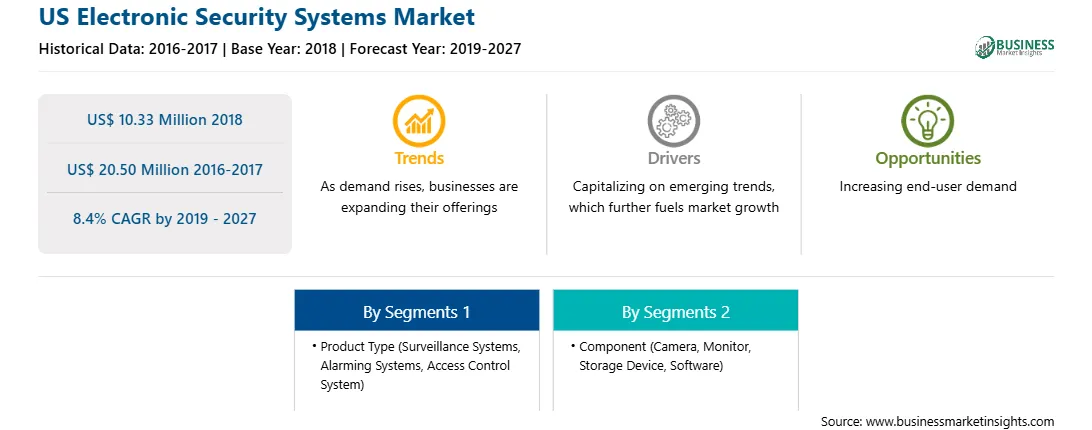

到 2027 年美国电子安全系统市场 - 按产品类型(监控系统、报警系统、访问控制系统)进行的国家分析和预测;组件(摄像头、监视器、存储设备、软件)

No. of Pages: 225 | Report Code: TIPRE00009207 | Category: Electronics and Semiconductor

No. of Pages: 225 | Report Code: TIPRE00009207 | Category: Electronics and Semiconductor

美国电子安全系统

2018年市场价值为1033万美元,预计将达到2050万美元到 2027 年,自 2019 年以来复合年增长率为 8.4% – 2027

。

美国电子预计安全系统市场在预测期内将以更快的速度增长,这主要是由于大量供应商挺身而出,向美国各地的联邦、州和地方政府机构提供电子安全系统。领先的参与者为联邦政府客户设计、开发、安装和维护技术复杂的集成电子安全系统。美国有许多机构和协会致力于安全系统的开发,例如国土安全部 (DHS)、国防部、交通部、卫生与公众服务部、美国安全许可指南、能源部、国家安全局 (NSA)、总务管理局 (GSA) 和电子安全协会 (ESA) 等。

近年来,随着买家群体的不断增加,电子安全系统市场参与者对其产品和解决方案的需求不断增加。电子安全系统的买家包括联邦政府部门。最终用户对电子安全系统的需求各不相同;例如,国土安全部(DHS)对生物识别系统、网络管理支持服务等访问控制系统的需求;入侵检测系统等。与国土安全部一样,国防部(DoD)也需要生物识别和入侵检测,国防部还采购读卡器、视频监控系统、电子锁。另一方面,交通部(DoT)主要采用智能卡读卡器和视频监控摄像头。对不同系统类型的混合需求正在抑制电子安全系统市场的增长。考虑到上述因素,预计买家的议价能力在整个预测期内仍将保持较高水平。

市场洞察

视频监控摄像机中人工智能的采用率上升

对人工智能的需求巨大将人工智能 (AI) 融入视频监控系统。将人工智能(AI)融入视频监控系统以协助视频、大数据和物联网(IoT)分析,可减少分析时间并提高决策能力。该视频分析软件还增强了网络摄像机的功能,使其能够智能、高效地运行。人工智能有助于有效监控,然后提供捕获的图像,并在工作站内和周围出现可疑活动时向警卫发出警报。这一因素有助于监控团队增强安全性,并节省人力和时间。此外,视频监控系统中的人工智能还可以实现多种功能,例如面部识别、运动检测和车牌读取。随着人工智能的融入,现代视频监控摄像机的处理能力得到了更大程度的提高,这反过来又增加了摄像机对各种分析工具的托管能力,从而提高了网络摄像机的可靠性。因此,人工智能在视频监控系统中的融入正在推动电子安全系统市场的发展,预计未来将推动该市场的发展。

电子安全系统市场 - 产品类型洞察

美国电子安全系统市场按产品类型分为监控系统、报警系统和访问控制。 监控系统细分市场在电子安全系统市场中占据主导地位,预计从 2019 年开始的整个预测期内将继续保持主导地位 - 2027 年。预计门禁系统细分市场将在预测期内大幅增长。

监控系统洞察

监控安全系统有有线和无线配置,可进一步细分为:摄像头、视频管理和 IP 视频录制。这些系统持续监控政府大楼、联邦办公楼或政府基础设施等建筑物。监控系统的输出可以在智能手机、平板电脑和计算机上远程查看,以记录任何非法活动。它可以帮助业主远程监控任务。美国联邦政府建筑物和基础设施面临着来自各种非法团体的严重威胁。因此,为了确保建筑物或基础设施场所免受任何非法进入,联邦政府正在采取重大举措,采用技术先进的监控系统,这推动了监控系统市场的发展,反过来又促进了美国电子监控系统的增长。安全系统市场。

访问控制系统洞察

<美国政府建筑、交通系统、边境地区、机场、海港等各类基础设施都曾遭遇非法侵入,造成资金和数据的重大损失。这一因素增加了全国范围内对门禁系统的需求,从而推动了美国电子安全系统市场的发展。读卡器是迄今为止联邦政府垂直行业中最具吸引力的门禁系统,然而,在当前情况下,对生物识别技术的需求更高。在当前技术先进的市场环境中,读卡器很容易被破解,这又对各种安全基础设施构成潜在威胁。另一方面,生物识别系统与相同的记录一样高度安全,并且可以访问个人的生物特征。这些因素吸引了客户,从而推动了美国电子安全系统市场的发展。

战略洞察

并购和收购合同是公司为增强产品组合和满足不断增长的需求而采取的两种最重要的策略。电子安全系统市场的参与者还采取扩张和投资研发的策略,以扩大美国和全球的客户群,这也使参与者能够在全球范围内保持其品牌声誉。

美国电子安全系统市场,按

产品类型

< /p>

美国电子安全系统市场(按组件)

电子安全系统市场 - 公司简介

Strategic insights for US Electronic Security Systems involve closely monitoring industry trends, consumer behaviours, and competitor actions to identify opportunities for growth. By leveraging data analytics, businesses can anticipate market shifts and make informed decisions that align with evolving customer needs. Understanding these dynamics helps companies adjust their strategies proactively, enhance customer engagement, and strengthen their competitive edge. Building strong relationships with stakeholders and staying agile in response to changes ensures long-term success in any market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 10.33 Million |

| Market Size by 2027 | US$ 20.50 Million |

| Global CAGR (2019 - 2027) | 8.4% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By 产品类型

|

| Regions and Countries Covered | 美国

|

| Market leaders and key company profiles |

The regional scope of US Electronic Security Systems refers to the geographical area in which a business operates and competes. Understanding regional nuances, such as local consumer preferences, economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved regions or adapting their offerings to meet regional demands. A clear regional focus allows for more effective resource allocation, targeted marketing, and better positioning against local competitors, ultimately driving growth in those specific areas.

The List of Companies - US Electronic Security Systems Market

The US Electronic Security Systems Market is valued at US$ 10.33 Million in 2018, it is projected to reach US$ 20.50 Million by 2027.

As per our report US Electronic Security Systems Market, the market size is valued at US$ 10.33 Million in 2018, projecting it to reach US$ 20.50 Million by 2027. This translates to a CAGR of approximately 8.4% during the forecast period.

The US Electronic Security Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Electronic Security Systems Market report:

The US Electronic Security Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Electronic Security Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Electronic Security Systems Market value chain can benefit from the information contained in a comprehensive market report.