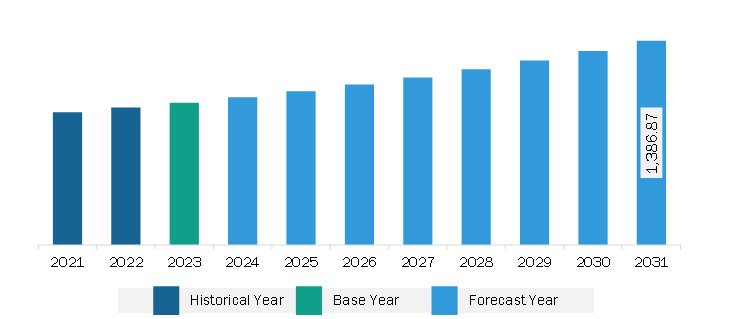

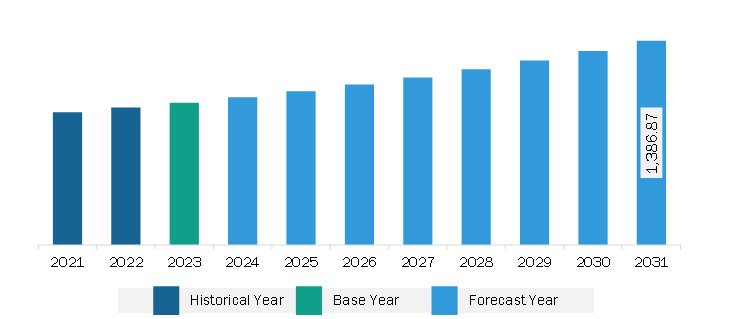

The Asia Pacific geostationary satellites market was valued at US$ 966.08 million in 2023 and is anticipated to reach US$ 1,386.87 million by 2031; it is estimated to register a CAGR of 4.6% from 2023 to 2031.

Satellite manufacturers such as Maxar Space Systems, Astranis, Terran Orbital, SWISSto12, and Saturn Satellite Network have already been focusing on the development of small satellites that can be deployed into the GEO orbit. This will further provide relief to the satellite operators and launch companies, reducing their operational costs for placing a satellite into the GEO orbit with lesser size, weight, and cost of manufacturing. During the conference of” SATELLITE 2020,” several satellite companies announced that they have been focusing on the development of smallsat constellations for geostationary orbits that can be deployed through small satellite-specialized launch vehicles, which will ultimately reduce the overall cost of satellite launches and orbit placement of satellites into the GEO orbits. The development of small satellites for deployment into geostationary orbit is likely to generate new opportunities for market vendors in the coming years.

The Asia Pacific geostationary satellite market growth is attributed to the increasing need for improving satellite-based navigation, communication, and several remote sensing applications. China, India, Australia and Japan have a strong focus on the launch of satellites. Key players in the geostationary satellite market in Asia Pacific include Neumann; Beijing Spacecraft Manufacturing Co., Ltd; China Aerospace Science Technology Corporation; and Kongtian Dongli. These companies are renowned for their initiatives to contribute to the progress of space technology. In March 2024, Thaicom Satellite Telecommunications ordered a small geostationary satellite from Astranis—Thaicom-9—which is scheduled for launch in geostationary orbit in 2025. As part of the agreement between Astranis and Space Tech Innovation Limited (Thaicom's subsidiary), Thaicom would deploy the Astranis MicroGEO satellite to provide Ka-band services over Asia. The new satellite is also likely to provide broadband connectivity in the most remote and unconnected areas in Asia.

Asia Pacific Geostationary Satellites Market Segmentation

Asia Pacific Geostationary Satellites Market Segmentation

The Asia Pacific geostationary satellites market is categorized into component, application, and country.

Based on component, the Asia Pacific geostationary satellites market is segmented into communication system, power system, propulsion system, and others. The communication system segment held the largest market share in 2023.

In terms of application, the Asia Pacific geostationary satellites market is categorized into communications, space exploration, navigation, earth observation, and others. The communications segment held the largest market share in 2023.

By country, the Asia Pacific geostationary satellites market is segmented into China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific geostationary satellites market share in 2023.

Airbus SE, Ball Corp, Israel Aerospace Industries Ltd, Korea Aerospace Industries Ltd., Lockheed Martin Corp, Northrop Grumman Corp, Thales SA, and The Boeing Co are some of the leading companies operating in the Asia Pacific geostationary satellites market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 966.08 Million |

| Market Size by 2031 | US$ 1,386.87 Million |

| CAGR (2023 - 2031) | 4.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

The Asia Pacific Geostationary Satellites Market is valued at US$ 966.08 Million in 2023, it is projected to reach US$ 1,386.87 Million by 2031.

As per our report Asia Pacific Geostationary Satellites Market, the market size is valued at US$ 966.08 Million in 2023, projecting it to reach US$ 1,386.87 Million by 2031. This translates to a CAGR of approximately 4.6% during the forecast period.

The Asia Pacific Geostationary Satellites Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Geostationary Satellites Market report:

The Asia Pacific Geostationary Satellites Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Geostationary Satellites Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Geostationary Satellites Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)