrial Radiography Market, Revenue and Forecast to 2028 – By End-user Industry (US$ Mn)

Table 7. India Industrial Radiography Market, Revenue and Forecast to 2028 – By Technique (US$ Mn)

Table 8. India Industrial Radiography Market, Revenue and Forecast to 2028 – By End-user Industry (US$ Mn)

Table 9. South Korea Industrial Radiography Market, Revenue and Forecast to 2028 – By Technique (US$ Mn)

Table 10. South Korea Industrial Radiography Market, Revenue and Forecast to 2028 – By End-user Industry (US$ Mn)

Table 11. Australia Industrial Radiography Market, Revenue and Forecast to 2028 – By Technique (US$ Mn)

Table 12. Australia Industrial Radiography Market, Revenue and Forecast to 2028 – By End-user Industry (US$ Mn)

Table 13. Rest of APAC Industrial Radiography Market, Revenue and Forecast to 2028 – By Technique (US$ Mn)

Table 14. Rest of APAC Industrial Radiography Market, Revenue and Forecast to 2028 – By End-user Industry (US$ Mn)

Table 15. List of Abbreviation

LIST OF FIGURES

Figure 1. APAC Industrial Radiography Market Segmentation

Figure 2. APAC Industrial Radiography Market Segmentation – By Country

Figure 3. APAC Industrial Radiography Market Overview

Figure 4. Digital Radiography held the largest market share in 2020

Figure 5. Automotive and Transportation held the largest market share in 2020

Figure 6. China held Largest Market Share in 2020

Figure 7. APAC – PEST Analysis

Figure 8. Expert Opinion

Figure 9. APAC Industrial Radiography Market: Impact Analysis of Drivers and Restraints

Figure 10. APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

Figure 11. APAC Industrial Radiography Market Revenue Share, by Technique (2020 and 2028)

Figure 12. Film-based Radiography: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. Digital Radiography: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. APAC Industrial Radiography Market Revenue Share, by End-User Industry (2020 and 2028)

Figure 15. Manufacturing: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. Aerospace: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. Automotive and Transportation: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. Power Generation: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. Petrochemical and Gas: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. Others: APAC Industrial Radiography Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. APAC Industrial Radiography Market, Revenue and Forecast to 2028 (US$ Mn)

Figure 22. APAC Industrial Radiography Market Breakdown, by Country, 2020 & 2028 (%)

Figure 23. China Industrial Radiography Market, Revenue and Forecast To 2028 (US$ Mn)

Figure 24. Japan Industrial Radiography Market, Revenue and Forecast To 2028 (US$ Mn)

Figure 25. India Industrial Radiography Market, Revenue and Forecast To 2028 (US$ Mn)

Figure 26. South Korea Industrial Radiography Market, Revenue and Forecast To 2028 (US$ Mn)

Figure 27. Australia Industrial Radiography Market, Revenue and Forecast To 2028 (US$ Mn)

Figure 28. Rest of APAC Industrial Radiography Market, Revenue and Forecast to 2028 (US$ Mn)

Figure 29. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

- Anritsu

- Comet Group

- Fujifilm Corporation

- GENERAL ELECTRIC

- METTLER TOLEDO

- Nikon Corporation

- SHIMADZU CORPORATION

- ZEISS International

- To understand the APAC industrial radiography market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for APAC industrial radiography market

- Efficiently plan M&A and partnership deals in APAC industrial radiography market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form APAC industrial radiography market

- Obtain market revenue forecast for market by various segments from 2021-2028 in APAC region.