Published On: Apr 2025

Published On: Apr 2025

At 4.5% CAGR, Middle East & Africa Aircraft Brackets Market is Projected to be Worth US$ 63.21 Million by 2031, says Business Market Insights

According to Business Market Insights’ research, the Middle East & Africa aircraft brackets market was valued at US$ 44.54 million in 2023 and is anticipated to reach US$ 63.21 million by 2031, recording a CAGR of 4.5% from 2023 to 2031. Rising deliveries of general aviation aircraft and helicopters and increasing orders and deliveries of narrow body aircraft are among the critical factors attributed to drive the Middle East & Africa aircraft brackets market growth.

The aviation industry has matured rapidly over the years, recording a significant number of aircraft production and deliveries. This has showcased massive order volumes for various commercial aircraft manufacturers worldwide. Commercial aviation is foreseen to surge in the coming years with an increase in air travel passengers and aircraft volumes. The increase in orders of narrow body passenger and commercial aircraft across the globe drives the demand for aircraft brackets. After the COVID-19 pandemic and ongoing geopolitical wars in Europe and the Middle East, the global economy is weakening. However, people's desire to travel and the flow of travel have increased. In addition, the rapid growth of secondary and tertiary airports has continued due to the COVID-19 pandemic. Hence, airlines plan to expand to more remote locations by launching routes to smaller city airports. With the increasing number of aircraft and airports, the demand for aircraft brackets is also rising.

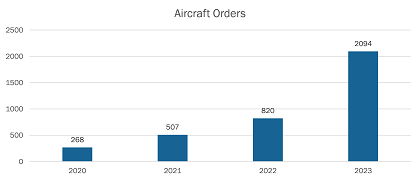

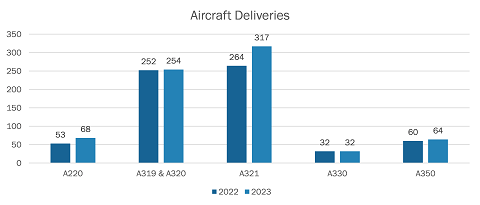

In the last two years, Boeing and Airbus have seen a significant increase in orders for narrow body aircraft. According to the Airbus order and delivery database, there were 820 commercial aircraft orders in 2022, which rose to 2094 in 2023, as shown in the above figure. However, according to the data, there is a rise in deliveries for narrow body aircraft—such as A220, A319 & A320, and A321—compared to the wide body aircraft—such as A330 and A350—in 2023, shown in the figure below.

Airbus and Boeing are the two aircraft manufacturing giants with significantly higher volumes of orders and delivery statistics. These two aircraft original equipment manufacturers (OEMs) continuously encounter orders for various aircraft models from civil airlines. The table below highlights the comparison of orders and deliveries from Airbus and Boeing during 2020–2023:

Aircraft Orders and Deliveries, by Boeing and Airbus, 2020 and 2023

Years | 2020 | 2021 | 2022 | 2023 | ||||

Commercial Aircraft | ||||||||

Aircraft Manufacturers | Boeing | Airbus | Boeing | Airbus | Boeing | Airbus | Boeing | Airbus |

Orders | 184 | 383 | 909 | 771 | 935 | 1078 | 1456 | 2319 |

Deliveries | 157 | 566 | 340 | 609 | 480 | 661 | 528 | 735 |

Moreover, Airbus forecasts that 40,850 new passenger and cargo aircraft will be delivered over the next 20 years, of which 32,630 will be typical single-aisle aircraft and 8,220 will be typical wide body aircraft from 2023 to 2042. In addition, the demand for freight aircraft is projected to reach 2,510 aircraft, with 920 newly built during the same timeframe. Thus, the increase in orders and deliveries of narrow body aircraft drives the market.

On the conversely, discontinuation of A380s and B747 jumbo jets hampers the growth of Middle East & Africa aircraft brackets market.

Based on aircraft type, the Middle East & Africa aircraft brackets market is segmented into commercial aircraft, general aviation, military aircraft, and helicopter. The commercial aircraft segment held 55.9% market share in 2023, amassing US$ 24.89 million. It is projected to garner US$ 35.46 million by 2031 to register 4.5% CAGR from 2023–2031.

By application, the Middle East & Africa aircraft brackets market is segmented into aircraft fuselage, aircraft wings, aircraft control surfaces, engine, and others. The aircraft fuselage segment held 46.3% share of Middle East & Africa aircraft brackets market in 2023, amassing US$ 20.61 million. It is anticipated to garner US$ 30.89 million by 2031 to expand at 5.2% CAGR during 2023–2031.

In the terms of material, the Middle East & Africa aircraft brackets market is segmented into aluminum, steel, and others. The aluminum segment held 63.2% share of Middle East & Africa aircraft brackets market in 2023, amassing US$ 28.15 million. It is anticipated to garner US$ 39.78 million by 2031 to expand at 4.4% CAGR during 2023–2031.

By end use, the Middle East & Africa aircraft brackets market is bifurcated into OEMs and aftermarket. The OEMs segment held 67.7% share of Middle East & Africa aircraft brackets market in 2023, amassing US$ 30.15 million. It is anticipated to garner US$ 43.79 million by 2031 to expand at 4.8% CAGR during 2023–2031.

Based on country, the Middle East & Africa aircraft brackets market is categorized South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Our regional analysis states that the Rest of Middle East & Africa captured 40.6% share of Middle East & Africa aircraft brackets market in 2023. It was assessed at US$ 18.07 million in 2023 and is likely to hit US$ 25.56 million by 2031, registering a CAGR of 4.4% during 2023–2031.

Key players operating in the Middle East & Africa aircraft brackets market are Arconic Corp; Hexagon AB; Hutchinson SA; Precision Castparts Corp.; SEKISUI Aerospace; Singapore Technologies Engineering Ltd; and Spirit AeroSystems Holdings Inc, others.

Contact Us

Phone: +16467917070

Email Id: sales@businessmarketinsights.com