Asia Pacific Endoscopy Guidewire Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Monofilament, Coiled, and Coated), Core Material (Stainless Steel and Nitinol), and Application (Diagnostics and Therapeutic)

Market Introduction

Asia Pacific region includes countries such as India, China, Japan, and Rest of Asia Pacific. This region accounted for over 24% of the global endoscopy devices market owing to the large population countries such as China and India, increasing focus of market players, and introduction of new products in the country. Gastric cancer is a heterogeneous disease with large variations across geographical regions. Although the global incidence of gastric cancer is declining, it remains highly prevalent in Asia as compared to the West. China is one of the countries with the highest incidence of gastric cancer, and accounts for over 40% of all new gastric cancer cases in the world. Gastric cancer is the third leading cause of cancer mortality in China. Gastric cancer in Chinese patients is different from that occurring in the West and is a significant health burden. Moreover, there is currently no internationally accepted standard treatment regimen and clinical practice varies widely across countries. With the development of medical technology and wide application of more and more novel technologies, evidence-based approaches in combination with the strengths of various treatments will be the key to multidisciplinary management of gastric cancer for ultimately improving the outcomes and quality of life of these patients. GI endoscopy is very popular in China, and almost any diagnostic and therapeutic endoscopy can now be conducted in all major hospitals of the country. The annual number of cases handled by main hospitals in Beijing, for example, is roughly estimated at as many as 200,000. At least 5000 doctors in China are using the endoscope to diagnose and treat GI diseases: among these doctors, gastroenterologists account for 90%, with surgeons performing only 10% of cases. Screening programs have been effective in reducing the mortality rate of cancer in China, through early detection. The rate of incidence prevalence is higher in the rural areas of China as compared in the urban population. Also, the screening procedure is expensive, making it unaffordable for the rural population. Hence, a novel swallow able, disposable, soft-tethered, endoscopic capsule, with the aim of enabling cost effective gastroesophageal cancer screening in rural areas has been developed by The Vanderbilt Institute for Global Health (VIGH).

Countries in Asia-Pacific are expecting to witness huge challenge due to growing COVID-19. Considering the economic operations and geographic condition, the outbreak of disease has affected on medical tourism, manufacturer of medical equipment, accessories and other problems posed by shortage of healthcare infrastructure in Asia-Pacific low-income countries. After the first case in December 2019, in Wuhan, China, the coronavirus has spread to at least 180 countries and regions. To prevent the spread of disease, restrictive measures have been taken in countries such as India, South Korea, Singapore, Malaysia, and by the Philippines. According to WHO, due to the rapidly changing risk of COVID-19 affected countries and constantly controlling outbreak trends, any additional health measures are likely to significantly interfere with international travel and trade. This pandemic has affected gastrointestinal endoscopy practice across India to a vast extent. As compared to usual practice, 75.4 % of units were performing < 10 % endoscopy procedures only. The major reasons for the decrease in endoscopy procedures during the COVID-19 pandemic were fewer patients coming to the hospital due to government-mandated national lock-down, endoscopists themselves limiting the number of procedures due to the latest guideline recommendations for avoiding routine endoscopies, limiting contact with patients due to the fear of getting exposed, difficulty in managing usual patient volumes due to reduced availability of staff due to lockdown and in at least one-third, reduction in endoscopic procedures was due to advice from hospital management to avoid routine endoscopy procedures, which were in a stand-by mode for the potential surge and hence were limiting any elective procedures. Countries such as Japan and Australia are conducting virtual international conferences to anticipate the impact of COVID-19 on medical devices related industry in the Asia Pacific. China is specifically facing issues with the pandemic, leading to disruption of the supply chain, projected losses in revenue, marketing, and sales within all industries, especially the medical device industry, as well as the concerns of health within the production units and other public places. However, the countries such as India is conducting vaccination drive for the age group wise including the people within age group of 18 to 44, and 45 years and above. The country has also initiated testing of vaccine of the children which is expected to have and positive impact on the market.

Get more information on this report :

Market Overview and Dynamics

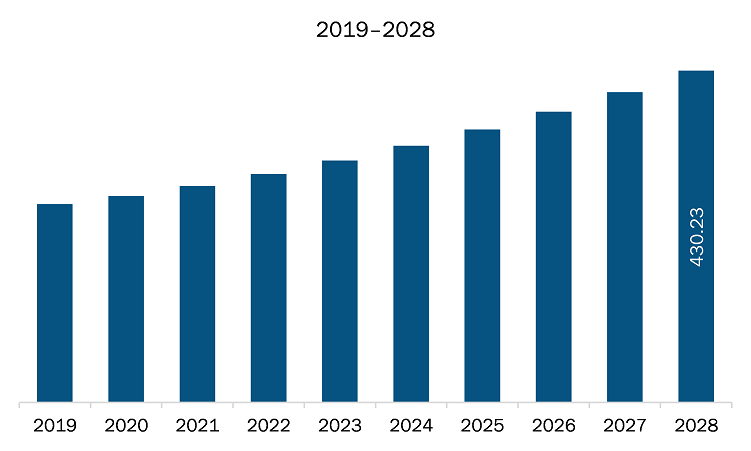

The endoscopy guidewire market in APAC is expected to grow from US$ 280.73 million in 2021 to US$ 430.23 million by 2028; it is estimated to grow at a CAGR of 6.3% from 2021 to 2028. Government initiatives have been proved to be an essential aspect for the growth of technology and the demand for any product in the market. To make endoscopic procedures accessible and beneficial to the patients, various government bodies have laid various initiatives supporting endoscopy devices. For instance, in July 2019, the Endoscopy Action Plan, implemented by the Queensland Government, was aimed toward improving the health of Queenslanders by means of delivering sustainable access to better quality gastrointestinal endoscopy services. The need for gastrointestinal endoscopy has been increasing rapidly owing to the national bowel screening program and a growing geriatric population. As per the plan, US$ 160 million would be invested over four years to deliver better services and improve access across the Queensland health system. Under the project, the services will be expanded to provide 50,000 more endoscopy procedures. Due to the implementation of this plan, the waiting time for endoscopy procedures has significantly reduced, and better services have been made available across the state. Moreover, the Gastroenterological Society of Australia (GESA) and the Australian Gastrointestinal Endoscopy Association (AGEA) established the National Endoscopy Training Initiative (NETI). This program was established to improve the quality and safety of colonoscopy and coordinate colonoscopy training in Australia. According to the program, comprehensive series of national, formalized, and standardized colonoscopy workshops are being conducted by experienced and highly qualified supervisors. In addition, standards are being laid down by NETI to be followed by individual endoscopists. Favorable government initiatives coupled with suitable policies are the major factors driving the growth of the market.

Key Market Segments

Based on type, the market is segmented into monofilament, coiled, coated. In 2020, the coated segment held the largest share APAC endoscopy guidewire market. Based on core material, the market is divided into stainless steel and nitinol. In 2020, the stainless steel segment held the largest share APAC endoscopy guidewire market. Based on application, the market is segmented into diagnostics and therapeutic. In 2020, the therapeutic segment held the largest share APAC endoscopy guidewire market.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the endoscopy guidewire market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Boston Scientific Corporation; CONMED Corporation; Cook Medical LLC; HOBBS MEDICAL INC; Medorah Meditek Pvt. Ltd; Medtronic; Merit Medical Systems Inc; Olympus Corporation; STERIS plc.

Reasons to buy report

- To understand the APAC endoscopy guidewire market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for APAC endoscopy guidewire market

- Efficiently plan M&A and partnership deals in APAC endoscopy guidewire market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form APAC endoscopy guidewire market

- Obtain market revenue forecast for market by various segments from 2021-2028 in APAC region.

APAC ENDOSCOPY GUIDEWIRE MARKETSEGMENTATION

By Type

- Monofilament

- Coiled

- Coated

By Core Material

- Stainless Steel

- Nitinol

By Application

- Diagnostics

- Therapeutic

By Country

- Japan

- China

- India

- South Korea

- Australia

- Rest of APAC

Companies Mentioned

- Boston Scientific Corporation

- CONMED Corporation

- Cook Medical LLC

- HOBBS MEDICAL INC

- Medorah Meditek Pvt. Ltd.

- Medtronic

- Merit Medical Systems Inc

- Olympus Corporation

- STERIS plc.

TABLE OF CONTENTS

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 APAC Endoscopy Guidewire Market – By Type

1.3.2 APAC Endoscopy Guidewire Market – By Core Material

1.3.3 APAC Endoscopy Guidewire Market – By Application

1.3.4 APAC Endoscopy Guidewire Market – By Country

2. APAC Endoscopy Guidewire Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. APAC Endoscopy Guidewire Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 Asia Pacific – PEST Analysis

4.3 Expert Opinions

5. APAC Endoscopy Guidewire Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Surge in Prevalence of Diseases Requiring Endoscopy

5.1.2 Favourable Government Initiatives

5.2 Market Restraints

5.2.1 Risk of Infections Caused Due to Endoscopy and High Cost of Endoscopy Procedures & Equipment

5.3 Market Opportunities

5.3.1 Increasing Patient Preference for Minimally Invasive Procedures

5.4 Future Trends

5.4.1 Enhancement of Endoscopic Robotic Systems

5.5 Impact analysis

6. Endoscopy Guidewire Market – APAC Analysis

6.1 APAC Endoscopy Guidewire Market Revenue Forecast and Analysis

7. APAC Endoscopy Guidewire Market Analysis – By Type

7.1 Overview

7.2 APAC Endoscopy Guidewire Market Revenue Share, by Type (2020 and 2028)

7.3 Monofilament

7.3.1 Overview

7.3.2 Monofilament: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

7.4 Coiled

7.4.1 Overview

7.4.2 Coiled: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

7.5 Coated

7.5.1 Overview

7.5.2 Coated: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

8. APAC Endoscopy Guidewire Market Analysis – By Core Material

8.1 Overview

8.2 APAC Endoscopy Guidewire Market Revenue Share, by Core Material (2020 and 2028)

8.3 Stainless Steel

8.3.1 Overview

8.3.2 Stainless Steel: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

8.4 Nitinol

8.4.1 Overview

8.4.2 Nitinol: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

9. APAC Endoscopy Guidewire Market Analysis – By Application

9.1 Overview

9.2 APAC Endoscopy Guidewire Market Revenue Share, by Application (2020 and 2028)

9.3 Diagnostics

9.3.1 Overview

9.3.2 Diagnostics: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

9.4 Therapeutic

9.4.1 Overview

9.4.2 Therapeutic: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

10. APAC Endoscopy Guidewire Market – Country Analysis

10.1 Asia Pacific Endoscopy Guidewire Market, Revenue and Forecast to 2028

10.1.1 Overview

10.1.2 Asia Pacific Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Country (%)

10.1.3 China: Endoscopy Guidewire Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3.1 Overview

10.1.3.2 China Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

10.1.3.3 China Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

10.1.3.4 China Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

10.1.3.5 China Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

10.1.4 Japan: Endoscopy Guidewire Market – Revenue and Forecast to 2028 (US$ Million)

10.1.4.1 Overview

10.1.4.2 Japan Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

10.1.4.3 Japan Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

10.1.4.4 Japan Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

10.1.4.5 Japan Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

10.1.5 India: Endoscopy Guidewire Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.1 Overview

10.1.5.2 India Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

10.1.5.3 India Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

10.1.5.4 India Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

10.1.5.5 India Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application ((US$ Million)

10.1.6 South Korea: Endoscopy Guidewire Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.1 Overview

10.1.6.2 South Korea Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

10.1.6.3 South Korea Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

10.1.6.4 South Korea Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

10.1.6.5 South Korea Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

10.1.7 Australia: Endoscopy Guidewire Market – Revenue and Forecast to 2028 (US$ Million)

10.1.7.1 Overview

10.1.7.2 Australia Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

10.1.7.3 Australia Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

10.1.7.4 Australia Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

10.1.7.5 Australia Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

10.1.8 Rest of Asia-Pacific: Endoscopy Guidewire Market – Revenue and Forecast to 2028 (US$ Million)

10.1.8.1 Overview

10.1.8.2 Rest of Asia-Pacific Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

10.1.8.3 Rest of Asia-Pacific Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

10.1.8.4 Rest of Asia-Pacific Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

10.1.8.5 Rest of Asia-Pacific Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

11. Impact of COVID-19 Pandemic on APAC Endoscopy Guidewire Market

11.1 Asia-Pacific: Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Overview

12.2 Organic Developments

12.2.1 Overview

12.3 Inorganic Developments

12.3.1 Overview

13. Company Profiles

13.1 Olympus Corporation

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 STERIS plc.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 CONMED Corporation

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Boston Scientific Corporation

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Merit Medical Systems Inc.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Medtronic

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Cook Medical LLC

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Medorah Meditek Pvt. Ltd.

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 HOBBS MEDICAL INC

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. APAC Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

Table 2. China Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

Table 3. China Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

Table 4. China Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

Table 5. Japan Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

Table 6. Japan Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

Table 7. Japan Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

Table 8. India Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

Table 9. India Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

Table 10. India Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

Table 11. South Korea Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

Table 12. South Korea Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

Table 13. South Korea Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

Table 14. Australia Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

Table 15. Australia Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

Table 16. Australia Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

Table 17. Rest of Asia-Pacific Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

Table 18. Rest of Asia-Pacific Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

Table 19. Rest of Asia-Pacific Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

Table 20. Organic Developments Done by Companies

Table 21. Inorganic Developments Done by Companies

Table 22. Glossary of Terms, Endoscopy Guidewire Market

LIST OF FIGURES

Figure 1. APAC Endoscopy Guidewire Market Segmentation

Figure 2. APAC Endoscopy Guidewire Market Segmentation, By Country

Figure 3. APAC Endoscopy Guidewire Market Overview

Figure 4. Coated Segment Held Largest Share of APAC Endoscopy Guidewire Market

Figure 5. China to Show Significant Growth During Forecast Period

Figure 6. Asia Pacific PEST Analysis

Figure 7. APAC Endoscopy Guidewire Market Impact Analysis of Drivers and Restraints

Figure 8. APAC Endoscopy Guidewire Market – Revenue Forecast and Analysis – 2020- 2028 (US$ Million)

Figure 9. APAC Endoscopy Guidewire Market Revenue Share, by Type (2020 and 2028)

Figure 10. Monofilament: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 11. Coiled: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 12. Coated: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 13. APAC Endoscopy Guidewire Market Revenue Share, by Core Material (2020 and 2028)

Figure 14. Stainless Steel: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 15. Nitinol: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 16. APAC Endoscopy Guidewire Market Revenue Share, by Application (2020 and 2028)

Figure 17. Diagnostics: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 18. Therapeutic: APAC Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 19. Asia Pacific Endoscopy Guidewire Market Revenue Overview, By Country (2020) (US$ Million)

Figure 20. Asia Pacific Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Country (%)

Figure 21. China Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

Figure 22. Japan Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

Figure 23. India Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

Figure 24. South Korea Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

Figure 25. Australia Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

Figure 26. Rest of Asia-Pacific Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

Figure 27. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

- Boston Scientific Corporation

- CONMED Corporation

- Cook Medical LLC

- HOBBS MEDICAL INC

- Medorah Meditek Pvt. Ltd.

- Medtronic

- Merit Medical Systems Inc

- Olympus Corporation

- STERIS plc.

- To understand the APAC endoscopy guidewire market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for APAC endoscopy guidewire market

- Efficiently plan M&A and partnership deals in APAC endoscopy guidewire market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form APAC endoscopy guidewire market

- Obtain market revenue forecast for market by various segments from 2021-2028 in APAC region.