The aerospace industry and defense forces use advanced communication systems to facilitate effective and continuous contact between personnel at different sites and the base station or ground station. Thus, these two industries pose a continuously high demand for technologically enhanced and high-speed communication systems. The major benefit conferred by high-speed data transfer solutions is the access to real-time information with minimum scope for data loss. Fiber optic cables are capable of transferring high-speed data over longer distances, which is one of the key features attracting aerospace and defense communication system manufacturers .Commercial airlines have been opting for long-haul flights owing to increasing passenger traffic on these routes. Long-haul flights demand high-speed communication and seamless connectivity; Ethernet has been the most preferred choice for network infrastructure protocol among commercial airlines over the years, owing to its superior performance, reliability, and universally accepted open standard. However, the Ethernet network connectivity faced limitations in transmitting high bandwidth data over longer distances. Owing to this, several aircraft cabling system manufacturers have ventured into the fiber-optic cable industry, which has been benefiting commercial airlines over the recent years. Defense forces require long-distance communications to transfer real-time information to the troops. They rely on a complex and large network of physical components and software for their communication capabilities. Fiber optic products have been a prominent choice among defense communication system manufacturers due to their ability to transfer data at high speed over longer distances.

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Asia Pacific aerospace and military fiber optics market growth at a notable CAGR during the forecast period.

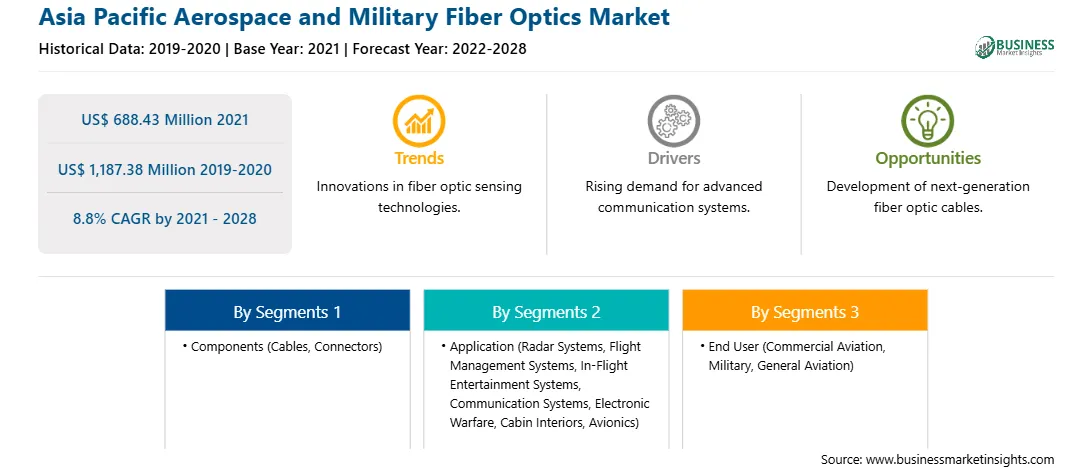

The Asia Pacific aerospace and military fiber optics market is segmented on the basis of components, application, and end user. Based on components, the market is bifructed into cables and connectors. Based on application, the Asia Pacific aerospace and military fiber optics market is segmented into radar systems, flight management systems, in-flight entertainment systems, communication systems, electronic warfare, cabin interiors, and avionics. Based on end user, the market is segmented into commercial aviation, military, and general aviation. By country, the Asia Pacific aerospace and military fiber optics market is segmented into Australia, China, India, Japan, South Korea, and Rest of Asia Pacific.

Carlisle Interconnect Technologies; TE Connectivity; Amphenol Corporation; Raytheon Technologies Corporation; Nexans; Radiall; and Glenair, Inc. are among the leading companies in the Asia Pacific aerospace and military fiber optics market.

Strategic insights for the Asia Pacific Aerospace and Military Fiber Optics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 688.43 Million |

| Market Size by 2028 | US$ 1,187.38 Million |

| CAGR (2021 - 2028) | 8.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Components

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

|

The geographic scope of the Asia Pacific Aerospace and Military Fiber Optics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific Aerospace and Military Fiber Optics Market is valued at US$ 688.43 Million in 2021, it is projected to reach US$ 1,187.38 Million by 2028.

As per our report Asia Pacific Aerospace and Military Fiber Optics Market, the market size is valued at US$ 688.43 Million in 2021, projecting it to reach US$ 1,187.38 Million by 2028. This translates to a CAGR of approximately 8.8% during the forecast period.

The Asia Pacific Aerospace and Military Fiber Optics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Aerospace and Military Fiber Optics Market report:

The Asia Pacific Aerospace and Military Fiber Optics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Aerospace and Military Fiber Optics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Aerospace and Military Fiber Optics Market value chain can benefit from the information contained in a comprehensive market report.