APAC & MEA Identity Theft Protection and Verification Market

No. of Pages: 215 | Report Code: BMIRE00028505 | Category: Technology, Media and Telecommunications

No. of Pages: 215 | Report Code: BMIRE00028505 | Category: Technology, Media and Telecommunications

APAC and MEA are witnessing a steep growth in online gaming, primarily fueled by the penetration of mobile internet and smartphones. China, Japan, and South Korea are the leading online gaming markets, while Malaysia, Indonesia, India, Thailand, the Philippines, Singapore, and Vietnam are witnessing a steep spike in the mobile gaming sector. The pandemic compelled people to stay indoors longer, increasing the acceptance of online games. According to Niko Partners, China's e-sports business was worth US$ 403.1 million in 2022, recording a rise of 14% from 2020. Similarly, the online gambling business is witnessing a considerable rise in both regions. As per SBC Events, the most popular online gambling sites generated US$ 72.2 billion from APAC in 2019, which was 47% of the global share. Sporting events—including the 2022 FIFA World Cup in Qatar and the 2023 Rugby World Cup in France—are further fueling the online gambling market in the region. Online gaming and gambling users are at risk of identity theft since fraudsters use stolen identities and fake documents to access existing accounts or create new ones. These accounts are also used to siphon off money from unsuspecting victims' bank accounts before withdrawing it elsewhere. Hence, the growth of the gambling and gaming industry offers the APAC & MEA identity theft protection and verification market growth opportunities.

The widespread integration of artificial intelligence (AI) and machine learning (ML) aids in boosting APAC & MEA identity theft protection and verification market size. The current digital marketplace is highly competitive, consisting of highly empowered customers with an array of choices. A poor experience during onboarding or sign-ups can lead to switching solutions/service providers immediately. Further, consumers are increasingly concerned with personal data protection since identity verification requires various documents—including birth certificates, identification cards, passports, and driver's licenses. Hence, businesses are adding more layers of security to build and retain trust in a digital world. Several identity theft protection and verification solution companies are utilizing ML, an application of AI, for identity verification. ML can analyze massive amounts of digital transaction data, recognize patterns, and improve decision-making, aiding in successful identity verification without human interaction. ML-enabled fraud detection layering can also help in immediate novel fraud identification and flagging. In all, the rising integration of AI and ML offers the APAC & MEA identity theft protection and verification market growth opportunities.

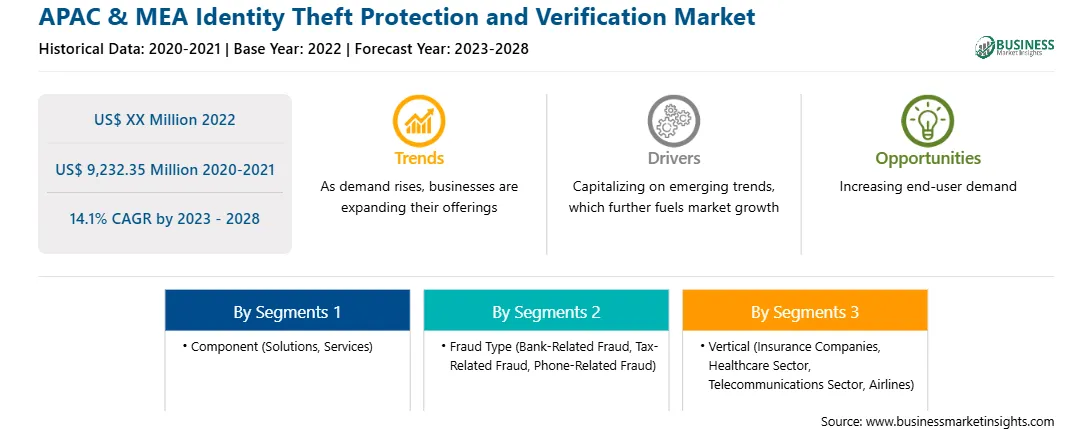

The APAC & MEA identity theft protection and verification market is segmented into component, fraud type, vertical, and region. Based on component, the APAC & MEA identity theft protection and verification market is bifurcated into solutions and services. The fraud type segment is further categorized into bank-related fraud, tax-related fraud, phone-related fraud, and others. By vertical, the APAC & MEA identity theft protection and verification market is sub-segmented into insurance companies, healthcare sector, telecommunications sector, airline, and others.

AllClear ID, Bitdefender, CrowdStrike, Equifax Inc, IDMERIT, Mcaffe LLC, Gen Digital Inc, Ravelin Technology Ltd, Shuftipro Ltd, and Thales Group are among the key APAC & MEA identity theft protection and verification market players operating in the regions.

The APAC & MEA identity theft protection and verification market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs; business development managers; market intelligence managers; national sales managers; and along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the APAC & MEA identity theft protection and verification market.

Strategic insights for the APAC & MEA Identity Theft Protection and Verification provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ XX Million |

| Market Size by 2028 | US$ 9,232.35 Million |

| CAGR (2023 - 2028) | 14.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

|

The geographic scope of the APAC & MEA Identity Theft Protection and Verification refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC & MEA Identity Theft Protection and Verification Market is valued at US$ XX Million in 2022, it is projected to reach US$ 9,232.35 Million by 2028.

As per our report APAC & MEA Identity Theft Protection and Verification Market, the market size is valued at US$ XX Million in 2022, projecting it to reach US$ 9,232.35 Million by 2028. This translates to a CAGR of approximately 14.1% during the forecast period.

The APAC & MEA Identity Theft Protection and Verification Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the APAC & MEA Identity Theft Protection and Verification Market report:

The APAC & MEA Identity Theft Protection and Verification Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The APAC & MEA Identity Theft Protection and Verification Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the APAC & MEA Identity Theft Protection and Verification Market value chain can benefit from the information contained in a comprehensive market report.