Published On: Jul 2022

Published On: Jul 2022

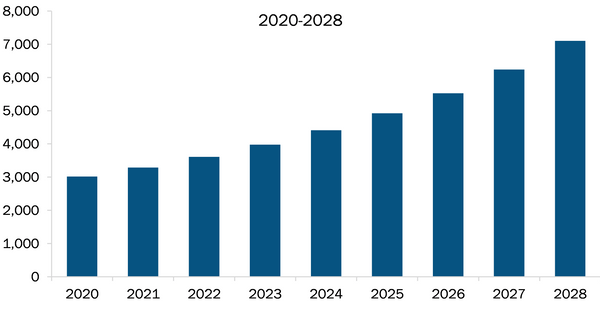

According to a new market study titled "North America 5G network and tower deployment Market Forecast to 2028 – COVID-19 Impact and Regional Analysis – by Component, Location, Frequency Band, and Small Cell Tower," the market is expected to grow from US$ 3,607.88 million in 2022 to US$ 7,100.97 million by 2028; it is estimated to grow at a CAGR of 11.9% from 2022 to 2028. The report provides trends prevailing in the market along with drivers and restraints.

Over the last couple of years, North America has experienced a rise in the adoption of advanced network technologies for residential, commercial, and industrial applications. This rise in demand for such technologies has influenced the growing service offerings by network service providers across the region. A few major 5G network providers in North America include Disk, C Spire, UScellular, T-Mobile, AT&T, and Verizon. Further, a few of the major services provided by these companies include:

• T-Mobile launched its 5G network services across North America on December 2, 2019. However, the Metro by T-Mobile prepaid service started offering access to their network on December 6, 2019.

• US cellular's started offering its 5G network services on March 6, 2020. The services are offered across various states of the US, such as Wisconsin, Maine, California, Oregon, Iowa, Oklahoma, North Carolina, Washington, etc.

• Dish, in September 2021, launched its beta version of the 5G network. Similarly, C Spire, a privately held wireless service provider in the US, launched its 5G fixed wireless network service in December 2018, which is available across Mississippi.

Various other 5G network service providers across North America include Charter, Comcast, Starry, Next-tech Wireless, US Mobile, Mint Mobile, Bell Mobility, Rogers Wireless, Telus Mobility, and Cellcom. These service providers are increasing their investment in expanding their services across major cities across the region. Thus, the rising offering of 5G services by numerous network service providers is driving the growth of the North America 5G network and tower deployment market.

5G network is the fifth-generation technology for broadband connections in the telecommunication industry. According to Groupe Speciale Mobile Association (GSMA), there will be over 1.1 billion 5G network subscribers across the globe by 2025. There is a rising demand for advanced network services to enable efficient and real-time communication across industries and personal applications. The increase in investments by communication service providers (CSPs) and regional government bodies is further enhancing the development and deployment of 5G network services across developed and developing countries in North America. Major 5G network solution providers operating across the region include Verizon, AT&T, Huawei, Cisco Systems, Ericsson, and Nokia. The adoption of 5G is constantly growing across North American markets such as the US and Canada, owing to factors such as post-pandemic economic recovery, rise in adoption of 5G smartphones, and expansion of network coverage by CSPs. Moreover, the 5G network rollout by mobile operators in reasonable subscription plans for commercial and residential applications across North American countries is also contributing to the North America 5G network and tower deployment market growth. Additionally, the increase in research & development expenditure by CSPs is constantly enhancing the effectiveness of the 5G network technology. For instance, Qualcomm Technologies, Inc. integrated mmWave into its 5G offerings for optimal utilization of 5G network capabilities. The fixed wireless access systems integrated with mmWave technology can be deployed in cost-effective solutions when installed across a highly populated residential or commercial area.

American Tower Corporation, Crown Castle, SBA Communications, Qualcomm Inc., and Verizon Communications Inc. are key North America 5G network and tower deployment market players profiled in the research study. The mentioned North America 5G network and tower deployment market players adopt organic growth strategies, such as product launches and expansions, to sustain their position in the North America 5G network and tower deployment industry.

The North America 5G network and tower deployment market size is segmented into component, location, frequency band, small cell tower, and country. Based on component, the North America 5G network and tower deployment market analysis is segmented into small cell, 5G mobile core network, and radio access network. Based on location, the North America 5G network and tower deployment market size is bifurcated into ground tower and rooftop tower. Based on frequency band, the North America 5G network and tower deployment market analysis is segmented into low band, medium band, and high band. Based on small cell tower, the North America 5G network and tower deployment market is categorized into femto cells, pico cells, and micro cells. Based on country, the North America 5G network and tower deployment market is segmented into the US, Canada, and Mexico.

North America has experienced an increase in the number of smartphone users over the last decade. The growing percentage of the young population and the rise in penetration of internet adoption across North American countries have increased the demand for smart mobiles and mobile subscriptions. For instance, according to GSMA, in North America, the subscription penetration is expected to grow from 84% in 2021 to 85% by 2025. In 2021, the adoption of smartphones in the region accounted for 82%, which is expected to reach 85% by 2025.

North America has been the pioneer in the rapid adoption of new and advanced technologies. The presence of multiple industries and their constant investment in technological advancements and the rise in demand for fast data transmission from commercial and residential broadband subscribers are propelling the demand for 5G networks across the region, thereby boosting the North America 5G network and tower deployment market growth.

Contact Us

Phone: +16467917070

Email Id: sales@businessmarketinsights.com