Published On: Apr 2023

Published On: Apr 2023

Facial and Body Contouring Segment by Application to Account Larger Share in Asia Pacific Medical Aesthetics Market during 2022–2028

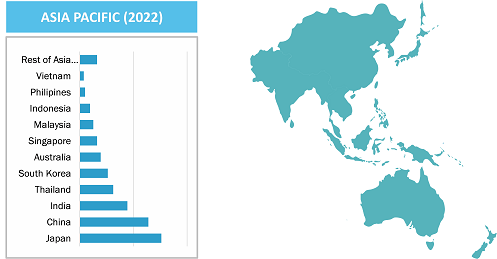

According to our latest study on “Asia Pacific Medical Aesthetics Market Forecast to 2028 – COVID-19 Impact and Regional Analysis – by Product Type, Application, and End User,” the market was valued at US$ 7,058.31 million in 2022 and projected to reach US$ 15,729.12 million by 2028; it is estimated to record a CAGR of 14.3% from 2022 to 2028. The report highlights the key factors driving the Asia Pacific medical aesthetics market growth and prominent players with their developments in the market.

Based on application, the Asia Pacific medical aesthetics market is segmented into facial and body contouring, facial and skin rejuvenation, breast augmentation, hair removal, reconstructive surgery, tattoo removal, and others. In 2021, the facial and body contouring segment held the largest share of the market. However, the breast augmentation segment is expected to register the highest CAGR during the forecast period. Facial contouring is also known as face sculpting—a facial contouring procedure that helps in improving facial appearance. Facial contouring has become an emerging trend in developing countries. For instance, according to the International Society of Aesthetic Plastic Surgery, India is among the top countries for aesthetic surgeries. Also, the cheap rate of aesthetic procedures in Asian countries compared to the countries in North America and Europe is attracting more patients to Asia under medical tourism. Thus, these factors are widely contributing to the growth of the market.

Nonsurgical body contouring, also known as nonsurgical fat reduction, helps remove stubborn pockets of fats in the body to shape up different areas of the body. Surgical body contouring, following major weight loss, removes excess sagging skin and fat while improving the shape of the underlying support tissue. A few of the common body contouring procedures include abdominoplasty, breast rejuvenation, buttock lift, branchioplasty, and inner thigh lift. However, nonsurgical body contouring procedures are not considered as weight loss solutions. Various players are focused on launching products to establish their foothold in the skin aesthetic devices market for body contouring. For instance, in September 2019, the Baldan Group introduced a 1,060-nm diode laser—LeShape—for nonsurgical body contouring, which is designed to protect the skin surface from any damage. Similar launches are likely to propel the growth of the market for the segment in the coming years.

Source: Business Market Insights Analysis

Market Driver

Growing Medical Tourism

In Asia Pacific, countries such as South Korea, Thailand, India, Singapore, and Malaysia are becoming hotspots for medical tourism destinations. The growth in medical tourism across Asia Pacific is due to the exceptional standard care offered for various medical purposes, including medical aesthetics. According to the United Nations World Travel Organization (UNWTO) World Tourism Barometer report published in 2022, international tourism in Asia Pacific has recorded a 64% increase in 2022 compared to 2021. In the first quarter of 2022, international tourism reached 182% year-on-year growth owing to the ease of travel restrictions and travellers seeking medical treatments. Due to the rising demand for cheaper medical treatments, hospitals and investors across Southeast Asia are boosting the growth of the medical tourism sector in several destinations, including Singapore, Thailand, and Malaysia.

In Thailand, the medical tourism sector witnessed exponential growth due to the government’s interest in hospital accreditation. As of December 2021, the government has approved 66 Joint Commission International (JCI)-accredited hospitals in the country. JCI accreditation is important as it reflects best standards for safety and quality of care. Therefore, the World Health Organization has also recommended the healthcare system in the country as “world-class” for breast implants, dental procedures, and gender reassignment surgeries.

Singapore is among the most expensive country in the world; however, medical services are much cheaper compared to North American and European countries. For instance, the cost of a knee replacement surgery in Singapore is US$ 13,000 compared to US$ 53,000 in the US. In contrast, the cost of surgeries in Singapore is much higher compared to countries such as Thailand and Malaysia. Nevertheless, the patients seek Singapore for their medical treatments due to remarkable standards of care. People widely preferred Singapore for major procedures such as hip and knee replacements, cardiac surgeries, and fertility and cancer treatments.

South Korea is the leading country in Asia Pacific that offers cosmetic procedures. In addition, South Korea is the leading adopter of various medical technologies. The country has adopted advanced technologies that can record patient information in real time on an electronic medical records system. In addition, due to technological advancements, the healthcare system in the country offers robotic surgery. Moreover, the government is promoting medical tourism by building international health centers and a special visa for treatments for medical tourists.

Malaysia is an ideal choice for medical travelers as the health system of the country offers balanced care, good accessibility, and affordability. It provides treatments at cheaper rates compared to the cost of treatments in the US. For instance, cardiac surgery can cost US$ 123,000 in the US, while it costs US$ 12,100 in Malaysia. Similarly, the total knee replacement cost in the US is US$ 19,995; however, it costs US$ 7,165 in Malaysia. Benefits provided by Malaysian medical tourism include cost-effective treatment, advanced facilities, great hospitality, and less waiting time, among others.

India is among the top three medical tourism destinations in the region. As per a renowned blog, it accounts for 90% of Asian medical tourism. The government of India secured foreign support and investments for the development of JCI-accredited equipment. Additionally, the cost of surgeries in India is less compared to the cost in Thailand. Thus, patients traveling to India for medical care can save up to 85% on their treatments. Under medical tourism in India, the country offers various medical services, including alternative medicine, cardiac surgeries, bone-marrow transplants, and hip replacements. Thus, the benefits of advanced medical treatments at cheaper rate are enabling the growth of APAC medical aesthetic market.

AbbVie Inc, Bausch Health Co Inc, Lumenis Be Ltd, ARC Laser GmbH, Alma Lasers Ltd, El.En. SPA, Crown Laboratories Inc , Merz Pharma GmbH & Co KgaA, Quanta System SpA, Galderma SA, Venus Concept Inc, PharmaResearch Co Ltd, and Neoasia (S) Pte Ltd are a few of the key companies operating in the Asia Pacific medical aesthetics market.

Companies operating in the Asia Pacific medical aesthetics market adopt various organic and inorganic strategies. Organic strategies mainly include product launches, expansions, and product approvals. Acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the Asia Pacific medical aesthetics market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall smart hospital beds market growth. Further, acquisition and partnership strategies help them strengthen their customer base and expand their product portfolios.

A few of the significant developments by key market players are listed below.

Contact Us

Phone: +16467917070

Email Id: sales@businessmarketinsights.com