Energy efficiency can be hard to monitor and improve with older HVAC systems. Generally, energy usage data is only discovered after it has been used, making it challenging to rectify or make up for. Additionally, if a system has a developing issue, it could struggle for days or weeks before failing entirely, wasting additional energy. IoT sensors installed on HVAC equipment can increase energy efficiency by monitoring usage trends and even considering weather predictions as they provide access to real-time data. The end effect is improved interior climate management with little electricity use. HVAC systems can be a significant component of IoT-enabled smart grid connectivity. IoT technology makes remote system monitoring possible, allowing users to identify issues from a distance by consulting a smartphone app or online portal. For Instance, some sensors track vital information, such as pressure, vibration, flow, temperature, humidity, on-off cycles, and fault tolerance for providing leak detection information. Technicians can easily access the insights they need to get into systems’ status and accordingly provide the solution to fix any malfunction. Most HVAC companies have a compulsory requirement for regulatory compliance, frequently requiring a field agent to inspect equipment regularly. It is challenging to accomplish and record such compliance with disconnected systems with no integration of IoT, which needs lots of paperwork and physical system checks to prove the adherence to compliance standards. Thus, the integration of IoT into HVAC systems is the key trend in the market, which is likely to boost the demand for HVAC systems.

Asia Pacific consists of several developed economies, such as Japan, Australia, and emerging economies like China, India, and others. HVAC industry growth in Asia Pacific is largely attributed to increasing urbanization, rising population growth especially in the Asia Pacific region and government regulations for creating the HVAC systems more energy efficient. The APAC region is witnessing a growth in numerous real estate projects and public-private investments in several industrial, residential, and commercial development areas due to the rise in urbanization. The need for HVAC services in the residential sector is mostly driven by new installations brough on by Asia Pacific region. Due to increased building and development projects, air conditioner penetration is rising throughout Southeast Asia nations including Vietnam, Thailand, Indonesia, Malaysia, the Philippines, and China.

The Asia Pacific HVAC system market is segmented based on component, type, implementation, application, and country. Based on component, the Asia Pacific HVAC system market is segmented into thermostat, air handling units, central ACs, furnace, heat pump, compressor, and others. The central ACs segment held the largest market share in 2022.

Based on type, the Asia Pacific HVAC system market is segmented into split system, ductless system, and packaged system. The split system segment held the largest market share in 2022.

Based on application, the Asia Pacific HVAC system market is segmented into residential, commercial, and industrial. The residential segment held a larger market share in 2022.

Based on implementation, the Asia Pacific HVAC system market is segmented into new installation and retrofit. The new installation segment held a larger market share in 2022.

Based on country, the Asia Pacific HVAC system market is segmented into Australia, China, India, Japan, South Korea, and the Rest of APAC. China dominated the Asia Pacific HVAC system market share in 2022.

Blue Star Ltd, Mitsubishi Electric Corp, Hitachi Ltd, Daikin Industries Ltd, Emerson Electric Co, Honeywell International Inc, LG Electric Inc, Carrier Global Corp, and Johnson Controls Inc are some of the leading companies operating in the Asia Pacific HVAC system market.

| Report Attribute | Details |

|---|---|

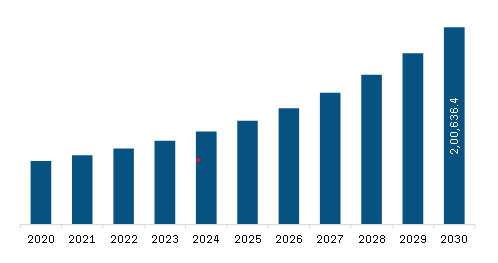

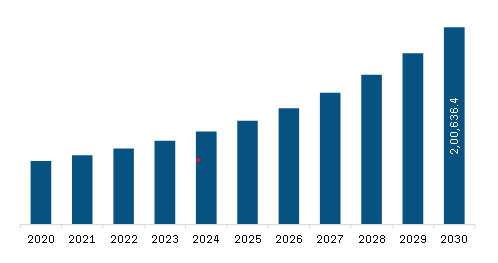

| Market size in 2022 | US$ 77,255.30 Million |

| Market Size by 2030 | US$ 2,00,636.44 Million |

| CAGR (2022 - 2030) | 12.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

The Asia Pacific HVAC System Market is valued at US$ 77,255.30 Million in 2022, it is projected to reach US$ 2,00,636.44 Million by 2030.

As per our report Asia Pacific HVAC System Market, the market size is valued at US$ 77,255.30 Million in 2022, projecting it to reach US$ 2,00,636.44 Million by 2030. This translates to a CAGR of approximately 12.7% during the forecast period.

The Asia Pacific HVAC System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific HVAC System Market report:

The Asia Pacific HVAC System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific HVAC System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific HVAC System Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)