Published On: Oct 2024

Published On: Oct 2024

At 8.0% CAGR, Asia Pacific Ferroalloys Market is Projected to be Worth US$ 203.89 Billion by 2031, says Business Market Insights

According to Business Market Insights’ research, the Asia Pacific ferroalloys market was valued at US$ 110.13 billion in 2023 and is expected to reach US$ 203.89 billion by 2031, registering a CAGR of 8.0% from 2023 to 2031. Rise in infrastructure development investments by government bodies and growing adoption in superalloys are among the critical factors attributed to drive the Asia Pacific ferroalloys market growth.

Government-supported infrastructure projects involve building roads, dams, bridges, tunnels, ports, airport pavements, and highways. The growing investments from government organizations lead to a rise in infrastructure construction. According to the World Bank Organization, the total global infrastructure investment reached US$ 3.9 trillion annually, with the highest demands in emerging countries. Further, in 2022, US$ 91.7 billion were invested in 263 infrastructure projects in the private sector across all low- and middle-income countries such as India, China, Japan, and Africa. This represents 23% growth in 2022 compared to 2021, at an average growth rate of 4% during 2017–2021. In 2022, there has been a significant rebound in construction activities in developing countries with growing investment commitments post-COVID-19 pandemic.

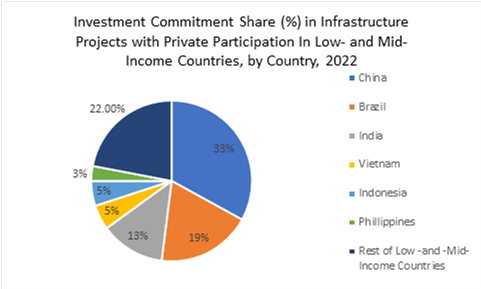

The following chart shows the share of investment commitments for infrastructure-building projects in low- and mid-income countries in 2022:

According to the Asia Development Bank Organization, Asia Pacific countries invest around US$ 1.7 trillion per year in the construction sector. The Department of Water Resources, River Development and Ganga Rejuvenation of India launched a scheme with a financial outlay of US$ 322.5 million for the rehabilitation of 223 dams in seven states in India. Additionally, in February 2024, the Thai government announced that it intends to invest US$ 33 billion in public-private partnership projects between 2020 and 2027 to support long-term economic growth. Also, to upgrade the nation's infrastructure, the Thailand Transport Ministry has announced plans to invest around US$ 18.5 billion in roughly 150 transportation projects 2024 and 2025. These include 18 road projects, including road No. 81 (Bang Yai-Kanchanaburi) and Motorway No. 6 (Bang Pa-in-Nakhon Ratchasima), would be opened to commuters this year. In addition, work on the Fifth Thai Lao Friendship Bridge in Bueng Kan is scheduled to begin in 2024.

Thus, rising investments and efforts in infrastructure development by governments of numerous countries across the region drive the ferroalloys market.

On the contrary, fluctuations in raw material prices hamper the growth of Asia Pacific ferroalloys market.

Based on type, the Asia Pacific ferroalloys market is segmented into ferrochrome, ferromanganese, ferro silico manganese, special alloys, and others. The ferro silico manganese segment held 34.6% market share in 2023, amassing US$ 38.06 billion. It is projected to garner US$ 72.25 billion by 2031 to register 8.3% CAGR during 2023–2031.

In terms of application, the Asia Pacific ferroalloys market is categorized into steel making, wire manufacturing, welding electrodes, superalloys, and others. The steel making segment held 85.1% share of Asia Pacific ferroalloys market in 2023, amassing US$ 93.70 billion. It is anticipated to garner US$ 174.75 billion by 2031 to expand at 8.1% CAGR during 2023–2031.

By country, the Asia Pacific ferroalloys market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. Our regional analysis states that China captured 75.0% share of Asia Pacific ferroalloys market in 2023. It was assessed at US$ 82.64 billion in 2023 and is likely to hit US$ 155.46 billion by 2031, registering a CAGR of 8.2% during 2023–2031.

Key players operating in the Asia Pacific ferroalloys market are Glencore Plc, Jindal Stainless Ltd, Ferro Alloys Corp Ltd (FACOR), Erdos Group, Pertama Ferroalloys Sdn Bhd, Brahm Group, Tata Steel Ltd, and Nava Ltd., among others.

Contact Us

Phone: +16467917070

Email Id: sales@businessmarketinsights.com