Report : UK Medical Courier Market Forecast to 2028 - COVID-19 Impact and Country Analysis - by Product Type (Lab Specimens, Medical Supplies and Equipment, Blood and Organs, Medical Notes, and Others); Destination (Domestic and International); Service (Standard Services and Rush and On-demand Services), and End User (Hospitals and Clinics, Diagnostics Labs, Pharmaceutical and Biotechnology Companies, Blood and Tissue Banks, Pharmacies, In Home Support, and Others)

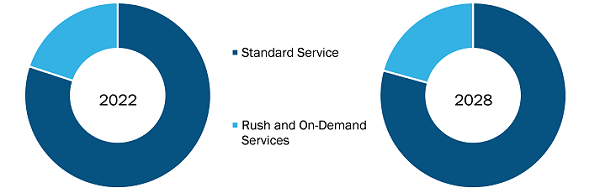

Standard Services Segment to Account for Largest Market Share by Service in UK medical courier market during 2023–2028

According to our new research study on " UK Medical Courier Market Forecast to 2028 – COVID-19 Impact and Country Analysis – by Product Type, Service, Destination, and End User," the market is expected to grow from US$ 373.92 million in 2022 to US$ 505.27 million by 2028; it is estimated to register a CAGR of 5.2% from 2023 to 2028. The report highlights the key factors driving the UK medical courier market growth and prominent players with their developments in the market.

Based on service, the UK medical courier market is segmented into standard services and rush and on-demand services. The standard services segment held a larger market share in 2022 and rush and on-demand services are anticipated to register the highest CAGR during the forecast period. Standard services for medical products are similar to traditional standard courier services that deliver products in a predefined time. Standards services are generally non-emergency services; therefore, they are more cost-effective, responsive, and flexible than other courier services, including same-day delivery, rush-hour deliveries, and others. Under standard services, deliveries are prioritized based on the parcels and products' weight, size, and durability. Companies offering standard services ensure deliveries within two to three days from the processed date, making them cost-effective. Also, traditional services can be personalized according to the customers' requirements based on extra or fewer delivery miles. It also offers traceability of the parcel to the customers that can see the real-time movement of their parcel and ensure safe and on-time delivery. The growth of the market is due to a boom in the purchase of medicines and medical products. According to a research article, “Attitudes and behaviors regarding online pharmacies in the aftermath of COVID-19 pandemic: At the tipping point towards the new normal,” published by National Library of Medicine in December 2022, online sales accounted for ~4.1% of the total pharmacy turnover in the UK in 2020. Also, the same year, distance-selling pharmacies witnessed increased distribution by 45% in the UK. Thus, medical courier services are expected to grow significantly in 2020 and flourish in the coming future as online pharmacies have increased post-COVID-19 pandemic.

Whereas the rush and on-demand services for medical couriers are expected to grow faster as the demand for critical, time-sensitive medical supplies from the healthcare systems increases. The growing technological advancements also enable companies to adopt hi-tech facilities to deliver medical couriers. For instance, in October 2022, Skyfarer and its partner Medical Logistics UK announced a joint Medical Drone Delivery Beyond Visual Line of Sight trial. The trial was known as 'The Medical Logistics UK Corridor,' and approved by Civil Aviation Authorities (CAA) to be conducted in the areas of Medical Logistics UK. The drone was developed in 2017 and launched in October 2022 to offer vital medical supplies to patients. Such innovations enable the growth of rush and on-demand services by enhancing the delivery time for medical products. It is also expected to reduce long wait times due to several transportation challenges. In addition, drone delivery will help cater to the emergency requirements of blood and organs during emergencies. Thus, such initiatives will likely create growth opportunities for the market during the forecast period.

ERS Transition Ltd; Send Direct Ltd; Med Logistics Group Ltd; CitySprint (UK) Ltd; United Parcel Service Inc; FedEx Corp; Aylesford Couriers Ltd; Reliant Couriers & Haulage Ltd; Coulson Ventures Ltd, and Deutsche Post AG. among others. are among the key companies operating in the UK medical courier market.

UK Medical Courier Market, by Service, 2022 (%)

Source: Business Market Insights Analysis

Companies operating in the UK medical courier market adopt various organic and inorganic strategies. Organic strategies mainly include product launches and expansion, and business planning. Acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the UK medical courier market. These growth strategies allow the market players to expand their businesses, thereby contributing to the overall UK medical courier market growth. Further, acquisition and partnership strategies help them strengthen their customer base and expand their product portfolios.

A few of the significant developments by key UK medical courier market players are listed below.

- In October 2022, Med Logistics Group Ltd partnered with Skyfarer and University Hospitals Coventry and Warwickshire (UHCW) NHS Trust to conduct a trial for Beyond Visual Line of Sight (BVLOS) drone in the UK. The drone is first-of-its-kind, and the trial was completed under secure CAA-approved airspace called "The Medical Logistics UK Corridor".

- ERS Medical merged with E-zec to expand their breadth of service expertise. The merger will create opportunities for both companies by combining operational best practice, expertise and high standards. The expanded business is expected to enlarge their business through delivering further opportunities for their employees, customers. In addition, the merger will be a better support for those who need the services most in the communities.

- In April 2022, FedEx Express, a subsidiary of FedEx Corp. and the world’s largest express transportation company, has expanded its operations at Newcastle International Airport, to serve growing export and import demands in the region. The new facility supports an upgrade to a FedEx-branded B737-400 aircraft, which is three times the size of its current ATR72 aircraft.

Contact Us

Contact Person: Sameer Joshi

Phone: +1-646-491-9876

Email Id: sales@businessmarketinsights.com