South America Wealth Management Platform Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Advisory Model (Human Advisory, Robo-Advisory, and Hybrid), Business Function (Performance Management, Risk and Compliance Management, Portfolio Accounting and Trading Management, Financial Advice Management, Reporting, and Others), Deployment Type (Cloud and On-Premises), and End User (Investment Management Firms, Trading and Exchange Firms, Banks, Brokerage Firms, and Others)

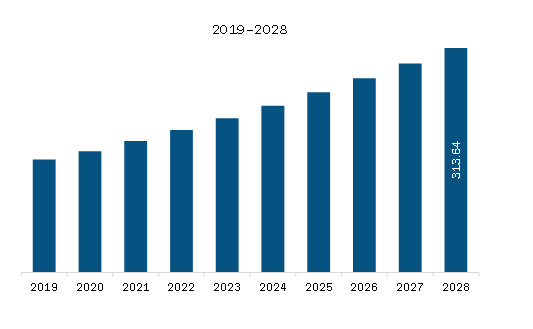

The wealth management platform market in SAM is expected to grow from US$ 183.87 million in 2021 to US$ 313.64 million by 2028; it is estimated to grow at a CAGR of 7.9% from 2021 to 2028.

The wealth management platform market is growing swiftly in SAM due to rising security concerns, increasing government support, and elevating advanced technology adoption—especially in developing countries such as Brazil, Chile, Argentina, Peru, and Colombia. Brazil holds more than 50% of the wealth management platform market in SAM and is anticipated to continue its dominance over the forecast period. Many of the companies in the region are opting for these platforms to boost their businesses and profit margins. SAM countries are attracting huge FDIs on the back of low-cost labor availability, and small entry barriers and interest rates. Certain countries in the region have relaxed FDI regulations, thus attracting investments from companies from other countries. Argentina is concentrating on attracting FDIs by easing import restrictions, signing international bilateral agreements, and lifting restrictions from foreign investments.

The growth of environmental, social, and governance guidelines (ESG) is one of the significant trends in SAM, which is impacting the development of the wealth management platform market. With the betterment of liquidity and stability in the region, several industries are concentrating on their expansion in emerging markets. However, emerging markets offer lower liquidity to organizations than developed markets, which compels them to make longer-term investments. This boosts the adoption of advanced and innovative platforms for wealth management that aid valuable insights to users about future market investments. Despite these benefits, wealth management platform providers need to address a few issues for operating seamlessly in SAM. Companies in this region have specific requirements that service providers do not readily provide. Inane acts and decisions of the new generation of entrepreneurs, scarcity of exit strategies, and lack of record of well-established organizations in Latin America have been restricting the adoption of these platforms in the region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM wealth management platform market. The market is expected to grow at a good CAGR during the forecast period.

SAM Wealth Management Platform Market Revenue and Forecast to 2028 (US$ Million)

SAM Wealth Management Platform Market Segmentation

SAM wealth management platform market is segmented into advisory model, business function, deployment type, end user, and country. The SAM wealth management platform market, based on advisory model, is segmented into human advisory, robo-advisory, and hybrid. Human advisory segment held the largest market share in 2020. The SAM wealth management platform market, by business function, is segmented into performance management, risk and compliance management, portfolio accounting and trading management, financial advice management, reporting, and others. Portfolio accounting and trading management segment held the largest market share in 2020. The SAM wealth management platform market, by deployment type, is segmented into cloud and on-premises. Cloud-based segment held the largest market share in 2020. The SAM wealth management platform market, by end user, is segmented into trading & exchange firms, banks, brokerage firms, investment management firms, and others. Investment management firms segment held the largest market share in 2020. Based on country, the SAM wealth management platform market is segmented into Brazil, Argentina, and the rest of SAM. Broadridge Financial Solutions, Inc.; Comarch SA; FIS Global; Fiserv, Inc.; InvestCloud; SS&C Technologies, Inc.; and Temenos Headquarters SA are among the leading companies in the market.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 SAM Wealth Management Platform Market – By Business Function

1.3.2 SAM Wealth Management Platform Market – By Advisory Model

1.3.3 SAM Wealth Management Platform Market – By Deployment Type

1.3.4 SAM Wealth Management Platform Market – By End User

1.3.5 SAM Wealth Management Platform Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. SAM Wealth Management Platform Market Landscape

4.1 Market Overview

4.2 SAM PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. SAM Wealth Management Platform Market- Key Market Dynamics

5.1 Market Drivers

5.1.1 Wealth Management Using Robo Advisors

5.2 Market Restraints

5.2.1 High-Profile Data Privacy and Security Concerns

5.3 Market Opportunities

5.3.1 Long-Term Financial Planning Becoming Popular

5.4 Future Trends

5.4.1 Integration of AI and Analytics in Wealth Management Platforms

5.5 Impact Analysis of Drivers and Restraints

6. Wealth Management Platform Market – SAM Analysis

6.1 SAM Wealth Management Platform Market Overview

6.2 SAM Wealth Management Platform Market Forecast and Analysis

7. SAM Wealth Management Platform Market – By Deployment Type

7.1 Overview

7.2 SAM Wealth Management Platform, by Deployment Type (2020 and 2028)

7.3 Cloud

7.3.1 Overview

7.3.2 Cloud: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

7.4 On-Premise

7.4.1 Overview

7.4.2 On-Premise: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

8. SAM Wealth Management Platform Market – By Advisory Model

8.1 Overview

8.2 SAM Wealth Management Platform, by Advisory Model (2020 and 2028)

8.3 Human advisory

8.3.1 Overview

8.3.2 Human Advisory: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Robo Advisory

8.4.1 Overview

8.4.2 Robo Advisory: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Hybrid

8.5.1 Overview

8.5.2 Hybrid: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

9. SAM Wealth Management Platform Market – By Business Function

9.1 Overview

9.2 SAM Wealth Management Platform, by Business Function (2020 and 2028)

9.3 Performance Management

9.3.1 Overview

9.3.2 Performance Management: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Risk and Compliance Management

9.4.1 Overview

9.4.2 Risk and Compliance Management: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

9.5 Portfolio Accounting and Trading Management

9.5.1 Overview

9.5.2 Portfolio Accounting and Trading Management: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

9.6 Financial Advice Management

9.6.1 Overview

9.6.2 Financial Advice Management: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

9.7 Reporting

9.7.1 Overview

9.7.2 Reporting: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

9.8 Others

9.8.1 Overview

9.8.2 Others: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

10. SAM Wealth Management Platform Market Analysis– By End User

10.1 Overview

10.2 SAM Wealth Management Platform Market, by End User (2020 and 2028)

10.3 Investment Management Firms

10.3.1 Overview

10.3.2 Investment Management Firms: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

10.4 Trading & Exchange Firms

10.4.1 Overview

10.4.2 Trading & Exchange Firms: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

10.5 Banks

10.5.1 Overview

10.5.2 Banks: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

10.6 Brokerage Firms

10.6.1 Overview

10.6.2 Brokerage Firms: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

10.7 Others

10.7.1 Overview

10.7.2 Others: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

11. SAM Wealth Management Platform Market – Country Analysis

11.1 Overview

11.1.1 SAM Wealth Management Platform Market Breakdown, By Country

11.1.1.1 Brazil Wealth Management Platform Market, Revenue and Forecast To 2028 (US$ Mn)

11.1.1.1.1 Brazil Wealth Management Platform Market Breakdown, By Advisory Model

11.1.1.1.2 Brazil Wealth Management Platform Market Breakdown, By Business Function

11.1.1.1.3 Brazil Wealth Management Platform Market Breakdown, By Deployment Type

11.1.1.1.4 Brazil Wealth Management Platform Market Breakdown, By End-User

11.1.1.2 Argentina Wealth Management Platform Market, Revenue and Forecast To 2028 (US$ Mn)

11.1.1.2.1 Argentina Wealth Management Platform Market Breakdown, By Advisory Model

11.1.1.2.2 Argentina Wealth Management Platform Market Breakdown, By Business Function

11.1.1.2.3 Argentina Wealth Management Platform Market Breakdown, By Deployment Type

11.1.1.2.4 Argentina Wealth Management Platform Market Breakdown, By End-User

11.1.1.3 Rest of SAM Wealth Management Platform Market, Revenue and Forecast To 2028 (US$ Mn)

11.1.1.3.1 Rest of SAM Wealth Management Platform Market Breakdown, By Advisory Model

11.1.1.3.2 Rest of SAM Wealth Management Platform Market Breakdown, By Business Function

11.1.1.3.3 Rest of SAM Wealth Management Platform Market Breakdown, By Deployment Type

11.1.1.3.4 Rest of SAM Wealth Management Platform Market Breakdown, By End-User

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

13. Company Profiles

13.1 Broadridge Financial Solutions, Inc.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Comarch SA

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 FIS Global

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Fiserv, Inc.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 PROFILE SOFTWARE S.A

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 SEI Investments Developments, Inc.

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 SS&C Technologies, Inc.

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Temenos Headquarters SA

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary

LIST OF TABLES

Table 1. SAM Wealth Management Platform Market, Revenue and Forecast, 2019–2028 (US$ Mn)

Table 2. Brazil Wealth Management Platform Market, Revenue and Forecast To 2028 – By Advisory Model (US$ Mn)

Table 3. Brazil Wealth Management Platform Market, Revenue and Forecast To 2028 – By Business Function (US$ Mn)

Table 4. Brazil Wealth Management Platform Market, Revenue and Forecast To 2028 – By Deployment Type (US$ Mn)

Table 5. Brazil Wealth Management Platform Market, Revenue and Forecast To 2028 – By End-User (US$ Mn)

Table 6. Argentina Wealth Management Platform Market, Revenue and Forecast To 2028 – By Solution (US$ Mn)

Table 7. Argentina Wealth Management Platform Market, Revenue and Forecast To 2028 – By Business Function (US$ Mn)

Table 8. Argentina Wealth Management Platform Market, Revenue and Forecast To 2028 – By Deployment Type (US$ Mn)

Table 9. Argentina Wealth Management Platform Market, Revenue and Forecast To 2028 – By End-User (US$ Mn)

Table 10. Rest of SAM Wealth Management Platform Market, Revenue and Forecast To 2028 – By Solution (US$ Mn)

Table 11. Rest of SAM Wealth Management Platform Market, Revenue and Forecast To 2028 – By Business Function (US$ Mn)

Table 12. Rest of SAM Wealth Management Platform Market, Revenue and Forecast To 2028 – By Deployment Type (US$ Mn)

Table 13. Rest of SAM Wealth Management Platform Market, Revenue and Forecast To 2028 – By End-User (US$ Mn)

Table 14. Glossary of Terms, SAM Wealth Management Platform Market

LIST OF FIGURES

Figure 1. SAM Wealth Management Platform Market Segmentation

Figure 2. SAM Wealth Management Platform Market Segmentation - Country

Figure 3. SAM Wealth Management Platform Market Overview

Figure 4. SAM Wealth Management Platform Market, By Advisory Model

Figure 5. SAM Wealth Management Platform Market, By Deployment Type

Figure 6. SAM Wealth Management Platform Market, By Country

Figure 7. SAM: PEST Analysis

Figure 8. SAM Wealth Management Platform Market Ecosystem Analysis

Figure 9. Expert Opinion

Figure 10. SAM Wealth Management Platform Market Impact Analysis of Drivers and Restraints

Figure 11. SAM Wealth Management Platform Market, Forecast and Analysis (US$ Mn)

Figure 12. SAM Wealth Management Platform Market Revenue Share, by Deployment Type (2020 and 2028)

Figure 13. SAM Cloud: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. SAM On-Premise: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. SAM Wealth Management Platform Market Revenue Share, by Advisory Model (2020 and 2028)

Figure 16. SAM Human Advisory: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. SAM Robo Advisory: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. SAM Hybrid: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. SAM Wealth Management Platform Market Revenue Share, by Business Function (2020 and 2028)

Figure 20. SAM Performance Management: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. SAM Risk and Compliance Management: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. SAM Portfolio Accounting and Trading Management: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. SAM Financial Advice Management: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. SAM Reporting: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. SAM Others: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. SAM Wealth Management Platform Market Revenue Share, by End User (2020 and 2028)

Figure 27. SAM Investment Management Firms: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. SAM Trading & Exchange Firms: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. SAM Banks: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. SAM Brokerage Firms: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. SAM Others: Wealth Management Platform Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. SAM Wealth Management Platform Market, by Key Country - Revenue (2020) (US$ Mn)

Figure 33. SAM Wealth Management Platform Market Breakdown, By Country, 2020 and 2028(%)

Figure 34. Brazil Wealth Management Platform Market, Revenue and Forecast To 2028 (US$ Mn)

Figure 35. Argentina Wealth Management Platform Market, Revenue and Forecast To 2028 (US$ Mn)

Figure 36. Rest of SAM Wealth Management Platform Market, Revenue and Forecast To 2028 (US$ Mn)

- Broadridge Financial Solutions, Inc.

- Comarch SA

- FIS Global

- Fiserv, Inc.

- InvestCloud

- SS&C Technologies, Inc.

- Temenos Headquarters SA

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the SAM wealth management platform market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the SAM wealth management platform market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth SAM market trends and outlook coupled with the factors driving the wealth management platform market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution