Published On: Feb 2025

Published On: Feb 2025

According to our new research study on "North America Offline Beauty Devices Market Forecast to 2031 – Regional Analysis – by Product Type, Application, Mode of Operation, and Distribution Channel," the North America offline beauty devices market size is projected to reach US$ 68,229.13 million by 2031 from US$ 27,568.36 million in 2024. The market is expected to register a CAGR of 13.8% during 2024–2031.The market report emphasizes trends prevalent in the market, along with drivers and deterrents affecting its growth. Increasing inclination toward beauty and wellness, and rising prevalence of skin issues driving the North America offline beauty devices market growth. Furthermore, new product introductions in North America are likely to bring in new market trends during the forecast period.

The geographic scope of the North America offline beauty devices market report mainly focuses on Countries such as the US, Canada, and Mexico. In terms of revenue, the US dominated the market in 2023. It is estimated to dominate the North America market during the forecast period.

From its earliest days, the US has been at the forefront of cosmetics innovation, entrepreneurship, and regulations. Consumers in the country have registered an increasing average annual expenditure on personal and beauty care products over the years, which is contributing to the market growth. Also, the growing Hispanic population and rising demand for luxurious personal care brands in the US are expected to support demand for beauty devices. Factors such as growth in consumer knowledge and an increase in awareness about the benefit of the latest technologies through digital media and other sources, coupled with the increasing use of social media, are also contributing to the growth of the market in this country.

The average life expectancy is increasing in the US, which is leading to the rise in the use of anti-aging devices. As per the US Census Bureau 2023, the number of people in America aged 65 and older is expected to grow from 58 million in 2022 to 82 million by 2050, which is an increase of 47%. This age group is also expected to make up a larger portion of the total population, rising from 17% to 23%. In addition, high per capita income, improved standards of living, and easy availability of innovative products have boosted the sale of beauty devices in the region. Other factors propelling the North America offline beauty devices market growth include increasing technological advancements, the growing influence of social media, and rising consciousness about personal appearance.

In October 2024, AccureAcne, Inc. received the US Food and Drug Administration (FDA) cleared its Accure Laser System for long-term treatment. The laser system was first approved in 2022 for treating mild to severe inflammatory acne vulgaris. Similarly, in August 2023, The Beauty Health Company received the US Food and Drug Administration (FDA) approval for its SkinStylus microneedling device for use on facial acne scarring in Fitzpatrick skin types I, II, and III in patients aged 22 years and older, making it the only microneedling device FDA cleared for both the face and abdomen. Additionally, in October 2023, Light Activated Beauty (LAB) launched a first-to-market, reusable LED patch created to treat acne with its next-generation Light Therapy Patch, which delivers a precise LED wavelength needed to shrink a pimple.

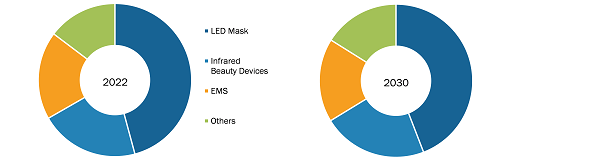

Based on product type, the North America offline beauty devices market is segmented into LED masks, infrared beauty devices, EMS, and others. The LED mask segment held the largest share of the market in 2024. The LED mask beauty device is an innovative skincare tool that uses light-emitting diode (LED) technology to improve skin health and appearance. These masks are gaining popularity in the beauty and wellness industry owing to their effectiveness and non-invasive nature. LED masks typically feature multiple light settings, each of which targets different skin concerns, offering an array of benefits. These devices are generally used for 10–20 minutes per session and are considered a non-invasive, pain-free way to improve skin health. Rising demand for at-home skincare, technological advancements by manufacturers, and growing popularity on social media platforms are likely to favor the market growth. In January 2025, Heirloom Beauty launched the at-home LED light therapy mask. It is an FDA-approved device that emits seven colors that target acne, fine lines, hyperpigmentation, and others.

In terms of application, the North America offline beauty devices market is categorized into anti-aging, acne and inflammation control, skin rejuvenation, and others. The anti-aging segment dominated the market in 2024. Anti-aging devices aimed at reducing or reversing the visible effects of aging, such as fine lines, wrinkles, and sagging skin. These devices often use technologies such as radiofrequency, LED light therapy, and microcurrent to stimulate collagen production, tighten skin, and improve skin elasticity. The increasing aging population, rising awareness about skincare, and continuous innovation in device technology are contributing to the growth in the market.

In November 2024, Cartessa Aesthetics (a premier aesthetic medical device company in North America) partnered with Classys, Inc. (a global aesthetics business leader based in South Korea) to bring the anti-aging device Volnewmer, rebranded as EVERESSE to the US market.

In terms of mode of operation, the North America offline beauty devices market is bifurcated into electric and battery operated and manual. The electric and battery-operated segment dominated the market in 2024. Electric or battery-operated beauty devices rely on an electrical power source (either plugged in or battery-powered) to perform skin treatments. These devices use technologies such as microcurrent, radiofrequency, ultrasonic vibrations, LED light therapy, and IPL (Intense Pulsed Light) for beauty purposes, including anti-aging, acne treatment, and hair removal. Factors such as ease of use, continuous innovation in battery life, charging systems, and device effectiveness, and rising demand for at-home skincare are driving the segment's growth

In terms of distribution channel, the North America offline beauty devices market is categorized into Walmart, Best Buy, Costco, Nordstrom, Macys, Saks Fifth Avenue, Sephora, Ulta Beauty, Target, and others. The Walmart segment held the largest market share in 2024. Walmart is one of the largest retail chains in the world, offering beauty devices through both in-store and online platforms. The segment includes a wide range of affordable, mass-market beauty technology, such as facial cleansers, hair removal devices, and anti-aging tools. Walmart's widespread accessibility and budget-friendly pricing appeal to a broad consumer base. As consumers increasingly seek professional-grade beauty treatments at home, affordable options are in high demand. The growing e-commerce platform of the company strengthens its position in the beauty device market.

Source: Business Market Insights Analysis

NuFACE, L'Oréal SA , The Procter & Gamble Co, Koninklijke Philips NV, Panasonic Holdings Corp, ZIIP, Silk'n, YA-MAN LTD, LUMINA NRG, FOREO, Nu Skin Enterprises Inc, MTG Co., Ltd. are among the leading companies profiled in the North America offline beauty devices market report.

As per the company news, few of the developments in the market are as follows:

Contact Us

Phone: +16467917070

Email Id: sales@businessmarketinsights.com