South America Smart Mining Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Component (Hardware, Software and Solution, and Services) and Mining Type (Underground Mining and Surface Mining)

Market Introduction

The smart mining market in SAM is further segmented into Brazil, Argentina, and the Rest of SAM. The growth of the smart mining market in SAM is attributed to the rising adoption of IoT in industries. Recent technological developments have had a direct impact on the economy of Brazil and Argentina. A recent study says that due to the changing economic conditions in South America, government enterprises, businesses, and consumers in the region are keen to implement and incorporate the upcoming technologies. In addition, growing corporate investment, along with favourable government regulations, is expected to lead to market expansion in SAM. Furthermore, attractive mining prospects presented to key companies as a result of cheap commodity prices and cheap mining taxes is expected to be another major driver driving market expansion in South America throughout the forecast period. Favorable government policies are creating a better mining environment; for instance, in 2017, the Government of Argentina implemented the system “New Federal Mining Agreement” to boost the mining market in the country. This region is rich in natural resources and have relatively low labor cost, which make the continent an attractive investment destination for smart mining. However, illegal mining operations, coupled with economic crisis in the mining industry, is anticipated to hinder the growth of the mining market in SAM. Ensuring data security and technological advancement in mining across the region are the major factor driving the growth of the SAM smart mining market

In case of COVID-19, SAM is highly affected especially Brazil, followed by Ecuador, Chile, Peru, and Argentina, among others. Most of the commercial operations in the region have been shut down to prevent the spread of the disease. Lockdowns imposed in cities have compelled most production plant operators to suspend their operation indefinitely, which has led to the discontinuation in the demand for mechanical and electronic parts. Therefore, the COVID-19 pandemic is restraining the smart mining market growth in SAM. However, the mining industry is likely to pick up pace soon after the governments across the region steadily lift the various containment measures in order to revive the economy. The production of the mining equipment is anticipated to gain pace from 2022, which is further foreseen to positively influence the mining industry, including hardware components of mining.

Get more information on this report :

Market Overview and Dynamics

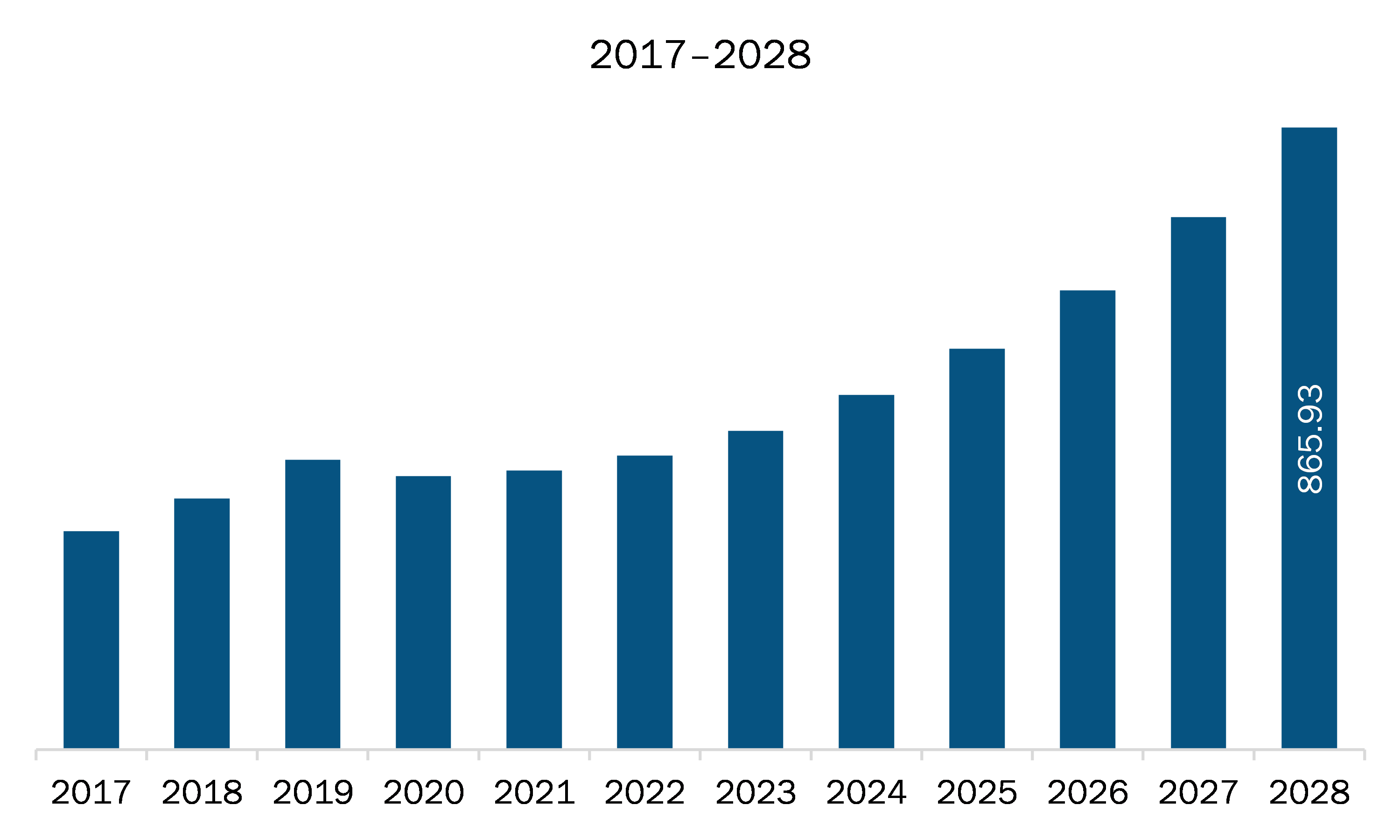

The SAM smart mining market is expected to grow from US$ 388.52 million in 2021 to US$ 865.93 million by 2028; it is estimated to grow at a CAGR of 12.1% from 2021 to 2028. The mining area is one of the hazardous places for people to work, and the security of the workers is a crucial issue. For example, when dams fail, both workers and those around mines are affected, or even lose their lives. In the countries across the region, there were lots of fatalities between 2008 and 2018. Figures remain challenging to confirm, but estimates suggest that mining accidents are responsible for more than lakhs deaths per year in the region. Workers conducting manual readings in remote mining sites are at particular risk of harm. Implementation of automated mobile assets such as vehicles, wireless gadgets, and remote sensors in mining sites, reduce the need for workforce on-site, which in turn increases the protection level of the workers. Predictive analysis and observations also enable mining operators to anticipate and avoid dangerous accidents. Workforce monitoring, with the help of wireless wearable devices, often facilitates operators to efficiently organize their staff and keep workers away from the risky region of the mining site. The advanced smart mining technologies help minimize the threat and damage caused during mining operations. Specific uses of IoT in mining include adding up of sensors to mining equipment to communicate and monitor the data in real-time and keep the workers safer. Sensors can also be attached to the workers’ clothing to monitor their health by tracking and transmitting data about their physical health and condition and can also raise alerts at the time of accidents. So, the growing accidents in the mines and rising importance of workers safety is expected to increase the demand of smart mining, there driving the SAM market growth.

Key Market Segments

In terms of component, the hardware segment accounted for the largest share of the SAM smart mining market in 2020. In terms of mining type, the surface mining segment held a larger market share of the SAM smart mining market in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the SAM smart mining market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ABB Ltd.; Caterpillar Inc.; Hexagon AB; Hitachi, Ltd.; Intellisense.io; MineSense; Rockwell Automation, Inc.; SAP SE; and Trimble Inc.

Reasons to buy report

- To understand the SAM smart mining market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for SAM smart mining market

- Efficiently plan M&A and partnership deals in SAM smart mining market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form SAM smart mining market

- Obtain market revenue forecast for market by various segments from 2021-2028 in SAM region.

SAM Smart Mining Market Segmentation

SAM Smart Mining Market - By Component

- Hardware

- RFID Tags

- Sensors

- Intelligent System

- Others

- Software and Solution

- Logistics Software

- Data & Operation Management Software

- Safety & Security Systems

- Connectivity Solutions

- Analytics Solutions

- Remote Management Solutions

- Asset Management Solutions

- Services

SAM Smart Mining Market - By Mining Type

- Underground Mining

- Surface Mining

SAM Smart Mining Market - By Country

- Brazil

- Argentina

- Rest of SAM

SAM Smart Mining Market - Company Profiles

- ABB Ltd.

- Caterpillar Inc.

- Hexagon AB

- Hitachi, Ltd.

- Intellisense.io

- MineSense

- Rockwell Automation, Inc.

- SAP SE

- Trimble Inc.

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. SAM Smart Mining Market Landscape

4.1 Market Overview

4.2 SAM PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. SAM Smart Mining Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Need to Keep the Workforce Safe

5.1.2 Ensuring Data Security

5.2 Market Restraints

5.2.1 Stringent Government Regulations

5.3 Market Opportunities

5.3.1 Technological Advancement in Mining Across the Region

5.4 Future Trends

5.4.1 Rapid Adoption of Industrial internet of Things (IIoT) and Artificial Intelligence

5.5 Impact Analysis of Drivers and Restraints

6. Smart Mining Market – SAM Analysis

6.1 SAM Smart Mining Market Overview

6.2 SAM Smart Mining Market –Revenue and Forecast to 2028 (US$ Million)

7. SAM Smart Mining Market Analysis – By Component

7.1 Overview

7.2 SAM Smart Mining Market Breakdown, by Component (2020 and 2028)

7.3 Hardware

7.3.1 Overview

7.3.2 Hardware: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

7.3.3 RFID Tags

7.3.3.1 Overview

7.3.3.2 RFID Tags Market Forecast and Analysis

7.3.4 Sensors

7.3.4.1 Overview

7.3.4.2 Sensors Market Forecast and Analysis

7.3.5 Intelligent Systems

7.3.5.1 Overview

7.3.5.2 Intelligent System Market Forecast and Analysis

7.3.6 Others

7.3.6.1 Overview

7.4 Software and Solutions

7.4.1 Overview

7.4.2 Software & Solutions: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

7.4.3 Logistics Software

7.4.3.1 Overview

7.4.3.2 Logistics Software Market Forecast and Analysis

7.4.4 Data and Operation Management

7.4.4.1 Overview

7.4.4.2 Data and Operation Management Market Forecast and Analysis

7.4.5 Safety and Security Systems

7.4.5.1 Overview

7.4.5.2 Safety and Security Systems Market Forecast and Analysis

7.4.6 Connectivity Solutions

7.4.6.1 Overview

7.4.6.2 Connectivity Solutions Market Forecast and Analysis

7.4.7 Analytics Solutions

7.4.7.1 Overview

7.4.7.2 Analytics Solutions Market Forecast and Analysis

7.4.8 Remote Management Solutions

7.4.8.1 Overview

7.4.8.2 Remote Management Solutions Market Forecast and Analysis

7.4.9 Asset Management Solutions

7.4.9.1 Overview

7.4.9.2 Asset Management Solutions Market Forecast and Analysis

7.5 Services

7.5.1 Overview

7.5.2 Services: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

8. SAM Smart Mining Market Analysis– By Mining Type

8.1 Overview

8.2 SAM Smart Mining Market Breakdown, by Mining Type (2020 and 2028)

8.3 Underground Mining

8.3.1 Overview

8.3.2 Underground Mining: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Surface Mining

8.4.1 Overview

8.4.2 Surface Mining: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

9. SAM Smart Mining Market – Country Analysis

9.1 Overview

9.1.1 SAM: Smart Mining Market, by Key Country

9.1.1.1 Brazil: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.1.1 Brazil: Smart Mining Market, by Component

9.1.1.1.2 Brazil: Smart Mining Market, by Hardware

9.1.1.1.3 Brazil: Smart Mining Market, by Software and Solution

9.1.1.1.4 Brazil: Smart Mining Market, by Mining Type

9.1.1.2 Argentina: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.2.1 Argentina: Smart Mining Market, by Component

9.1.1.2.2 Argentina: Smart Mining Market, by Hardware

9.1.1.2.3 Argentina: Smart Mining Market, by Software and Solution

9.1.1.2.4 Argentina: Smart Mining Market, by Mining Type

9.1.1.3 Rest of SAM: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.3.1 Rest of SAM: Smart Mining Market, by Component

9.1.1.3.2 Rest of SAM: Smart Mining Market, by Hardware

9.1.1.3.3 Rest of SAM: Smart Mining Market, by Software and Solution

9.1.1.3.4 Rest of SAM: Smart Mining Market, by Mining Type

10. Impact Of COVID-19 Pandemic on SAM Smart Mining Market

10.1 SAM: Impact Assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 Merger and Acquisition

11.4 New Development

12. Company Profiles

12.1 ABB Ltd.

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Caterpillar Inc.

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Hexagon AB

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Intellisense.io

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Hitachi, Ltd.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 MineSense

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 SWOT Analysis

12.6.5 Key Developments

12.7 Rockwell Automation, Inc.

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 SAP SE

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Trimble Inc.

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. SAM Smart Mining Market –Revenue and Forecast to 2028 (US$ Million)

Table 2. Brazil: Smart Mining Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 3. Brazil: Smart Mining Market, by Hardware – Revenue and Forecast to 2028 (US$ Million)

Table 4. Brazil: Smart Mining Market, by Software and Solution – Revenue and Forecast to 2028 (US$ Million)

Table 5. Brazil: Smart Mining Market, by Mining Type – Revenue and Forecast to 2028 (US$ Million)

Table 6. Argentina: Smart Mining Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 7. Argentina: Smart Mining Market, by Hardware – Revenue and Forecast to 2028 (US$ Million)

Table 8. Argentina: Smart Mining Market, by Software and Solution – Revenue and Forecast to 2028 (US$ Million)

Table 9. Argentina: Smart Mining Market, by Mining Type – Revenue and Forecast to 2028 (US$ Million)

Table 10. Rest of SAM: Smart Mining Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 11. Rest of SAM: Smart Mining Market, by Hardware – Revenue and Forecast to 2028 (US$ Million)

Table 12. Rest of SAM: Smart Mining Market, by Software and Solution – Revenue and Forecast to 2027 (US$ Million)

Table 13. Rest of SAM: Smart Mining Market, by Mining Type – Revenue and Forecast to 2028 (US$ Million)

Table 14. List of Abbreviation

LIST OF FIGURES

Figure 1. SAM Smart Mining Market Segmentation

Figure 2. SAM Smart Mining Market Segmentation – By Country

Figure 3. SAM Smart Mining Market Overview

Figure 4. Hardware Segment Held the Largest Market Share in 2020

Figure 5. Surface Mining Held the Largest Market Share in 2020

Figure 6. Brazil was the Largest Revenue Contributor in 2020

Figure 7. SAM – PEST Analysis

Figure 8. Ecosystem Analysis

Figure 9. Expert Opinion

Figure 10. SAM Smart Mining Market Impact Analysis of Drivers and Restraints

Figure 11. SAM Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 12. SAM Smart Mining Market Revenue Share, by Component (2020 and 2028)

Figure 13. SAM Hardware: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. SAM RFID Tags: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. SAM Sensors: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. SAM Intelligent System: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. SAM Others: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. SAM Software & Solutions: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. SAM Logistics Software: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. SAM Data and Operation Management: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. SAM Safety and Security Systems: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. SAM Connectivity Solutions: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. SAM Analytics Solutions: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. SAM Remote Management Solutions: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. SAM Asset Management Solutions: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. SAM Services: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. SAM Smart Mining Market Revenue Share, by Mining Type (2020 and 2028)

Figure 28. SAM Underground Mining: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. SAM Surface Mining: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. SAM: Smart Mining Market, by Key Country – Revenue (2020) (USD Million)

Figure 31. SAM: Smart Mining Market Revenue Share, by Key Country (2020 and 2028)

Figure 32. Brazil: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 33. Argentina: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 34. Rest of SAM: Smart Mining Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Impact of COVID-19 Pandemic in SAM Country Markets

- ABB Ltd.

- Caterpillar Inc.

- Hexagon AB

- Hitachi, Ltd.

- Intellisense.io

- MineSense

- Rockwell Automation, Inc.

- SAP SE

- Trimble Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the SAM smart mining market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in SAM smart mining market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth SAM market trends and outlook coupled with the factors driving the smart mining market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution