Published On: Apr 2025

Published On: Apr 2025

At 5.8% CAGR, Asia Pacific Petrochemicals Market is Projected to be Worth US$ 388.60 Billion by 2031, says Business Market Insights

According to Business Market Insights' research, the Asia Pacific petrochemicals market was valued at US$ 246.85 billion in 2023 and is expected to reach US$ 388.60 billion by 2031, registering a CAGR of 5.8% from 2023 to 2031. Surge in demand for polymers across various end-use industries and development of biodegradable petrochemical-based products are among the critical factors attributed to the Asia Pacific petrochemicals market expansion.

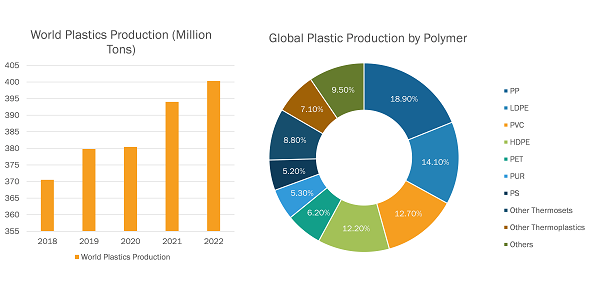

Petrochemical-based polymers such as polyamide, polypropylene, polystyrene, high-density polyethylene, thermoplastic elastomers, polyurethane, polycarbonate, and polyvinyl chloride are widely used in the automotive industry as these polymers offer excellent durability and resistance to corrosion. According to the CDI Products Company, the automotive industry is a significant consumer of polymers. These polymers enhance the longevity of automotive components, including interior parts and exterior body panels, as well as under-the-hood applications. As per the Plastics Europe 2023 report, the global production of plastics increased from 380.4 million tons in 2020 to 400.3 million tons in 2022.

Global Plastics Production - by Polymer, 2022

Source: Plastics Europe, 2023

According to the CDI Products Company, the automotive industry has various applications of petrochemical-based polymers, including PTFE seals, O-rings, bearings and thrust bearings, low-drag mudflaps, suspension cylinder seals, sensor covers, diaphragms, rotary seals, custom-made gaskets, wiring harnesses & housing, and battery sealing for pressure valves, among others.

Polymers are used in construction for insulation, windows, pipes, and coatings due to their energy-efficient properties. They help reduce energy consumption in buildings by providing effective thermal insulation. As per the International Trade Administration, total investments in China's infrastructure during the 14th Five-Year Plan period (2021-2025) are estimated to reach ~US$ 4.2 trillion. Similarly, according to the National Investment Promotion & Facilitation Agency, the Government of India allocated an investment budget of US$ 1.4 trillion in infrastructure under the National Infrastructure Pipeline by 2025, of which 18% accounted for roads and highways, 17% accounted for urban infrastructure, and 12% for railways. With the rise in construction activities, the demand for petrochemical-based materials is also increasing. Thus, the rising demand for polymers across various end-use industries fuels the petrochemicals market growth.

On the contrary, fluctuations in the crude oil prices hamper the growth of Asia Pacific petrochemicals market.

Based on type, the Asia Pacific petrochemicals market is segmented into ethylene, benzene, propylene, xylene, and others. The ethylene segment held 42.2% market share in 2023, amassing US$ 104.18 billion. It is projected to garner US$ 164.91 billion by 2031 to register 5.9% CAGR during 2023-2031.

In terms of application, the Asia Pacific petrochemicals market is categorized into polymers, paints and coatings, solvent, rubber, adhesives, surfactants, and others. The polymers segment held 62.6% share of Asia Pacific petrochemicals market in 2023, amassing US$ 154.53 billion. It is projected to garner US$ 250.78 billion by 2031 to expand at 6.2% CAGR during 2023-2031.

In terms of end-use industry, the Asia Pacific petrochemicals market is segmented into packaging, automotive, construction, electrical and electronics, healthcare, agriculture, aerospace and defense, and others. The packaging segment held 28.7% share of Asia Pacific petrochemicals market in 2023, amassing US$ 70.94 billion. It is projected to garner US$ 117.09 billion by 2031 to expand at 6.5% CAGR during 2023-2031.

Based on country, the Asia Pacific petrochemicals market has been categorized into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. Our regional analysis states that China captured 54.3% share of Asia Pacific petrochemicals market in 2023. It was assessed at US$ 134.13 billion in 2023 and is likely to hit US$ 227.72 billion by 2031, exhibiting a CAGR of 6.8% during 2023-2031.

Key players operating in the Asia Pacific petrochemicals market are Shell Plc, LyondellBasell Industries NV, Saudi Basic Industries Corp, BASF SE, INEOS Group Holdings SA, Dow Inc, Chevron Phillips Chemical Company LLC, China Petroleum & Chemical Corp, Mitsubishi Chemical Group Corp, and Exxon Mobil Corp. among others.

Contact Us

Phone: +16467917070

Email Id: sales@businessmarketinsights.com