US Dairy Free Creamer Market to 2027 - Regional Analysis and Forecasts by Form (Powder, Liquid); Nature (Organic, Conventional); Flavor (Original, French Vanilla, Chocolate, Coconut, Hazelnut, Others); End-Use (Food and Beverage Processing, Bakery Products and Ice Creams, RTD Beverages, Infant Food Prepared and Packaged Food, Others); Distribution Channel (Hypermarkets/Supermarkets, Grocery Stores, Specialty Stores, Online Retail, Others)

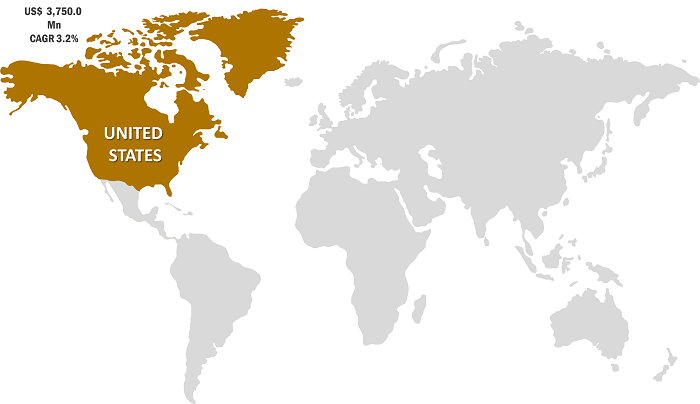

The US dairy free creamer market is accounted to US$ 3,750.0 Mn in 2018 and is expected to grow at a CAGR of 3.2% during the forecast period 2019 – 2027, to account to US$ 4,989.1 Mn by 2027.

Rising prevalence of lactose intolerance condition and increasing health consciousness amongst consumers has bolstered the growth of US dairy free creamer market.

Get more information on this report : US Dairy Free Creamer Market, Revenue and Forecast, 2018

Market Insights

Surge in demand for plant-based food products boost the dairy free market growth

Plant-based products and ingredients are becoming more popular in the US. This is mainly due to the fact that consumers are growing increasingly more interested in sustainability and health. Consumers are increasingly adopting these products into their regular diet. Moreover, the rise in the number of vegan population and people who are reducing their meat consumption, also called flexitarians provide a lucrative opportunity for the dairy free creamer market over the forecast period. Wide range of creamers such as coconut, almond, and hazelnut, among others are available in the market, which further provides a variety of option for the customers.

Growing use of dairy free creamers as a substitute for milk or cream provides opportunity for the dairy free creamer market growth

Dairy free creamers are used in various types of recipes. It is mostly used in baked products and coffee. Dairy free creamer is used as a substitute for milk and milk creamers as it does not affect the taste of the products. Dairy free creamer is also used as a milk substitute in custards and other creamy desserts to enhance the taste. Different type of creamers, such as coconut, hazelnut, and soy creamer, are used for preparing different type of dishes. For instance, dairy-free creamer has a perfect consistency for making flaky, tender, healthy biscuits.

Flavor Insights

The US dairy free creamer market by flavor has been categorized in original, french vanilla, chocolate, coconut, hazelnut, others. The demand for original flavored dairy free creamer is rising due to growing demand from the food and beverage processing industry. The original or unflavored dairy free creamer is entirely gluten-free and does not contain any genetically modified organisms. People are inclining more towards plant based food which is bound to expand the original flavor dairy free creamer market in the coming years.

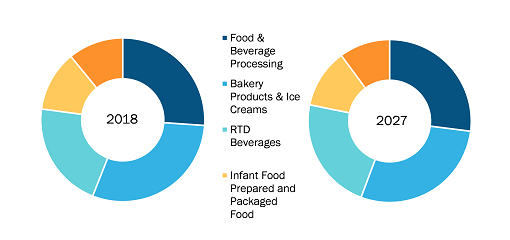

End Use Insights

On the basis of end use, the US dairy free creamer market has been segmented into food and beverage processing, bakery products and ice creams, RTD beverages, infant food prepared and packaged food, others. Under end use segment, bakery products & ice creams is the leading segment in the US dairy free creamer market. There has been a high growth in the application of dairy free creamer in the bakery products & ice creams production. Some of the popular dairy free creamer bakery products include Mississippi mud pie, apple pies, gluten-free pie crust, vegan chocolate cherry tartlets, raspberry lemon cake with a frosting of vegan free creamer, gluten-free strawberry cheesecakes, frozen cold brew cookies, and gluten-free puddings. The wide range of application of on dairy creamer for production of bakery products and ice cream boost the growth of the dairy free creamer market.

Get more information on this report : US Dairy Free Creamer Market by End Use

Strategic Insights

Mergers & acquisition and new product development were observed as the most adopted strategies in US dairy free creamer market. Few of the recent developments in the US dairy free creamer market are listed below:

2019: Starbucks partnered with Nestlé for launching a line of creamers to reach more customers at home

2019: Blue Diamond Growers expanded their extensive Almond Breeze product line with the addition of Almond Breeze Almondmilk Horchata

2018: So Delicious Dairy Free launched its new line of Oatmilk Frozen Desserts. With the oat milk category continuing to grow, So Delicious is first-to-market nationwide with its oat milk is frozen desserts, which are crafted with smooth oat milk and blended with delicious flavors

2016: Laird Superfood has entered into a partnership agreement with Azure Standard of Dufur, Oregon for the nationwide distribution of the company’s award-winning coffee and superfood products

US DAIRY FREE CREAMER MARKET SEGMENTATION

- By Form

- Powder

- Liquid

- By Nature

- Organic

- Conventional

- By Flavor

- Original

- French Vanilla

- Chocolate

- Coconut

- Hazelnut

- Others

- By End Use

- Food & Beverage Processing

- Bakery Products & Ice Creams

- RTD Beverages

- Infant Food Prepared and Packaged Food

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Grocery Stores

- Specialty Stores

- Online Retail

- Others

- Company Profiles

- Blue Diamond Growers

- Califia Farms

- COMPACT INDUSTRIES, INC.

- Danone S.A.

- Green Grass Foods

- Laird Superfood, Inc.

- milkadamia

- Mooala Brands, LLC.

- NESTLé S.A.

- New Barn Organics

- PRYMAL COFFEE CREAMER

- TreeHouse Foods, Inc

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 US Dairy Free Creamer Market – By Form

1.3.2 US Dairy Free Creamer Market – By Nature

1.3.3 US Dairy Free Creamer Market – By Flavor

1.3.4 US Dairy Free Creamer Market – By End-Use

1.3.5 US Dairy Free Creamer Market – By Distribution Channel

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. US Dairy Free Creamer Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 US PEST Analysis

4.3 Expert Opinion

4.4 Pricing Analysis of Dairy Free Creamer

5. US Dairy Free Creamer Market Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Surge in demand for plant-based food products

5.2 Increasing prevalence of lactose intolerance condition

5.3 Key Market Restraints

5.3.1 Health concerns associated with the consumption of dairy free milk and creamer

5.4 Key Market Opportunities

5.4.1 Growing use of dairy free creamers as a substitute for milk or cream

5.5 Future Trends

5.5.1 Emerging benefits of coconut milk and coconut creamer products for heart diseases

5.6 Impact Analysis of Drivers and Restraints

6. Dairy Free Creamer Market – US Analysis

6.1 US Dairy Free Creamer Market Overview

6.2 US Dairy Free Creamer Market Forecast And Analysis

6.3 Market Positioning – Top 5 Players Ranking

7. US Dairy Free Creamer Market Analysis – By Form

7.1 Overview

7.2 US Dairy Free Creamer Market Breakdown, By Form, 2018 & 2027

7.3 Powder

7.3.1 Overview

7.3.2 US Powdered Dairy Free Creamer Market Volume and Revenue Forecasts To 2027 (Kg, US$ Mn)

7.4 Liquid

7.4.1 Overview

7.4.2 US Liquid Dairy Free Creamer Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

8. US Dairy Free Creamer Market Analysis – By Nature

8.1 Overview

8.2 US Dairy Free Creamer Market Breakdown, By Nature, 2018 & 2027

8.3 Organic

8.3.1 Overview

8.3.2 US Organic Dairy Free Creamer Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

8.4 Conventional

8.4.1 Overview

8.4.2 US Conventional Dairy free creamer Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

9. US Dairy Free Creamer Market Analysis – By Flavor

9.1 Overview

9.2 US Dairy Free Creamer Market Breakdown, By Flavor, 2018 & 2027

9.3 Original

9.3.1 Overview

9.3.2 US Original Dairy Free Creamer Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

9.4 French Vanilla

9.4.1 Overview

9.4.2 US French Vanilla Dairy Free Creamer Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

9.5 Chocolate

9.5.1 Overview

9.5.2 US Chocolate Dairy Free Creamer Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

9.6 Coconut

9.6.1 Overview

9.6.2 US Coconut Dairy Free Creamer Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

9.7 Hazelnut

9.7.1 Overview

9.7.2 US Hazelnut Dairy Free Creamer Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

9.8 Others

9.8.1 US Other Dairy Free Creamer Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

10. US Dairy Free Creamer Market Analysis – By End Use

10.1 Overview

10.2 US Dairy Free Creamer Market Breakdown, By End-Use, 2018 & 2027

10.3 Food and Beverage Processing

10.3.1 Overview

10.3.2 US Food and Beverage Processing Market Volume and Revenue Forecasts to 2027 (Kg, US$ MN)

10.4 Bakery Products and Ice-Cream

10.4.1 Overview

10.4.2 US Bakery Products and Ice-Cream Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

10.5 RTD Beverages

10.5.1 Overview

10.5.2 US RTD Beverages Volume and Revenue Forecasts to 2027 (Kg, US$ MN)

10.6 Infant Food Prepared and Packaged Food

10.6.1 Overview

10.6.2 US Infant Food Prepared and Packaged Food Market Volume and Revenue Forecasts to 2027 (Kg, US$ MN)

10.7 Others

10.7.1 Overview

10.7.2 US Others Market Volume and Revenue Forecasts to 2027 (Kg, US$ MN)

11. US Dairy Free Creamer Market Analysis – By Distribution Channel

11.1 Overview

11.2 US Dairy Free Creamer Market Breakdown, By Distribution Channel, 2018 & 2027

11.3 Hypermarket & Supermarket:

11.3.1 US Hypermarket & Supermarket Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

11.4 Grocery Stores

11.4.1 US Grocery Stores Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

11.5 Specialty Stores

11.5.1 US Specialty Stores Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

11.6 Online Retails

11.6.1 US Online Retails Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

11.7 Others

11.7.1 US Other Market Volume and Revenue Forecasts to 2027 (Kg, US$ Mn)

12. Industry Landscape

12.1 Merger & Acquisition

12.2 New Development

13. Dairy Free Creamer, Key Company Profiles

13.1 Blue Diamond Growers

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Califia Farms

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.3 Compact Industries, Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.4 DANONE S.A.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Green Grass Foods

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Laird Superfood, Inc.

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Milkadamia

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.8 Mooala Brands, LLC.

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Nestle S.A.

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 New Barn Organics

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.11 Prymal Coffee Creamer

13.11.1 Key Facts

13.11.2 Business Description

13.11.3 Products and Services

13.11.4 Financial Overview

13.11.5 SWOT Analysis

13.12 TreeHouse Foods, Inc

13.12.1 Key Facts

13.12.2 Business Description

13.12.3 Products and Services

13.12.4 Financial Overview

13.12.5 SWOT Analysis

14. Appendix

14.1 About The Insight Partners

14.2 Glossary Of Terms

LIST OF TABLES

Table 1. US Dairy Free Creamer Market Revenue and Volume Forecasts to 2027 (Kg, US$ Mn)

Table 2. Glossary of Term: Dairy Free Creamer Market

LIST OF FIGURES

Figure 1. Dairy Free Creamer Market Segmentation

Figure 2. US Dairy Free Creamer Market Overview

Figure 3. Original Segment Held Largest Share In The US Dairy Free Creamer Market

Figure 4. Rtd Beverages Segment Is Expected To Show Remarkable Traction During The Forecast Period

Figure 5. US Dairy Free Creamer Market, Industry Landscape

Figure 6. US– PEST Analysis

Figure 7. Expert Opinion

Figure 8. Dairy Free Creamer Market Impact Analysis Of Driver And Restraints

Figure 9. US Dairy Free Creamer Market Forecast And Analysis, (US$ Mn)

Figure 10. US Dairy Free Creamer Market Breakdown By Form, Value, 2018 & 2027 (%)

Figure 11. US Powdered Dairy Free Creamer Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 12. US Dairy Free Creamer Market, Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 13. US Dairy Free Creamer Market Breakdown By Nature, Value, 2018 & 2027 (%)

Figure 14. US Organic Dairy Free Creamer Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 15. US Conventional Dairy Free Creamer Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 16. US Dairy Free Creamer Market Breakdown, By Flavor, Value, 2018 & 2027 (%)

Figure 17. US Original Dairy Free Creamer Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 18. US French Vanilla Dairy Free Creamer Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 19. US Chocolate Dairy Free Creamer Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 20. US Coconut Dairy Free Creamer Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 21. US Hazelnut Dairy Free Creamer Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 22. US Other Dairy Free Creamer Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 23. US Dairy Free Creamer Market Breakdown, By End-Use, 2018 & 2027 (%)

Figure 24. US Food And Beverages Processing Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 25. US Bakery And Ice-Cream Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 26. US RTD Beverages Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 27. US Infant Food Prepared And Packaged Food Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 28. US Others Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 29. US Dairy Free Creamer Market Breakdown By Distribution Channel, Value, 2018 & 2027 (%)

Figure 30. US Hypermarket & Supermarket Sales Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 31. US Grocery Stores Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 32. US Specialty Stores Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 33. US Online Retails Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

Figure 34. US Other Market Volume And Revenue Forecasts To 2027 (Kg, US$ Mn)

The List of Companies

- Blue Diamond Growers

- Califia Farms

- Compact Industries, Inc.

- Danone S.A.

- Green Grass Foods

- Laird Superfood, Inc.

- milkadamia

- Mooala Brands, LLC.

- NESTLé S.A.

- New Barn Organics

- Prymal Coffee Creamer

- TreeHouse Foods, Inc.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the US dairy free creamer market, thereby allowing players to develop effective long term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth the market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.