Published On: Nov 2020

Published On: Nov 2020

Retail Segment to Dominate US Data Center Colocation Market during 2019–2027

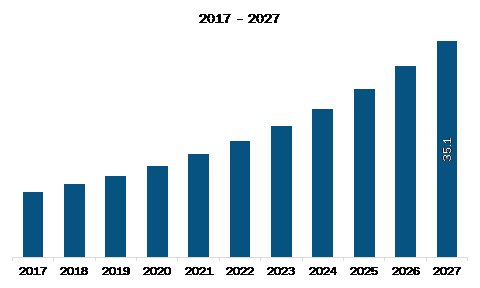

According to a new market research study on “US Data Center Colocation Market to 2027 – COVID-19 Impact and Regional Analysis and Forecast by Type, Enterprise Size, and Industry,” is expected to reach US$ 35.10 billion by 2027 from US$ 13.18 billion in 2019. The market is estimated to grow at a CAGR of 13.1% from 2020 to 2027. The report provides trends prevailing in the US data center colocation market along with the drivers and restraints pertaining to the market growth. increasing enterprise demands for cost-effective solutions to reduce overall it cost and growing disaster recovery and business continuity requirements are the major factor driving the growth of the US data center colocation market. However, high initial and maintenance costs hinder the growth of US data center colocation market.

The US data center colocation market is segmented into type, enterprise size, and industry. Based on type, the market is segmented into retail and wholesale. In 2019, the retail segment held the largest share US data center colocation market. Based on enterprise size the US data center colocation market is divided into SMEs and large enterprises. Large enterprises is expected to the fastest growing segment over the forecast period. Similarly, based on industry, the market is bifurcated into BFSI, telecom & IT, healthcare, retail, and others. The telecom & IT segment contributed a substantial share in 2019.

The COVID-19 pandemic situation in the US has forced companies to implement work from home (WFH) process as a contingency for the continuity of the business. As per CBRE's North American Data Center Trends Report 2020, the region’s data center sector was strong in the first half of 2020 because hybrid IT infrastructure is being widely implemented by the organizations to develop remote working capabilities. Data center business have never dealt with a global pandemic Covid-19. Nearly all industries got impacted by the ongoing spread of the virus and are creating potential IT and related business opportunities for data center business.

Equinix Inc., Cyxtera Technologies, Inc., Digital Realty Trust LP, CoreSite Realty Corporation, CyrusOne, Inc., QTS Realty Trust, Inc., 365 Data Centers, UnitedLayer, LLC, Telehouse, and NTT Communications Corporation are among the leading companies in the US data center colocation market. The companies are focused on adopting organic growth strategies such as product launches and expansions to sustain their position in the dynamic market. For instance, in 2020, Equinix, Inc. acquired 13 Bell Data centers in Canada for US$780 Million.

US Data Center Colocation Market Revenue and Forecast to 2027 (US$ Mn)

The report segments the US Data Center Colocation Market as follows:

US Data Center Colocation Market – By Type

US Data Center Colocation Market – By Enterprise Size

US Data Center Colocation Market – By Industry